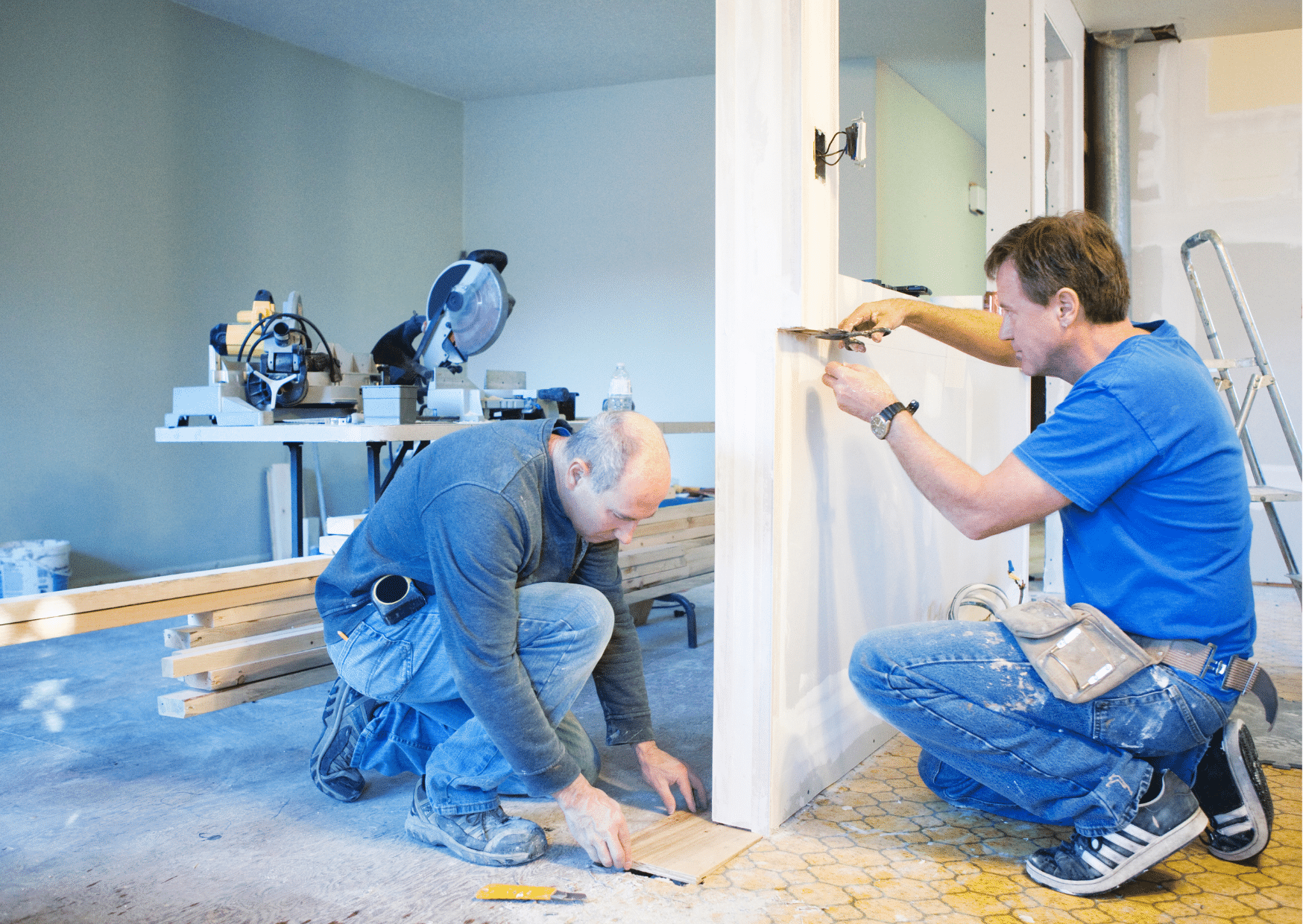

Are you considering upgrading your old kitchen or making it more sustainable? Wondering how to do it without depleting your savings?

-

Specialized mortgage brokerage firm

-

Competitive rates from 25+ lenders

-

Assisting with your tax benefits

A renovation mortgage is specifically designed to finance home repairs and improvements. In the Netherlands, it provides homeowners with a flexible solution for funding various projects, such as updating bathrooms and kitchens or improving the home's overall energy efficiency.

These renovations can be financed through options such as increasing the mortgage, obtaining a second mortgage, using personal savings, or applying for consumer loans.

At Mister Mortgage, we specialize in renovation mortgages. We can find the right solution for your financial situation by working with you. Please get in touch with our mortgage specialists today to discuss your situation and preferences.

-

Increase mortgage: you can often increase your mortgage within your mortgage registration, saving money on notary costs. We calculate your options based on your income, property value, financial goals, and the banks’ conditions.

-

Get a second mortgage: if you want to increase for more than the mortgage registration, there can be a world of options based on your financial situation and renovation plans.

-

Use personal savings or a consumer loan: you could consider using your savings or applying for a consumer loan with higher interest rates. Contact us for personalized guidance on keeping your savings intact and minimizing your payments.

Schedule a free call with our mortgage specialists

-

We advise on how to increase your mortgage.

-

We guide you through the entire mortgage process tailored for renovations.

-

English translations of bank documents are shared.

-

Highly competitive rates and flexible terms.

- 100% Independent Advice