We help you understand mortgage eligibility, determine borrowing capacity, and guide you through home-buying. For personalized guidance, talk with one of our mortgage advisors.

-

Expat mortgage broker

-

Competitive rates from 25+ lenders

-

Assisting with your tax benefits

The most crucial step in your home buying journey is your budget.

The maximum mortgage amount you can finance is 100% in the Netherlands.

Scenario 1: if you plan to purchase a property appraised at € 500,000, and your loan-to-income is € 450,000, then the bank borrows you € 450,000. The amount of € 50,000 should come from your savings.

Scenario 2: if you plan to purchase a property appraised at € 500,000, with a loan-to-income of € 550,000, the bank borrows you € 500,000.

Asking price: € 385.000

-

Closing fees: € 19.300

-

Monthly payments: € 1.524

-

Salary needed: € 72.000 ( alone or together )

Asking price: € 450.000

-

Closing fees: € 21.575

-

Monthly payments: € 1.781

-

Salary needed: € 81.000 (alone or together)

Asking price: € 675.000

-

Closing fees: € 29.450

-

Monthly payments: € 2.671

-

Salary needed: € 117.000 ( alone or together)

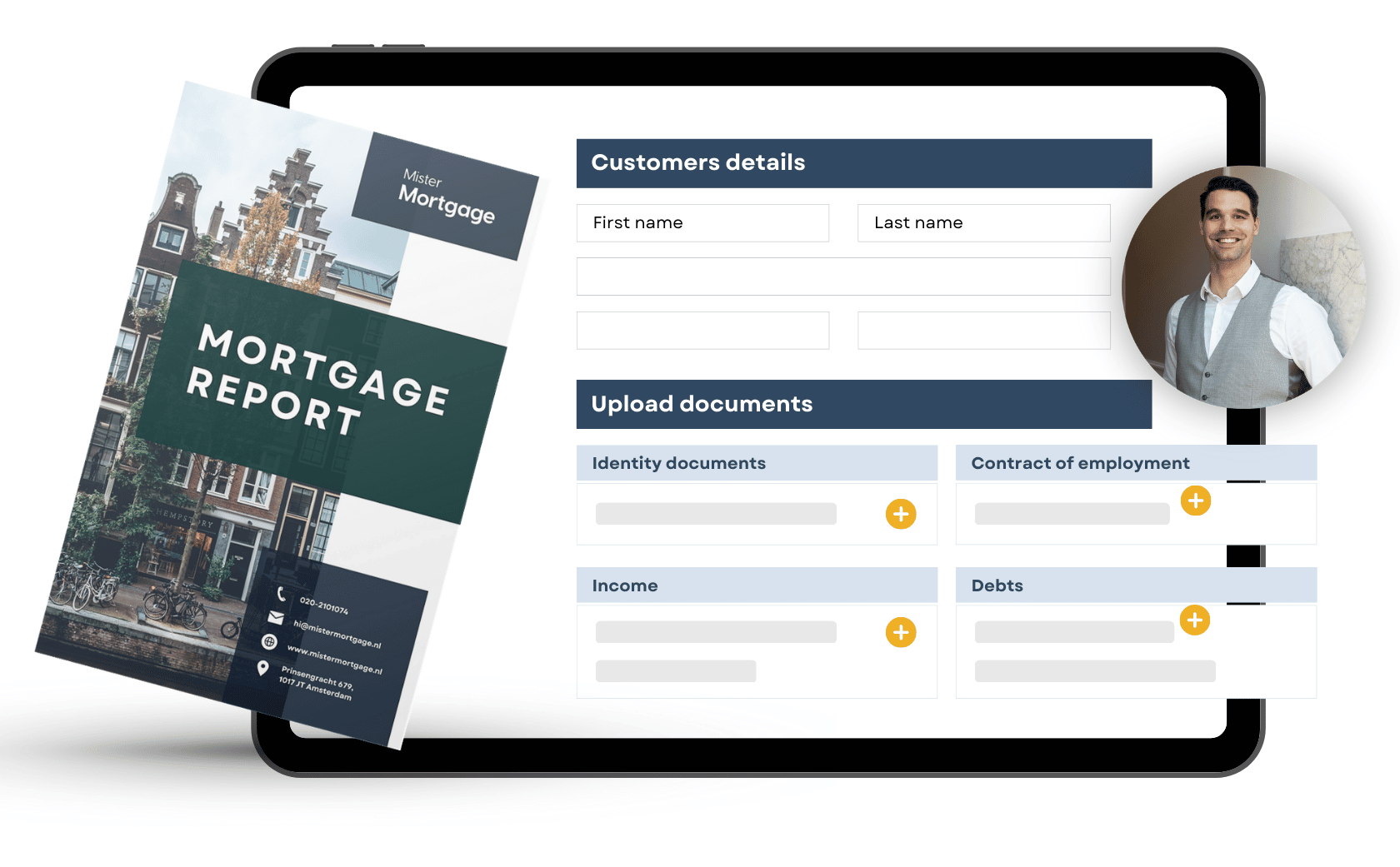

We provide a comprehensive mortgage report tailored just for you at Mister Mortgage. First, we arrange a quick 10-minute call to understand your goals. Then, you upload your documents to our secure online portal. Finally, you receive a personalized mortgage report detailing your maximum mortgage, monthly payments, closing fees, and tax-deductible expenses.eady for the next step? Start searching for your dream home with confidence.

Schedule a complimentary introductory call with our mortgage specialists. We specialize in mortgages for expats and are dedicated to navigating you through the home-buying process.

-

Access to a trusted network.

-

Highly competitive rates and flexible terms.

-

Guidance through the entire mortgage process.

-

English translations of bank documents are shared.

During the 10-minute call, we discuss your eligibility and answer your questions. We invite you to our online mortgage portal if you choose to work together.

10-minute intake call.

We set up a mortgage overview based on the uploaded documents. During the next call, we discuss your mortgage report including your monthly payments, closing fees, and tax-deductible fees.

45-minutes analysis

Time to start looking for a dream home. Feel free to contact us when you find a property. We update your online mortgage report accordingly.

House hunting

Congratulations! Contact the Mister Mortgage team to start the mortgage application process as soon as your bid is accepted.

Bidding

It's time to collect documents for the mortgage application. We arrange a meeting to discuss possible mortgage lenders before we submit your application.

30-minute call

We select the best mortgage lender and manage all required communication with your mortgage lender.

Mortgage application

When your mortgage is approved, it is time to sign a mortgage agreement. We apply for a binding offer as well as a bank guarantee.

Mortgage approval

We arrange the final meeting to discuss insurances and future scenarios, including disability, unemployment, retirement, and passing away.

Future financial analysis

Your notary sends you a statement of completion with closing fees. In the Netherlands, you pay closing fees the day you visit the notary.

Closing fees

Visit the property before you sign a transfer of ownership at the notary's office. Has the property benefit as promised?

Transfer date

Time to receive your keys and celebrate, you became a homeowner in the Netherlands.

Collect your keys

Schedule a free, no-obligation call with our team