Buying a house comes with many complex decisions. With so many different options out there, it’s hard to make the right decision for your mortgage. One of the options is which of the mortgage forms you choose.

The three decisions on a mortgage are:

-

Mortgage forms: annuity, linear, or interest-only.

-

Mortgage interest rates: fixed interest rate or floating interest rate.

Which mortgage forms are the best?

It’s nonsense to say one mortgage form is better than the other. To make this decision, we need to know your personality and financial situation. Different roads sometimes lead to the same castle.

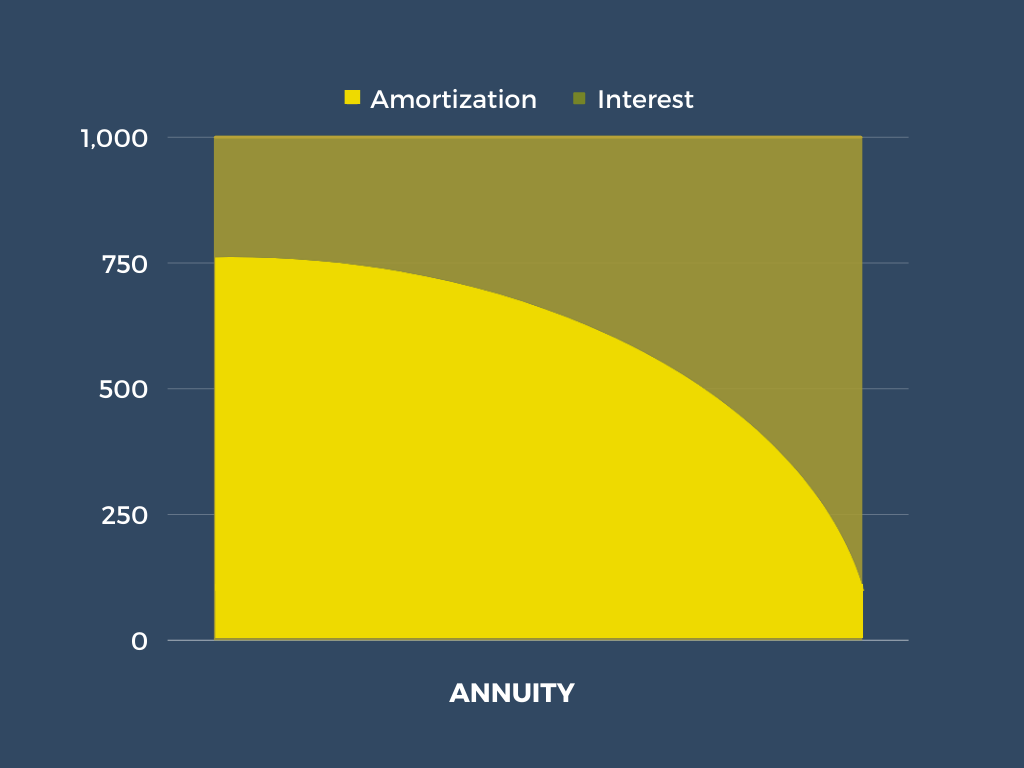

The advantages of this mortgage form are:

-

Monthly payments stay on the same level. Especially relevant if you expect a higher income in the future.

-

Interest payments decline over time. As a result, the repayments increase.

-

Zero debt at the end of the duration. So you’re debt-free at the end of the duration.

Why should you pick the annuity form for your mortgage? If you expect that your income will increase in the future, then the annuity form could be a good decision for you.

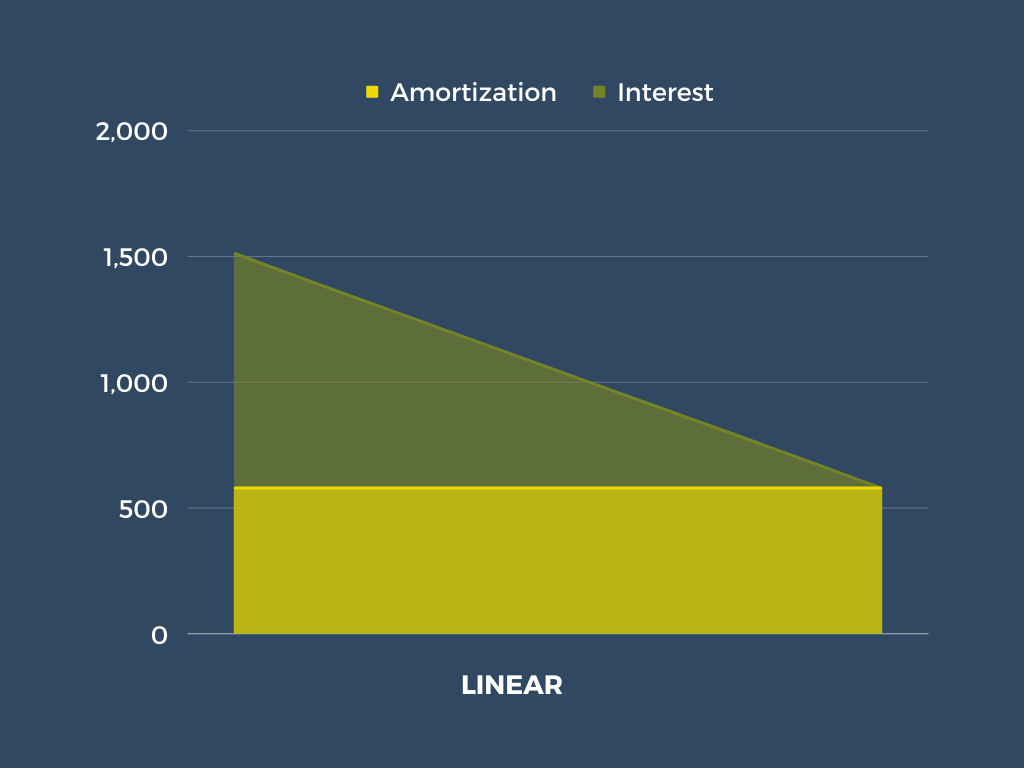

The advantages of this mortgage form are:

-

Repayments stay on the same amount. Especially relevant if you want to repay more at the beginning.

-

Interest payments decline over time. As a result, the monthly payments decline.

-

Zero debt at the end of the duration. So you’re debt-free at the end of the duration.

Why should you pick the linear form for your mortgage? If you expect that your income will decrease in the future, then the linear form could be a good decision for you.

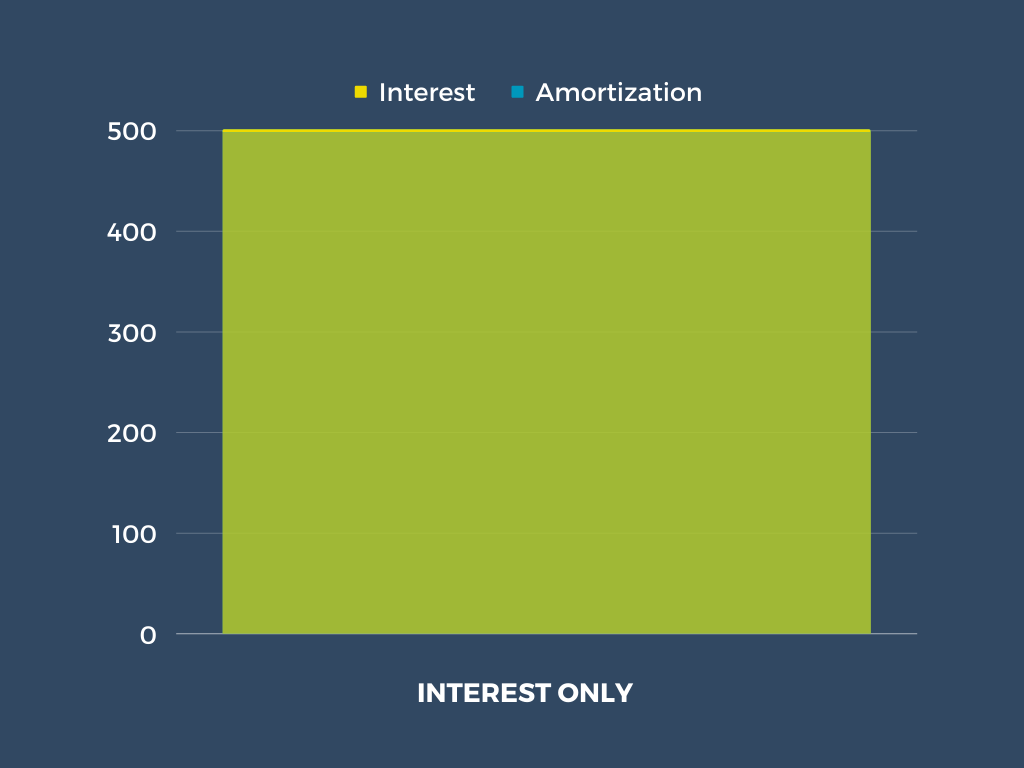

The advantages of this mortgage form are:

-

Monthly payments stay on the same level. This is especially relevant if you expect to repay the debt with savings.

-

You only pay interest for the duration. As a result, your debt stays on the same amount.

-

Repay your debt at the end of the duration. So you’ll have the full debt until the end of the duration.

Why should you pick the interest-only form for your mortgage? If you expect that your assets will be enough to repay your mortgage in the future, then the interest-only form could be a good decision for you. See what you know and where you can improve your mortgage approach. Make an informed decision about the terms of your mortgage.

Schedule a complimentary introductory call with our mortgage specialists. We specialize in mortgages for expats and are dedicated to navigating you through the home-buying process.

-

Get clarity on your financial possibilities.

-

Access to a trusted network.

-

Highly competitive rates and flexible terms.

-

English translations of bank documents are shared.

- 100% Independent Advice