How does it work if you want to get a mortgage later in life? Can age determine your borrowing capacity? Obtaining a mortgage or refinancing after the age of 50 can present some new challenges, but it is possible. The most important thing is to meet the lender's requirements.

Does the mortgage age limit exist in the Netherlands?

The Netherlands' minimum age requirement for obtaining a mortgage is 18. For certain home loans, the minimum age may be set higher, such as 21 or 25 years. Lenders have the choice to determine their minimum age for loan eligibility.

The age limit for obtaining a mortgage can vary from 60 to 78 years. It is crucial to consider these limitations, as they may be accompanied by additional conditions such as lower loan amounts, shorter repayment terms, or a mandatory repayment age.

Which factors determine your mortgage after the 50's?

-

Income

-

Retirement funds. Lenders may be more mindful of giving a mortgage to older borrowers as they approach retirement and may have fewer years to repay the loan than younger borrowers. However, having a solid retirement plan in place can ease these concerns.

Mortgage if you will not retire in the next 10 years

If you are younger than 57 and do not plan on retiring within the next decade, then your age will not affect the mortgage conditions. The crucial factors in obtaining a mortgage are your income, property value, and interest rate.

Mortgage if you will retire in the next 10 years

Your pension income will be included in your mortgage calculation if you reach the age to receive a state pension within the next 10 years. This helps you determine if you can continue paying the mortgage after retirement. Note that pension income is usually lower than your current income, which may result in a more down maximum mortgage or require you to pay off part of the mortgage before retiring.

Mortgage when you are already retired

Have you retired? If so, your pension income serves as your fixed income source. In this case, mortgage lenders evaluate your monthly expenses and ability to sustain the payments over an extended period. In most cases, pension income is considered a fixed source of income.

For example:

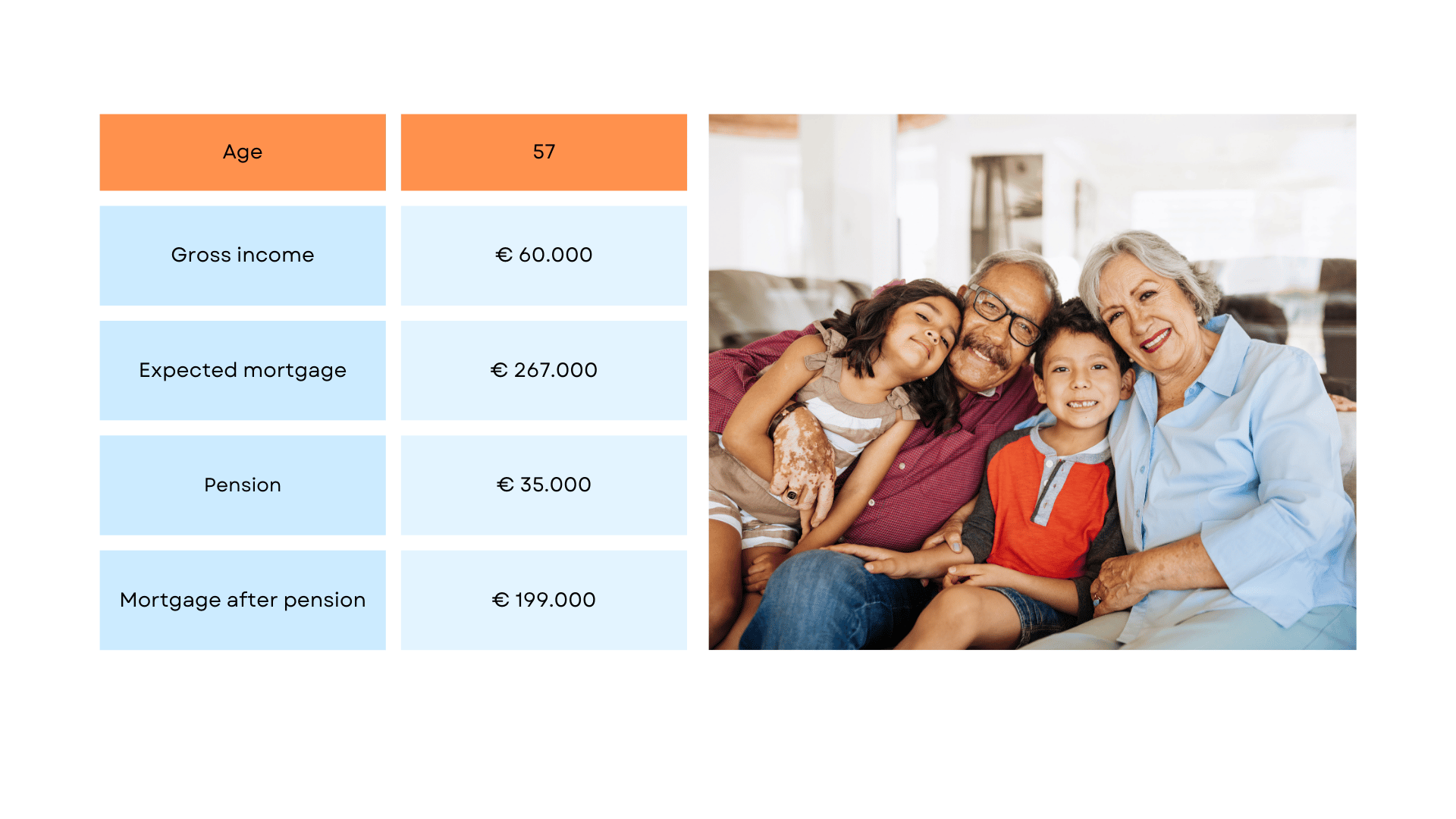

According to 2023 standards, a 55-year-old individual with a gross income of €60,000 can secure a mortgage of €267,000. However, for a 57-year-old person with the same income but an expected pension of €35,000, the standard rules result in a lower mortgage amount of €199,000. It's worth noting that the bank may enforce additional conditions, such as requiring faster loan repayment after retirement.

Schedule a complimentary introductory call with our mortgage specialists. We specialize in mortgages for expats and are dedicated to navigating you through the home-buying process.

-

Get clarity on your financial possibilities.

-

Access to a trusted network.

-

Highly competitive rates and flexible terms.

-

English translations of bank documents are shared.

- 100% Independent Advice