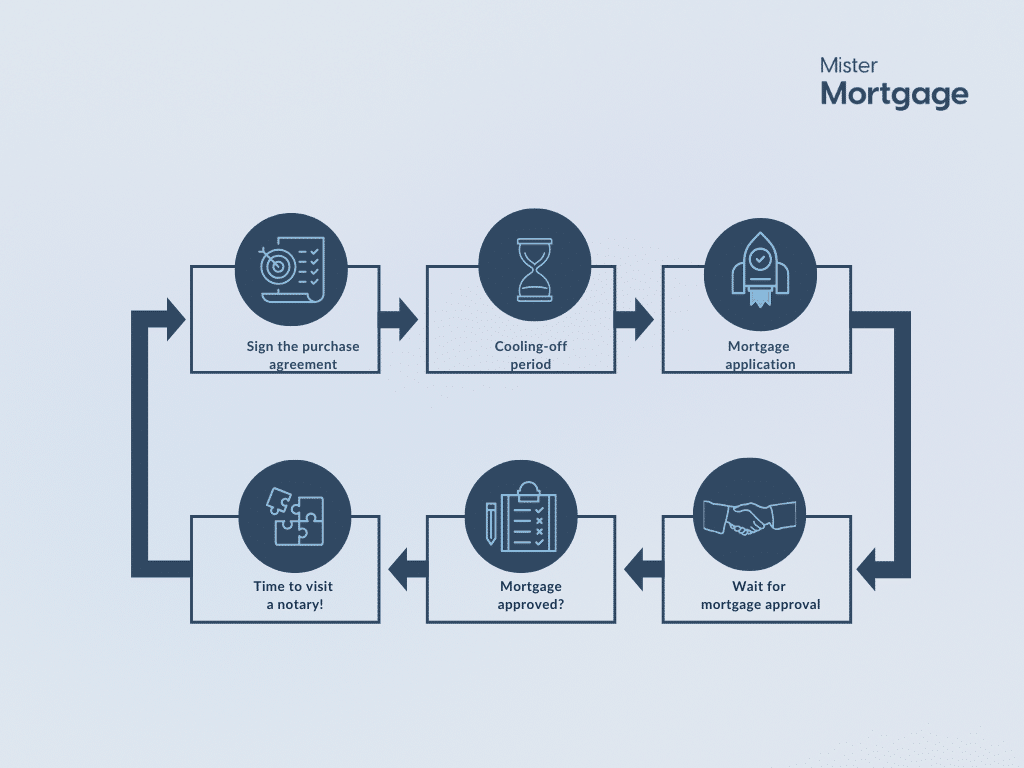

What happens when you find a dream home in the Netherlands? The next step is to put in an offer on the house. As soon as your bid is accepted, you sign a purchase agreement with a seller.

How does the financial clause work?

A purchase agreement outlines terms and conditions between a buyer and a seller.

The moment you sign the agreement, the deal comes into force. It is good to know that you have three days (cooling-off period) to cancel the purchase agreement. After the cooling-off period, the financial clause comes into place.

What is a financial clause in a Dutch house purchase agreement?

You don’t get a pre-approval from a bank in the Netherlands. The financial clause allows the buyer to arrange a mortgage within a given time frame, for example, four weeks. If a mortgage lender does not approve the finances, you cannot go through with the agreement, and you can cancel it.

Signing a purchase agreement with a financial clause

The financial clause protects you, the buyer, from losing 10% of the purchase price if you cannot get a mortgage approved. It gives you the freedom to walk away from the deal.

Rejection for a mortgage application

It’s crucial to keep in mind different requirements that each lender has for their mortgage applicants. When a mortgage application is rejected, you can move forward with another mortgage lender, or you can decide to cancel the purchase agreement. When you choose to work with us, we make sure to assess your options and tell you beforehand if it’s feasible to move forward.

If you signed a purchase agreement with a financial clause and the mortgage is not approved, you don’t need to pay a deposit to the seller because you use the financial clause to cancel the agreement.

Want to put in a winning offer in today's competitive market? Mister Mortgage offers Bid with Certainty.

Signing a purchase agreement without a financial clause

When you sign the agreement without putting in a financial clause, the seller is more protected than you. If you do not get your finances in place before the handover date, the deal fails, and a seller receives 10% of the property price.

The reason to exclude the financial clause from the agreement is that you can close the deal quicker. However, you must be sure you can get a mortgage. For more information, please contact us.

A financial clause in a Dutch house purchase agreement (voorbehoud van financiering) allows the buyer to cancel the contract without penalty if they cannot secure a mortgage within a specified time frame. Unfortunately, there is no such thing as a bank pre-approval in the Netherlands.

The financial clause protects the buyer from being legally bound to purchase the property if financing is not approved. In other words, if a bank rejects a mortgage application and the buyer has a financial clause, they can cancel the agreement without paying any penalties to the seller. The financing period typically lasts around 3 to 4 weeks, and the buyer must provide proof (such as a rejection letter from a bank) if they wish to invoke this clause.

If you want to include/exclude a financial clause (voorbehoud van financiering) in your purchase agreement, the first step is to consult our mortgage specialists so we can tell you what the difference is and what the impact is.

Why is this important? In the Netherlands, pre-approval for a mortgage does not exist, so you want to be certain that you can secure financing before committing to a property.

-

Protects you from losing your 10% deposit if your mortgage is denied.

-

Allows you to cancel the contract without penalty if financing is not secured within the agreed period (typically 3-4 weeks).

-

Recommended if you are unsure about mortgage approval or have a complex financial situation.

-

Makes your offer more attractive to sellers, especially in competitive markets.

-

Increases your financial risk—if your mortgage is denied, you must still complete the purchase or pay a deposit of 10%.

-

It should only be considered if your mortgage broker confirms that your financing is highly secure.

If your mortgage is not approved and you have a financial clause in your purchase agreement, you can cancel the contract without penalty. In this case:

-

You do not lose your 10% deposit.

-

Depending on the contract terms, you must provide proof, such as a rejection letter from at least one or two banks.

-

The cancellation must happen within the agreed financing period (typically 3-4 weeks).

If you miss the deadline or cannot provide the required proof, you may still be obligated to proceed with the purchase or lose your deposit.

The deadline for the financial clause is usually between 3 and 4 weeks, but it can always be negotiated with the seller.

Schedule a complimentary introductory call with our mortgage specialists. We specialize in mortgages for expats and are dedicated to navigating you through the home-buying process.

-

Get clarity on your financial possibilities.

-

Access to a trusted network.

-

Highly competitive rates and flexible terms.

-

English translations of bank documents are shared.

- 100% Independent Advice