This article will provide overview predictions for the housing market, highlighting the key trends and factors likely to shape the housing market in the coming year.

ABN AMRO's projections for the housing market:

-

ABN AMRO expects that mortgage rates will stay high while incomes won't increase fast enough to make up for it. As a result, to make housing more affordable, house prices will need to decrease even more.

-

A shortage of new construction is anticipated to lead to a modest increase of 2.5% in home purchases in 2024, according to ABN AMRO's projections.

-

More homes are being put up for sale again, as sellers are listing their properties earlier due to longer sales times. Greater attention is now paid to factors like foundation quality and water safety.

-

The current housing market has more houses for sale as homeowners who wish to move on to a new property are listing their current homes sooner. Due to a reduction in potential buyers and fewer offers exceeding the asking price, it is crucial to allocate additional time for the sale.

-

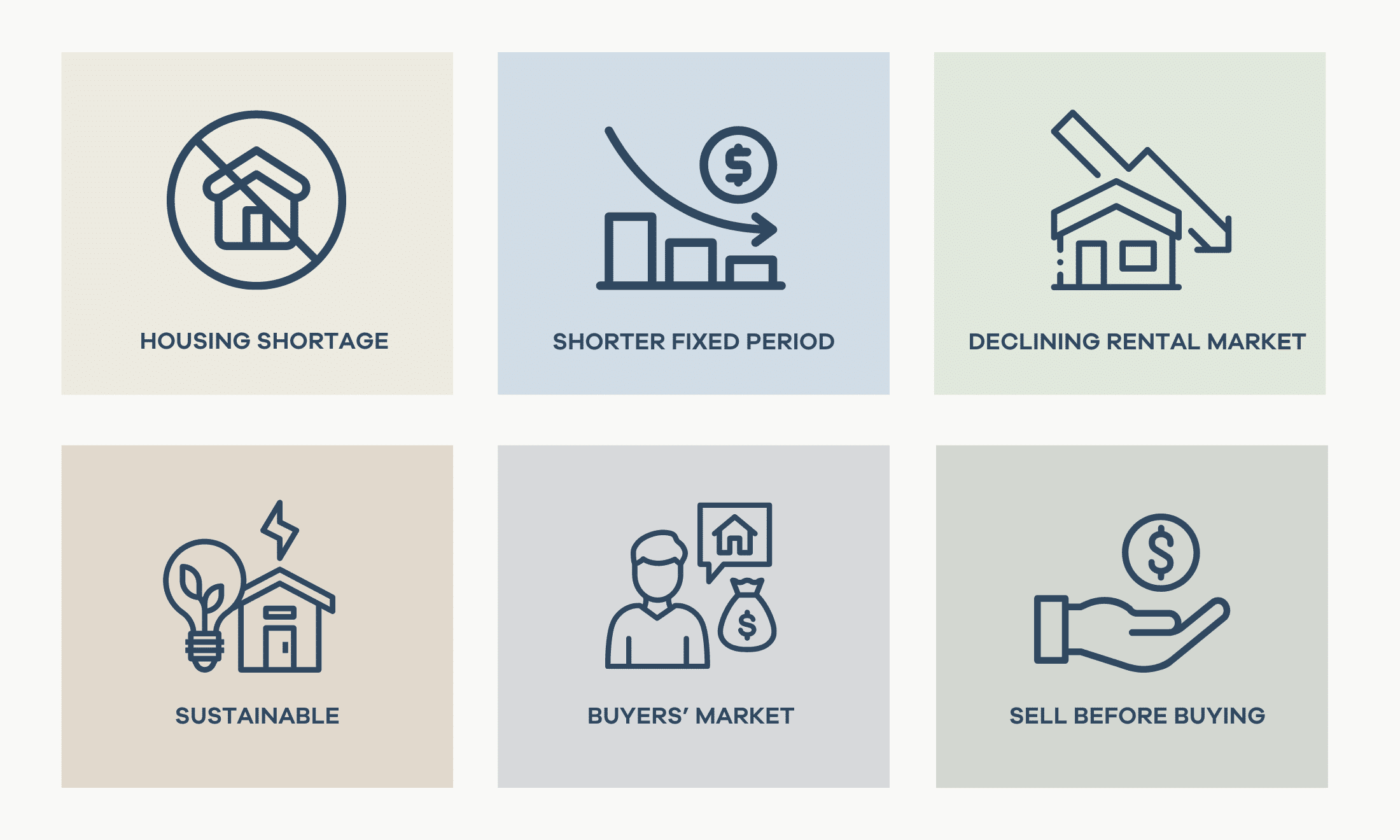

Because mortgage rates have increased, many individuals choose shorter fixed interest periods

-

Investor interest in rental housing is expected to decline. The attraction of rental properties to investors was boosted by increasing rental income that kept pace with inflation and favorable tax policies. Nonetheless, the government is presently limiting rents, and landlords are encountering raised taxes, while the rise in interest rates negatively affects housing valuations.

-

The surge in energy prices has prompted homeowners to take a greater interest in sustainable living. A crucial initial step in this regard is insulation. By investing in wall, roof, and floor insulation, homeowners can quickly reap the benefits, even accounting for the rebound effect, which refers to the tendency of people to use more energy-efficient appliances and raise their thermostat settings in response to lower energy bills.

Rabobank projections for the housing market:

-

This year, the decline in home prices remains significant, mainly because some potential buyers withdrew from the market due to the increase in mortgage rates. It is predicted that in 2023, there will be a year-on-year drop of 4.2 percent in home prices, and by the conclusion of that year, home prices are anticipated to be 7.6 percent lower than the peak reached in July 2022.

-

Decreasing housing prices and increasing wages have resulted in more affordable homes for sale this year, leading to a resurgence in demand for owner-occupied homes. However, the housing supply still needs to be improved.

-

It is projected that house prices will remain relatively stable in 2024. However, due to significant price drops expected in 2023, the average price level in 2024 is anticipated to be 1.5 percent lower than the intermediate price level in 2023.

-

In 2022, the housing market experienced extreme conditions. At the start of the year, there was a significant increase in house prices, but towards the end, there was a sharp decline in the rate of house price growth.

-

Rabobank predicts a significant decrease in the prices of existing owner-occupied homes this year, with an estimated 7.6 percent reduction in the fourth quarter, compared to the peak in July 2022.

-

Based on Rabobnak's latest forecasts for capital market rates and the economy, we anticipate the housing market to reach its lowest point this year. Three factors support our expectation for house prices to bottom out: the increasing affordability of owner-occupied homes over the next few years, the relatively robust labor market, and our prediction of a slight decline in capital market interest rates.

-

Rabobank indicates that housing affordability will enhance with the decreasing cost of homes, which will reduce the amount homebuyers need to borrow, leading to better financial stability by the end of 2023. In addition, housing affordability will be boosted by the substantial wage increase, responding to inflation.

-

The current trend in the housing market shows that more homes are available for sale, but fewer transactions are taking place, as people now prefer to sell their homes before buying a new one. The number of houses for sale has more than doubled compared to a year ago, but the surge in supply has subsided. While earlier in the year, there was a notable decrease in the number of homes for sale; recent weeks have shown a less drastic decline in supply.

In conclusion, the housing market is subject to various factors that can impact its trajectory. While it is challenging to predict the future with certainty, the housing market is expected to continue to experience some changes.

Schedule a complimentary introductory call with our mortgage specialists. We specialize in mortgages for expats and are dedicated to navigating you through the home-buying process.

-

Get clarity on your financial possibilities.

-

Access to a trusted network.

-

Highly competitive rates and flexible terms.

-

English translations of bank documents are shared.

- 100% Independent Advice