Before diving into the details, let's start by understanding how equity works and how you can determine how much equity you have. The first step in determining your home equity is to check your mortgage debt.

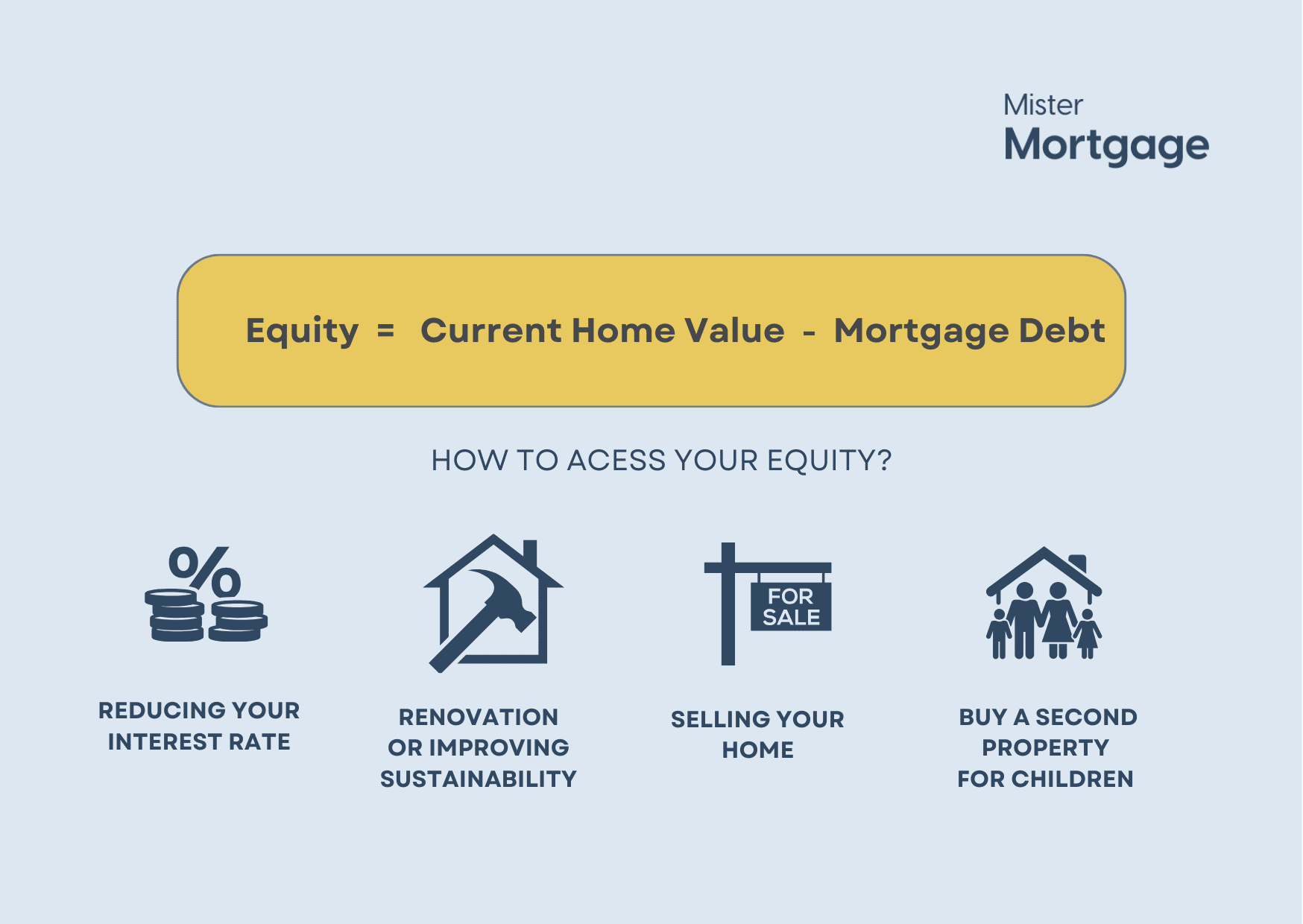

This helps you understand your financial position and the portion of your home you truly own. You can calculate your equity using the following formula:

Equity = current home value - mortgage debt.

In other words, equity is the difference between your home's current value and the remaining mortgage balance. If the housing market is healthy, each mortgage payment you make increases your equity. However, equity can also become negative depending on market conditions.

Imagine owning a home worth €700,000; your remaining mortgage balance is €250,000. The equity you have earned in a healthy market would be €450,000. This means you have €450,000 in equity that you can use for various purposes.

-

Access the equity by selling your home.

-

Use existing equity to reduce your interest rate.

-

Use equity to buy a second property.

-

Use equity to renovate or make your home more sustainable.

Selling your property is one of the most common methods for releasing equity. Once you sell your home and repay any outstanding mortgage debt to your lender, the remaining balance—known as equity—becomes yours.

You can either cash it out or reinvest it to purchase another property. A significant advantage of the Dutch tax system is that homeowners are not required to pay taxes on the profits realized from the sale of their primary residence.

This tax exemption allows for greater financial flexibility, allowing homeowners to utilize their equity without incurring tax liabilities.

As a homeowner, you can access your home equity to finance the purchase of a second property, such as a holiday home or rental property. This involves borrowing additional funds from your bank and using the equity in your primary residence as collateral for the loan.

For example, your property is valued at €500,000, and your mortgage balance is €400,000, leaving you with €100,000 in equity. In that case, lenders typically offer only 70-80% of that equity for additional financing. It's important to know that getting a second mortgage has different requirements, higher interest rates, and different taxes on the second property.

Another way to utilize your home equity is by contacting your mortgage provider to inquire about a potential reduction in your mortgage interest rate.

When you first obtained your mortgage, the lender evaluated your risk based on the loan-to-value (LTV) ratio. Now that you have built up equity, your mortgage might represent only around 60% of your home's value. This reduced risk could qualify you for a lower interest rate.

By taking advantage of this opportunity, you can use your equity to lower your monthly mortgage payments.

Many homeowners use the opportunity to finance sustainable renovations or home upgrades, which also increase the property's value and help build more equity over time.

Additionally, you might qualify for mortgage interest deductions if the loan is repaid within 30 years on an annuity or linear basis.

Many lenders also offer favourable rates for energy-efficient improvements, making investing in projects that support long-term equity growth easier.

You can also access your equity and help your children purchase their first home or pay for their studies. Let's say your child needs a student loan; in this case, they can use your equity, which means they no longer have to pay monthly repayments with interest.

Good to know that you need to borrow against your equity, which means your loan will be higher, and you need to qualify for an additional loan.

Do you have equity in your home and want to access it? Contact our mortgage advisors to explore your options and the requirements for unlocking your equity. We're here to help you navigate the Dutch mortgage market.

Schedule a free introductory call with our mortgage specialist to understand your options.

-

Access to a trusted network.

-

Highly competitive rates and flexible terms.

-

Guidance through the entire mortgage process.

-

English translations of bank documents are shared.

- 100% Independent Advice