Many internationals live in the Netherlands, yet their salaries are paid in foreign currency. Can I receive a Dutch mortgage with a foreign income?

If you have a BSN number, the answer is YES. However, verifying foreign currency income may be more challenging and require additional inspections that many lenders do not want. Yet, a mortgage application with a foreign salary is possible in the Netherlands.

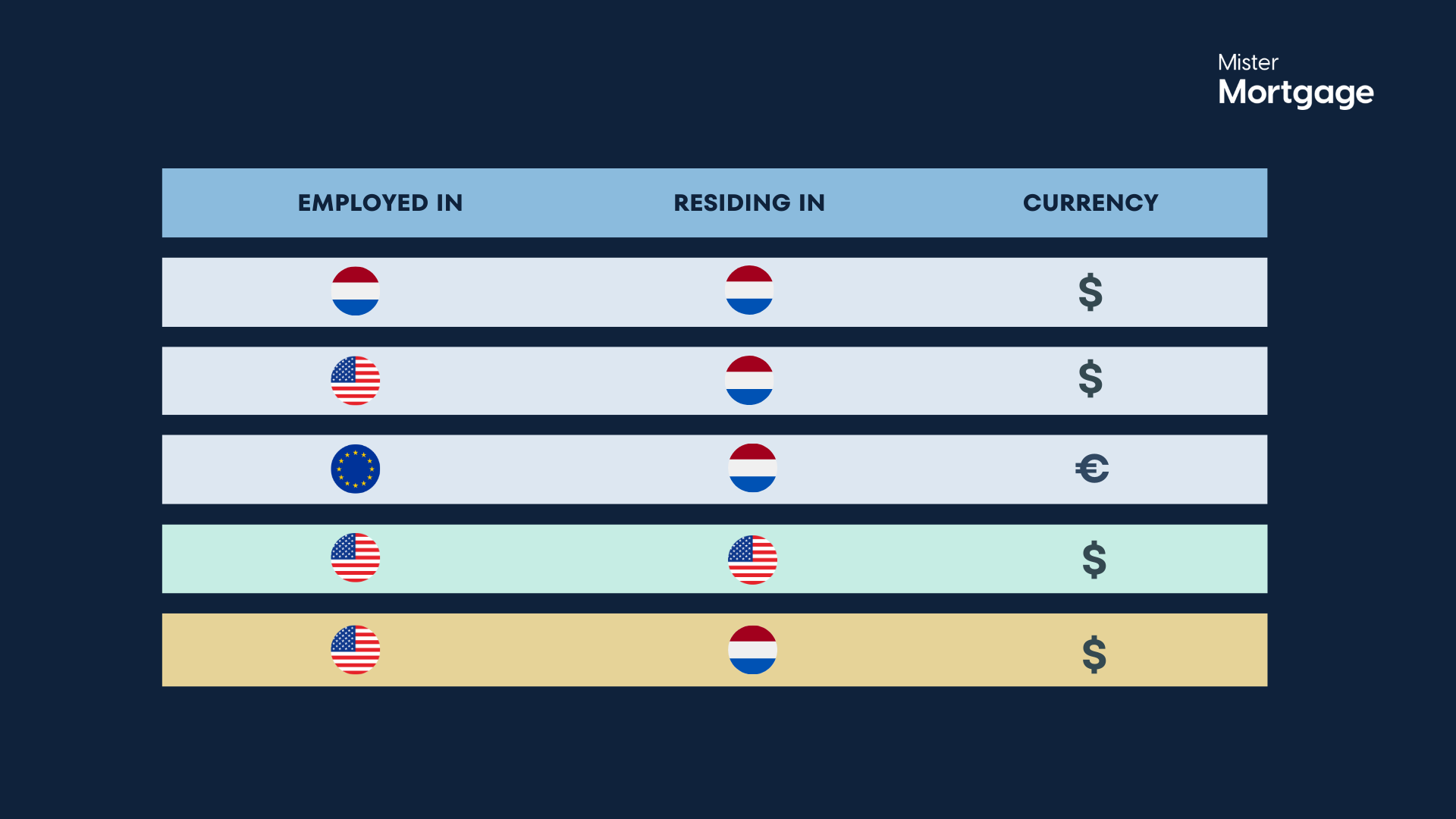

The following are the most common examples involving foreign income:

-

Foreign currency = being paid in USD while working for a company in NL and also living in NL.

-

Foreign income A = being paid in USD by a company based in the US but living in NL.

-

Foreign income B = being paid in USD by a company based in the US, but the partner lives in NL.

-

Foreign income C = being paid in EUR by a company based in Germany and living in NL.

-

Foreign income D = being paid in USD by a company based in the US and also living in the US, but with a Dutch passport.

Does a foreign salary have an impact on my maximum mortgage?

Yes. If you earn your salary overseas, in most cases, you can borrow a 90% loan to income, which is lowered by 10% percent in most cases. However, the maximum amount depends on the mortgage lender and your circumstances.

For example mortgage and foreign salary

If you live in the Netherlands and earn your income in the United States, your maximum mortgage is calculated based on 90% of a loan to income.

Or

Some exemptions apply to expats who work for international or EU organizations. In these cases, you can borrow a 100% loan to income.

Or

If you live and work in the US but have a Dutch passport, you can borrow only 85% loan to income for 20 years instead of 30 years.

Please note: regulations and expectations differ per mortgage lender.

Documents translated into English

You must have your salary and employment documentation translated into English from a foreign language to apply for a mortgage.

Schedule a complimentary introductory call with our mortgage specialists. We specialize in mortgages for expats and are dedicated to navigating you through the home-buying process.

-

Get clarity on your financial possibilities.

-

Access to a trusted network.

-

Highly competitive rates and flexible terms.

-

English translations of bank documents are shared.

- 100% Independent Advice