We believe in transparency and fair pricing. Mister Mortgage doesn’t come with surprises.

We do what we promise to you, and we don’t charge extra for our service. Our priority is to find the best solution and help you plan a stable financial future.

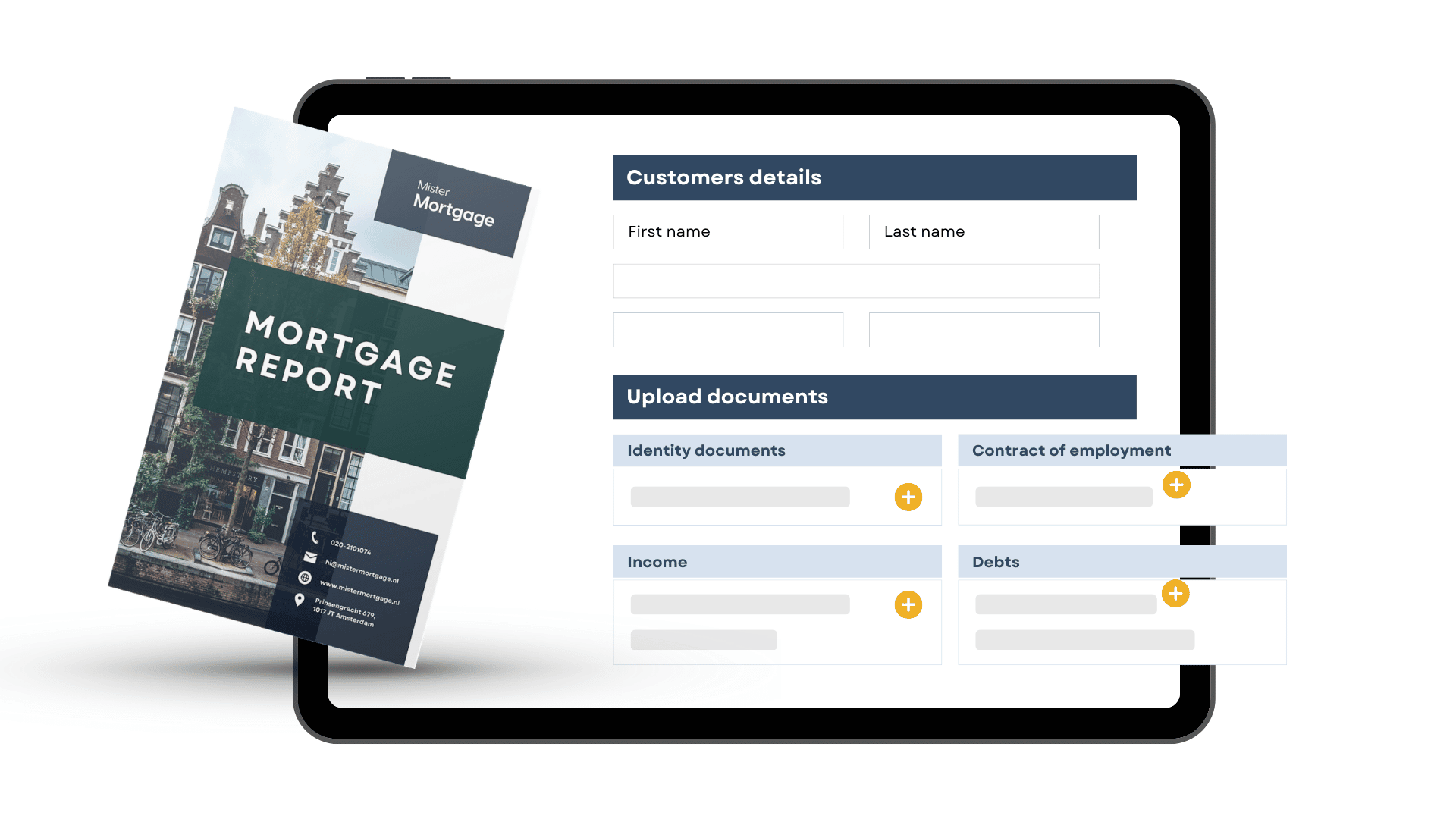

Whether you are a first-time homebuyer looking to invest, refinance or increase your mortgage, we analyze your situation and set up a personalized mortgage report.

-

Documents translated into English

We have all translations of the documents that needed to be signed. If anything remains unclear, we take the time to go through and explain all the documents.

-

Access to our network

As a Mister Mortgage customer, you can access our trusted network of real estate agents, notaries, appraisers, and tax advisors.

-

Future financial analysis

We explain the impact of five different life scenarios (disability, unemployment, divorce, retirement, and passing away) and help you to plan your financial future.

-

1-year support granted

You get 1-year free of charge support if your life situation changes in the future.

-

Mortgage Brokerage

We work with more than 30 mortgage lenders. We select a mortgage lender based on your financial situation and manage your mortgage application process from start to end.

Schedule a call to receive a full mortgage report based on your situation.

-

Mortgage monthly payments.

-

Mortgage closing fees.

-

Tax-deductible fees.

-

A 45-minute video call to explain the home buying process in the Netherlands.