In 2025, the maximum mortgage amount will be determined by your income and considering your property's energy label. A higher energy label can allow you to qualify for a larger mortgage, while a lower energy label may reduce your borrowing capacity.

Energy labels in the Netherlands

An energy label is like a report card that shows how good a house is at saving energy. It's graded from A (very good at saving energy) to G (not good).

For example, a house with an A label saves energy. It has good insulation, solar panels, and windows that keep the heat inside. On the other hand, a house with a G label is not good at saving energy. It doesn't have enough insulation, loses a lot of heat, and doesn't use eco-friendly energy sources.

The energy label helps homeowners, buyers, and banks understand how well a house saves energy. This way, everyone knows how energy-efficient a house is before making decisions about it.

Energy label and maximum mortgage

Starting next year, a home's energy efficiency will be considered when calculating the maximum mortgage. Before, burden percentages were based on an "average home" with an energy label of C.

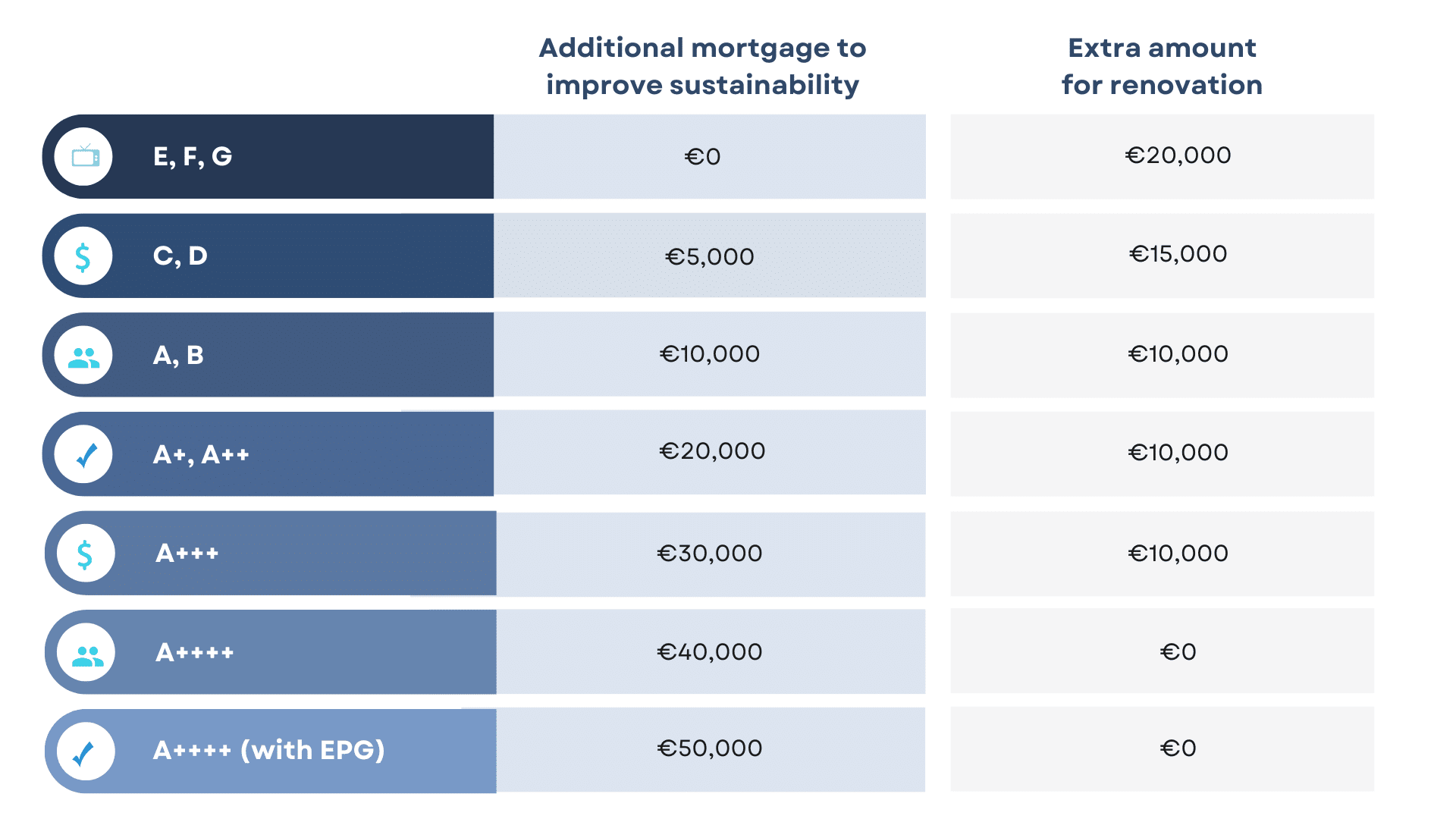

There will be two methods for figuring out mortgages based on the energy label:

-

Higher mortgage for energy-efficient homes: If your home has a good energy label (A or B), you can qualify for a higher mortgage.

-

Lower mortgage for poor energy labels with the option to improve: If your home has a bad energy label, you may get a more down mortgage, but there's a chance to increase it by making energy improvements.

For example

| Name | Amount (in euros) | |

|---|---|---|

| Home Value | €400,000 | |

| Maximum Borrowing Capacity Based on Income | €375,000 | |

| Additional Borrowing for Energy Label (B) | €10,000 | |

| Revised Maximum Borrowing Capacity | €385,000 | |

| Out-of-Pocket Expense | €5,000 | |

| Appraised Value of the Home | €375,000 | |

| Maximum Loan Amount (Limited by Home Value) | €375,000 |

The Nibud (National Institute for Family Finance Information) indicates that it is important to consider the energy label when figuring out how much money you can borrow for a house. They do this because if your home is energy-efficient, you save money on monthly energy bills.

The idea is that the money you save can be used to pay for your house. Plus, you can borrow some extra money to make your home more energy-efficient.

For example, if your house has a lower energy label (E, F, or G), you may borrow an extra 20,000 euros, but there's a condition—you must spend that money on making your home more sustainable.

For all income levels, there will be a substantial reduction in the borrowing capacity for homes with an E, F, or G label next year. The decrease in borrowing allowance varies significantly based on the income level. The decline in borrowing capacity ranges from an average of 5,500 euros for incomes between 40,000 and 50,000 euros to nearly 30,000 euros less for high incomes.

Schedule a complimentary introductory call with our mortgage specialists. We specialize in mortgages for expats and are dedicated to navigating you through the home-buying process.

-

Access to a trusted network

-

Highly competitive rates and flexible terms.

-

Guidance through the entire mortgage process.

-

English translations of bank documents are shared.

- 100% Independent Advice