In this blog article, we address the top questions about how foreigners can become homeowners and provide all the necessary information to help you understand the buying process and potential costs.

Let's begin by clarifying the term 'foreigner,' which is often used to describe anyone considered an international—meaning someone who does not hold Dutch citizenship. Suppose you are a foreigner and do not hold a Dutch passport. In that case, you can still buy a home in the Netherlands, as the country does not impose any restrictions on foreign property purchases for either residents or non-residents. However, to qualify for a Dutch mortgage, you must live in the Netherlands and have a BSN number or a residence permit (if required).

In the Netherlands, foreigners can generally be categorized into several groups based on their legal status :

-

EU citizens

Citizens from European Union (EU) or European Economic Area (EEA) countries, as well as Switzerland, have the same rights as Dutch nationals, including the right to residence, work, and property ownership. If you are an EU citizen and want to become a homeowner and obtain a mortgage, one of the requirements is to have a BSN.

-

Non-EU citizens

Non-EU citizens are individuals who are not citizens of any of the 27 member states of the European Union.

If you are not an EU citizen, you can still buy a house and apply for a mortgage if you meet the requirements: have a BSN number and permanent residency.

Many foreigners living in the Netherlands and earning salaries in foreign currencies can still qualify for a Dutch mortgage. The main requirement is having a BSN number. In most cases, you can borrow up to 90% of your income, reducing your income by 10%. The exact loan you qualify for depends on the lender and your individual circumstances.

As a foreigner in the Netherlands, you can borrow up to 100% of the property's value (loan-to-value). The amount you can borrow is determined by two key factors:

-

Your income

-

The value of the property

Would you like to know your mortgage options and estimated monthly payments? Schedule a free call with our mortgage specialists.

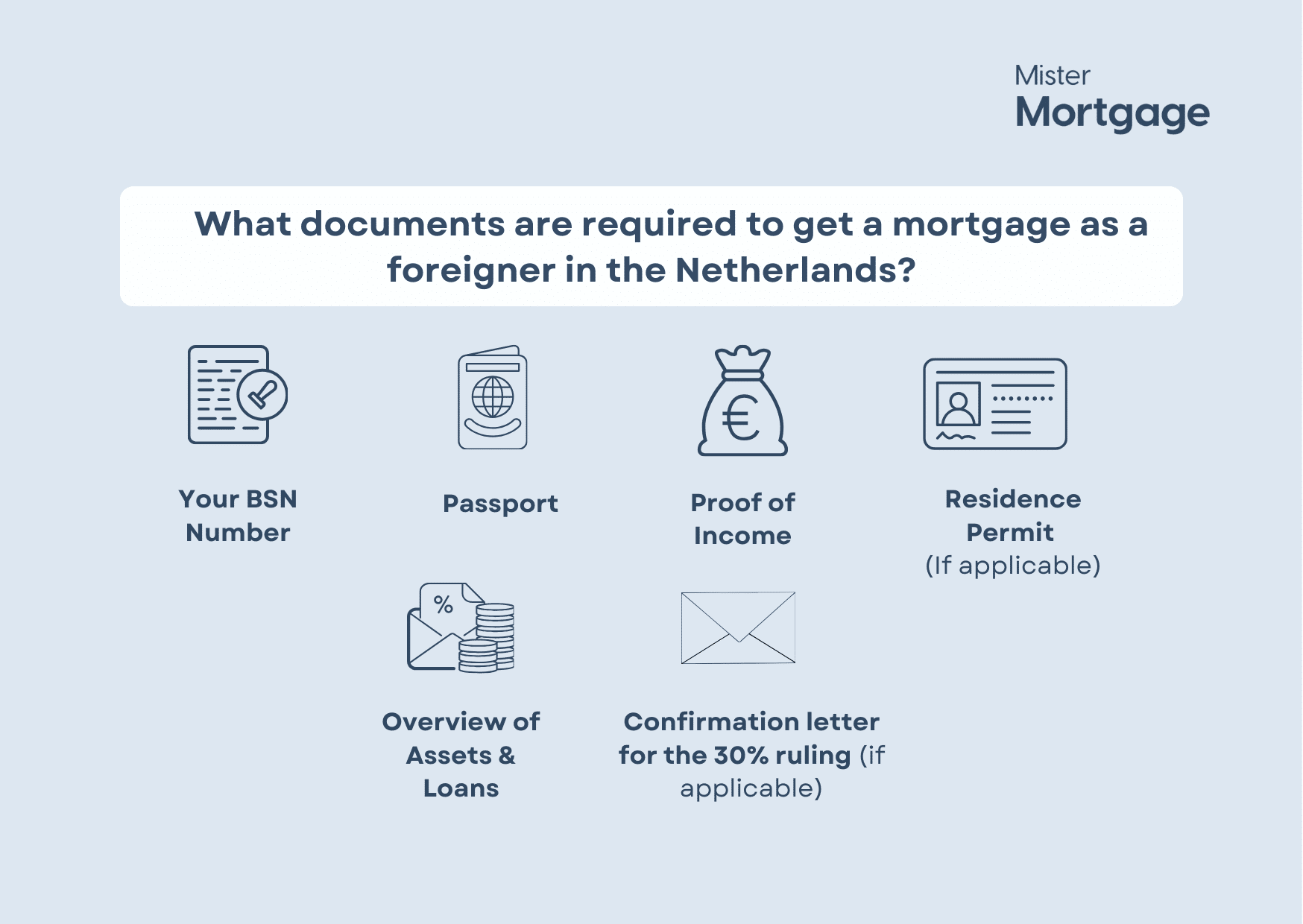

Regardless of your nationality or residency status, you must be registered in the Netherlands and have a BSN (Burger Service Nummer). In addition to your BSN, you must provide the bank with the following documents:

-

Copy of your passport

-

Residence permit (if applicable)

-

Recent salary slip

-

Employment contract

-

Confirmation letter for the 30% ruling (if applicable)

-

Overview of assets/savings

-

Overview of outstanding credits/loans

Are you a foreigner unsure where to start? Let our mortgage advisors help you! We specialize in mortgages for foreigners and will guide you through the process.

Schedule a complimentary introductory call with our mortgage specialists. We specialize in mortgages for expats and are dedicated to navigating you through the home-buying process.

-

Get clarity on your financial possibilities.

-

Access to a trusted network.

-

Highly competitive rates and flexible terms.

-

English translations of bank documents are shared.

- 100% Independent Advice