How do you move to a bigger property while keeping your interest rate? When buying a second home, there are more factors to consider than with your first home, such as your existing mortgage type, interest rate, and provider.

The question often arises: what should I do with my mortgage?" One of the options is to keep your current interest and conditions. The article discusses the possible options for porting a mortgage in the Netherlands.

Mortgage porting - what is it?

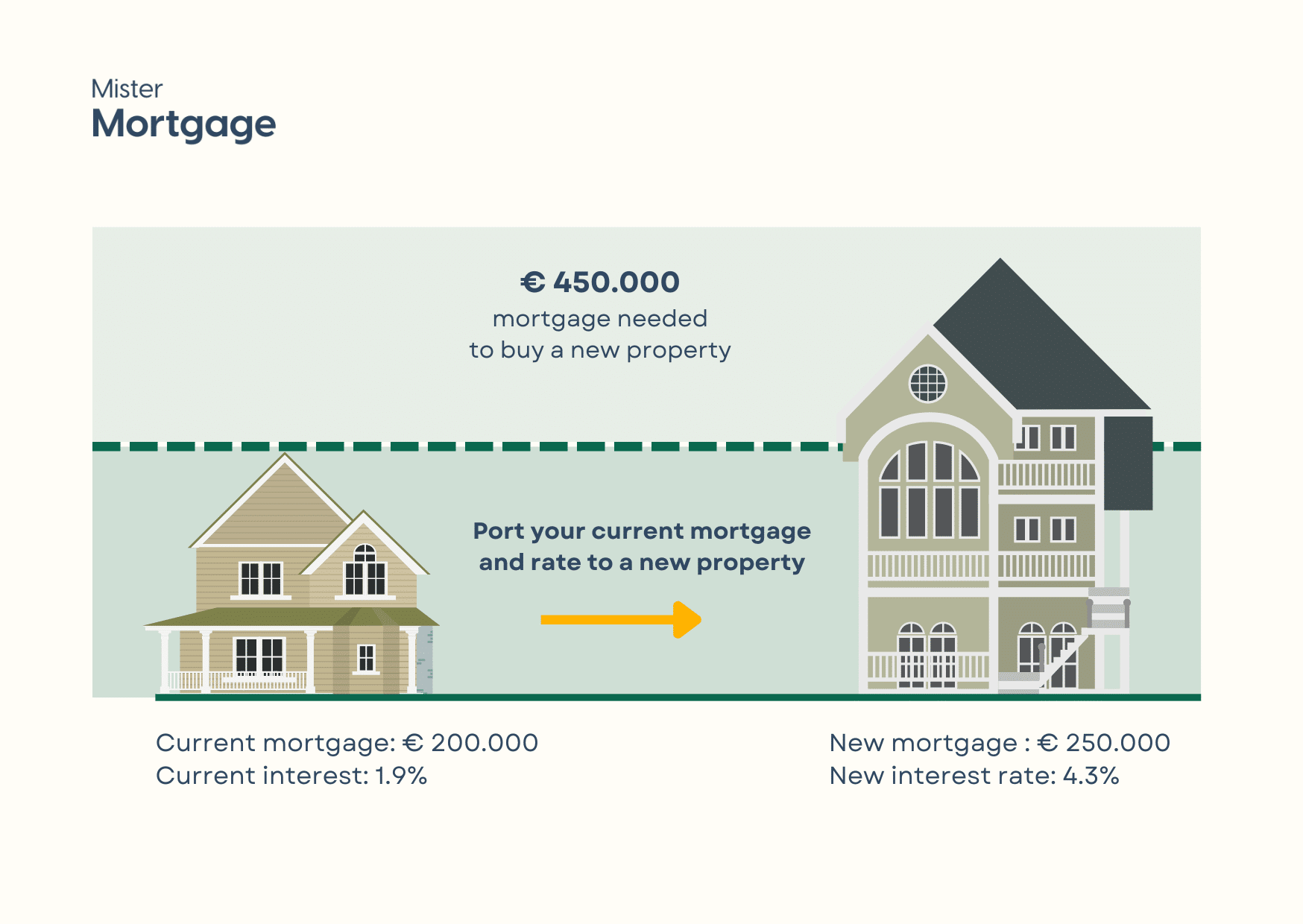

The process of moving your mortgage to another property is called porting. Mortgage porting means transferring your mortgage to a new property. Moving your current mortgage to a new property can be cost-effective since you don't need to pay exit fees or early repayment charges. With mortgage interest rates increasing by 2 % or 2.5 % in the last year, porting your low interest rate can save you money.

How does porting a mortgage work?

Porting a mortgage involves transferring the terms of your current mortgage to a new property. This includes maintaining the same interest rate, fixed-rate period, and fees. However, some lenders may allow for modification of the mortgage terms, such as extending the duration or changing from a joint to an individual mortgage. While many lenders advertise the option of mortgage porting, it's important to note that it's not a guarantee, and the lender has the right to reject a request to port the mortgage loan.

Pros and cons of porting a mortgage

Pros

-

Favorable interest rates and conditions.

-

Lower monthly payments assuming interest rates have increased.

-

No penalty.

Cons

-

There's a short time to complete the process.

-

You need to be lucky to find a new property in time.

-

Sometimes, you'll miss out on better rates and conditions.

Can I port my mortgage?

A few factors can influence the lender's decision to allow you to port a mortgage.

1. If your mortgage lender allows you to port your mortgage:

-

If your current home was eligible for an NHG mortgage and the new home is not eligible for a mortgage with NHG.

-

Sometimes, lenders do not permit changing the mortgage type, duration, or other conditions.

-

Any discounts on the rate related to the current home cannot always be transferred.

2. Your financial circumstances:

-

You should be eligible for the new financing.

What If my current mortgage is not enough to cover a new mortgage?

If you buy a home that requires a larger mortgage than you currently have, your lender may allow you to blend and extend a ported mortgage. There is no penalty to pay because you are not breaking your initial mortgage.

When you port your mortgage to a less expensive home, some lenders can allow you to make prepayments to reduce your mortgage balance. Many lenders permit porting to a cheaper property and won't impose any penalties if your mortgage falls within the prepayment privilege limit.

Schedule a complimentary introductory call with our mortgage specialists. We specialize in mortgages for expats and are dedicated to navigating you through the home-buying process.

-

Get clarity on your financial possibilities.

-

Access to a trusted network.

-

Highly competitive rates and flexible terms.

-

English translations of bank documents are shared.

- 100% Independent Advice