How do mortgages work for newly built properties? What is a building deposit, and how do you deal with double expenses? This article guides you through the top mortgage questions for newly built properties.

When do mortgage payments start for new construction?

The mortgage payments start immediately after signing the mortgage deed at the notary. While building your new home, you must manage the monthly expenses of your existing mortgage or the costs of your current residence. What's good to know: There are options to pay with your savings or to get an additional mortgage to pay double expenses. It's called double expenses because you're paying the mortgage/rent of the property where you live and the mortgage for the new property.

What double expenses do you need to pay?

Your double costs include payments for the current home and the prospective property because the property is still under construction. You can use your savings to deal with double charges during this period. Alternatively, applying for a bridging loan is also recommended to help cover the costs before selling your old property.

Can I borrow an additional loan for interior decoration?

It is possible to borrow more to finalize the interior decoration before moving in, as long as you ensure the cost can be covered with your income. The interior spaces of a newly built property are typically left blank for the owner to complete. Therefore, you must include interior design and decoration costs when calculating your budget. If you don't have enough savings, you can discuss this with our mortgage specialists and borrow an additional amount for interior decoration when applying for the mortgage.

What is a building/construction deposit?

When the mortgage is approved, your lender sets up a building or construction deposit, which is part of the mortgage. The building deposit pays for all home construction bills and receives interest. Whenever the developer finishes part of the construction, you declare the invoices to the lender, who then pay the developer with the funds from the building deposit.

When the construction is finished, the building deposit is supposedly used up, and the account is closed. If there is remaining money in the account, it will be used for repaying your mortgage.

How much does it cost to buy a new build?

-

Mortgage deed

-

NHG deposit

-

Mortgage advisory

How much do you save on a mortgage when buying a newly built property?

When buying a new build as home, you save the following closing fees:

-

property transfer tax

-

appraisal costs

-

real estate agent commission

-

notary fees

For example

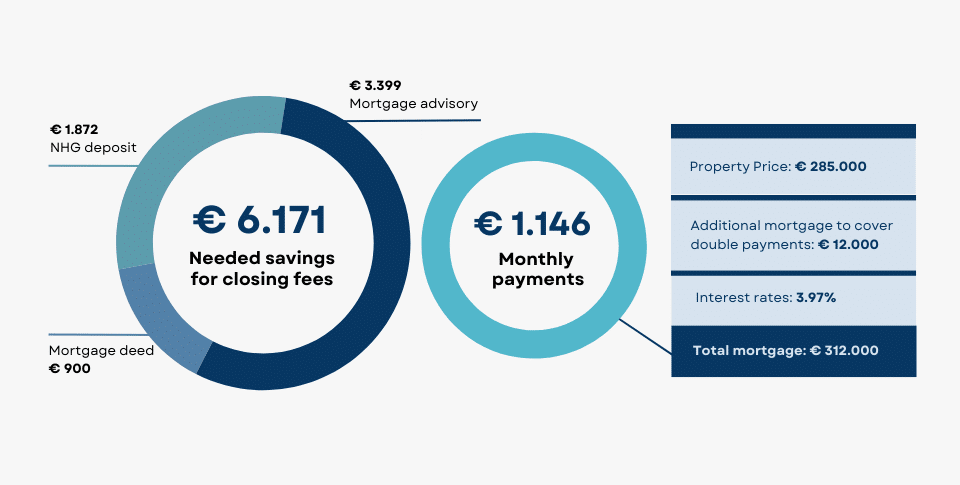

For example, here's a payment overview of a new build worth € 285.000:

Newly built properties have better performance in energy efficiency, which gives you extra benefits when applying for a mortgage in the Netherlands. Lenders offer different discounts on the interest rate (usually up to 0.15%) if the property you buy meets certain sustainability requirements. Interest rates discounts offered by main banks:

-

ABN AMRO (up to 0.15%

-

ING (up to 0.15%)

-

Rabobank (0.15%)

-

Obvion (0.05%)

How does a ground lease work for new builds?

In the Netherlands, a lot of ground is owned by the municipalities. If the new build is subject to a ground lease when purchased, you only buy the property, not the land. In this case, you must pay the landlord the additional rent for using the land. The payment amount for ground leases varies across different municipalities and contract types.

Schedule a complimentary introductory call with our mortgage specialists. We specialize in mortgages for expats and are dedicated to navigating you through the home-buying process.

-

Access to a trusted network.

-

Highly competitive rates and flexible terms.

-

Guidance through the entire mortgage process.

-

English translations of bank documents are shared.

- 100% Independent Advice