The Netherlands has been ranked as the top 10 countries to live and work worldwide in 2021. In the last years, many international companies have chosen to relocate to the Netherlands for various reasons. Whether you plan to relocate for the long or short term, the next important step is to think about housing possibilities in the Netherlands.

Before moving countries, it is essential to decide whether you want to rent out or buy a home. The answer depends on your preferences. For example, renting a home can be the right solution for the short term (shorter than two years), while purchasing a home benefits you longer.

1. Buying is a cheaper solution in the long term.

2. The government offers tax benefits to owning a home (mortgage interest deduction).

3. You build equity when owning a home

4. Borrow up to 100% of the property’s value.

5. The freedom to renovate and make it feel like home.

6. No capital gains tax when selling the property.

1. Flexibility to leave.

2. No maintenance costs.

3. Short-term solution.

1. Passport and residence permit (if applicable).

2. Proof of income: salary slip, employment contract, 30% ruling.

3. Overview of assets/debts.

4. Property documents: valuation report, purchase agreement.

The short answer is yes.

Whether your company relocates you from an EU or non- EU country, you can get a mortgage in the Netherlands.

To apply for a Dutch mortgage, you must have a BSN number. Everybody living in the Netherlands is required to have a citizen service number (BSN). You can apply online, or your relocation agency (Expat Help) arranges your BSN on arrival at the local municipality (Gemeente)Non-EU citizens have similar requirements as EU citizens. Besides the list of documents required to apply for a mortgage, non-EU citizens must present a valid visa/residency.

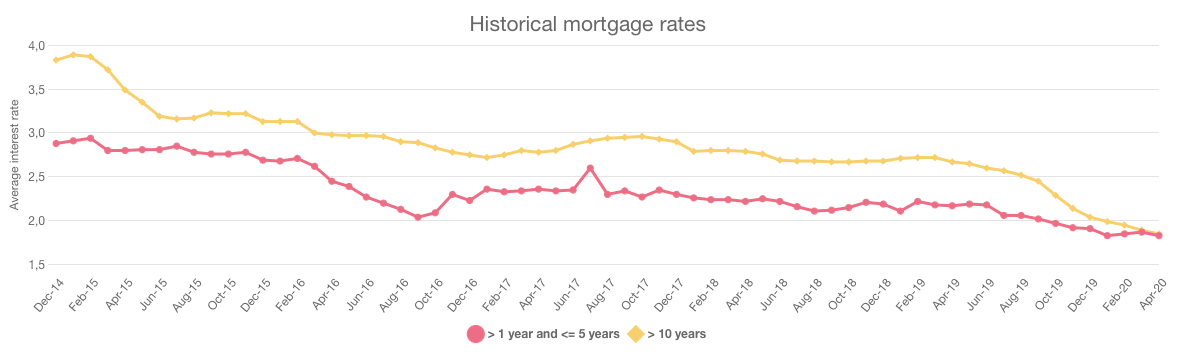

Rental prices are increasing annually while mortgage interest rates are decreasing in the Netherlands. The Dutch housing market performed strongly in the last years. In 2020, housing prices increased by 12%. Housing prices will continue rising due to the existing housing shortage. To get a realistic view of how much you gain after selling your property in the Netherlands, use our calculator to check your gains.

In the Netherlands, you can borrow up to 100% of the property’s value. For example, you can get a mortgage of € 400,000 (loan-to-value) if the property’s value is € 400,000. This rule is different for most of our clients when considering the mortgage possibilities in their home country.

A Dutch mortgage is based on the loan-to-income (LtI) ratio. We calculate how much you can spend every month and recalculate it back to a mortgage sum. The amount you can afford depends on your annual income and the property’s value. The term ‘income’ is, for some of our clients, a broad term.

When buying a property in the Netherlands, you can get a 100% loan-to-value. However, you need to pay closing fees to secure your mortgage. Use calculator to check how much savings do you need to secure a mortgage.

When you buy a property in the Netherlands, you must pay a transfer tax of 2% for residential properties and 8% for buy-to-let properties. As of Jan 1, 2021, people aged 18-34 years old who buy their first property worth less than € 400,000 will no longer pay the property transfer tax of 2 percent. The government aims to regulate the housing market by providing more opportunities to first-time home buyers. Use our calculator to check how much transfer tax you need to pay in the Netherlands.