To get a Dutch mortgage, you must have a BSN number. Are you planning to move to the Netherlands and do not have a BSN yet? We can calculate your mortgage estimate to check how much you can borrow without a BSN number.

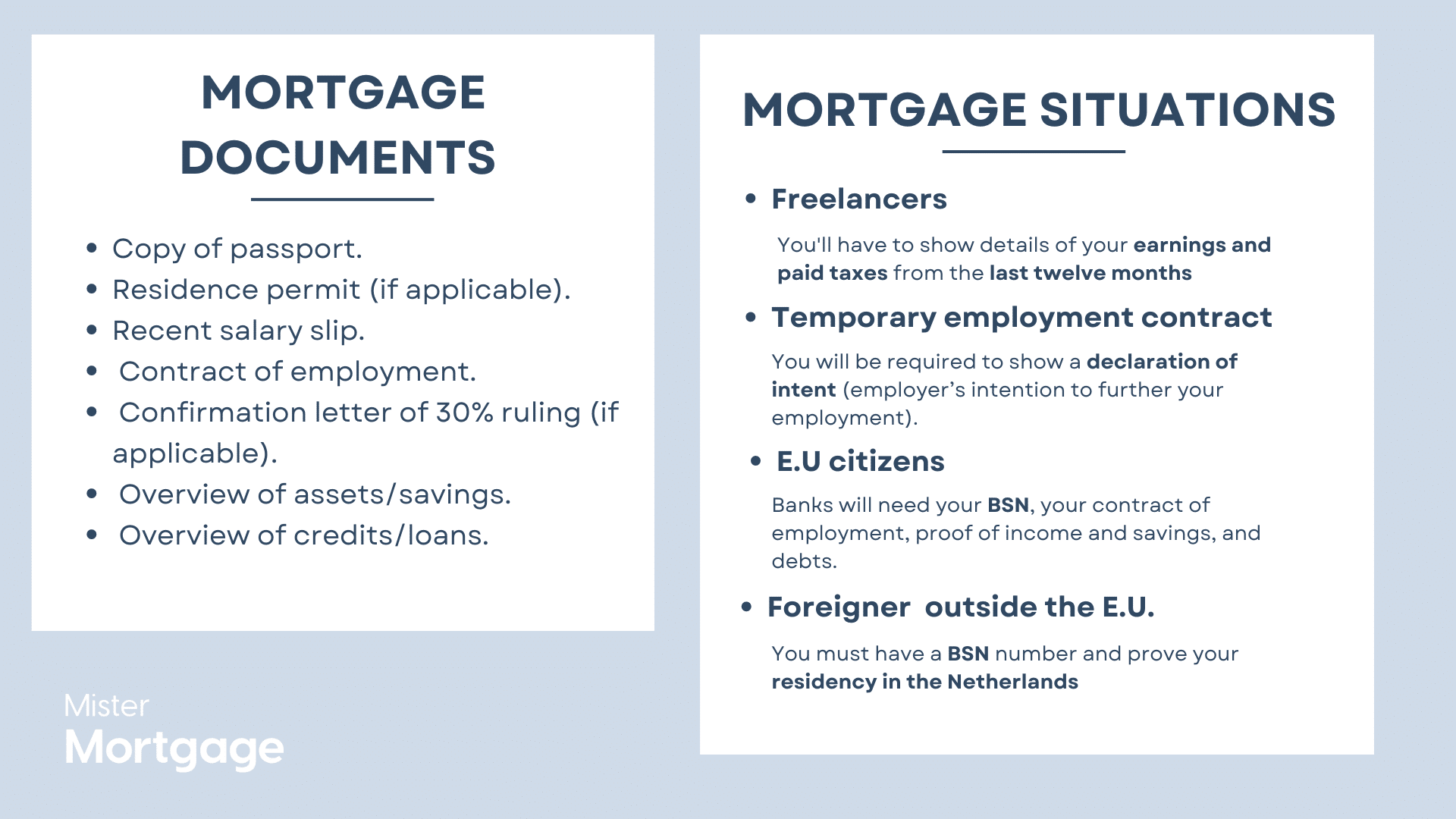

What documents are needed to apply for a mortgage in the Netherlands?

1. Copy of passport.

2. Resident permit (if applicable).

3. Recent salary slip.

4. Contract of employment.

5. Confirmation letter of 30% ruling (if applicable).

6. Overview of assets/savings.

7. Overview of credits/loans.

Can I get a mortgage in the Netherlands with a temporary contract?

Yes. You can get a mortgage if you have temporary employment. You can get a mortgage in the Netherlands if you're temporarily employed. To get a mortgage, you will be required to show a declaration of intent. In other words, your employee must have the intention to further your employment as soon as your temporary contract expires. Besides, you must provide a list of mortgage application documents.

Do I qualify for a mortgage in the Netherlands if I'm permanently employed?

Yes. You can get a mortgage if you're permanently employed.

One of the requirements to get a mortgage in the Netherlands in a more quick way is a permanent contract. If you have a permanent agreement, your mortgage application process will be more rapid. The additional documents required when getting a mortgage in the Netherlands are:

1.your proof of income, proof of savings/assets

2. proof of debts/financial obligations

3. documents about the property

Can I get a mortgage if I'm a freelancer?

Yes. You can get a mortgage if you're a freelancer. The same rules apply to freelancers as self-employed internationals in the Netherlands. To get a mortgage as a freelancer, you must show the details of your earnings and paid taxes from the last twelve months. We work with different mortgage lenders in Amsterdam, so we can always find the best solution for you. Are you a freelancer? Tell us about your situation, and we will provide a matching solution.

I'm an E.U. citizen. Can I buy a house in the Netherlands?

Yes. E.U. citizens are eligible to apply for a mortgage in the Netherlands.

Banks need your BSN, show your contract of employment, proof of income and savings, and debts. The additional mortgage requirements depend on the mortgage lender in the Netherlands. Contact us for more information.

Can U.S. citizens buy property in Amsterdam?

Yes. U.S. citizens are eligible to apply for a mortgage in the Netherlands.

The U.S. or non-European Union passport holders can get a mortgage in the Netherlands, yet they need to prove their residency in The Netherlands. Non-EU citizens are subject to almost the same rules as E.U. citizens. You can check the list of required documents here.

Are Ph.D. students/academics able to get a mortgage on their house in the Netherlands?

Yes. PHD professionals can apply for a mortgage in the Netherlands.

PhD students/academics can buy a house in the Netherlands and finance their homes with a mortgage. Check the list of documents required to get a mortgage in Amsterdam here.

Can a foreigner buy a house in the Netherlands?

Yes. Non-residents can get a mortgage in the Netherlands.

The citizens from non-Eu countries have similar requirements for a mortgage in the Netherlands. You must have a BSN number and prove your residency in the Netherlands. If you are living abroad and planning to purchase a property, schedule a call with us to explore your possibilities in the Netherlands.

I'm changing jobs in the Netherlands. Can I secure a mortgage?

Yes, it is possible to get a mortgage; however, your new employer must provide a letter of consent to retain you after the probation period.

If you decide on a new job, it is safest to apply for a mortgage based on your new job after the probationary period ends to minimize risk. If you have already resigned from your current job but are not in a hurry, we recommend waiting until after the probation period before applying for a new mortgage.

Can I get a mortgage if I'm unemployed?

Your chances of mortgage approval are very low when you are unemployed because banks prioritize ensuring a high level of certainty that you can meet your monthly financial obligations.

Do people with personal loans can qualify for a mortgage?

Yes, you can still get a mortgage with a personal loan; however, the financial obligations of your loans will be considered when calculating the maximum mortgage. To maximize your mortgage, paying off your loan before applying for a mortgage is best.

Is it possible to get a mortgage with a low income?

There is no lowest limitation for income to apply for a mortgage. The amount on the interest rate at that moment can vary per mortgage lender. They typically conduct a thorough affordability assessment to determine your qualifications.

-

A large deposit

-

Extra sources of income

-

High credit score

-

Living expenses

-

Opt for a more budget-friendly property.

If you plan to take out a mortgage, several costs are involved, and the total amount you need depends on your situation and the property's price. The property transfer tax is considered one of the biggest costs, significantly impacting the required savings. For example:

-

If you buy a property for €560,000, you must pay €11,200 from your pocket for the transfer tax.

-

If you buy a property for €880,000, the transfer tax will be €17,600.

In addition to the transfer tax, you must cover other fees such as notary fees, appraisal charges, mortgage brokerage fees, and advisory fees. Schedule a call with our mortgage specialists for a personalized calculation to determine the exact amount you need for your situation.

The main difference between Dutch residents and expats, especially those from non-EU countries, is that expats typically need to provide additional documentation. This can include proof of a valid residence permit, long-term employment contracts, or income verification from abroad. On the other hand, Dutch residents usually have a more straightforward process with fewer additional requirements. Schedule a free, no-obligation call with our mortgage specialists for more information.

In the Netherlands, the maximum mortgage amount is typically 100% loan-to-value. However, your mortgage amount can depend on several factors, including your income, the value of the property, and its energy efficiency.

A new rule was introduced a few years ago that connects the property's energy label to your mortgage calculation. Homes with higher energy labels (A or B) can borrow more, while properties with lower energy labels (E, F, G) can borrow a bit less.

Do you have a property in mind that you want to buy? Schedule a call with our mortgage specialists. During the call, you learn about your maximum mortgage, monthly payments, and the savings you need to close the mortgage.

The final mortgage approval in the Netherlands can take 5 to 15 business days, depending on the workload of a mortgage lender. Mister Mortgage is a priority partner with many banks, so we can secure approval within less than two weeks.

The minimum income needed for a mortgage in the Netherlands depends on factors like the property price, your financial situation, and the type of mortgage. Lenders usually consider your income compared to your expenses and the amount of your mortgage. For example, a household income of €35,000 to €40,000 per year could be enough for a mortgage on a property worth up to €200,00, depending on the interest rate and the energy label.

Schedule a complimentary introductory call with our mortgage specialists. We specialize in mortgages for expats and are dedicated to navigating you through the home-buying process.

-

Access to a trusted network.

-

Highly competitive rates and flexible terms.

-

Guidance through the entire mortgage process.

-

English translations of bank documents are shared.

- 100% Independent Advice