Many people have a hard time finding a home in the current market. The increasing number of buyers usually results in overbidding.

When mortgage interest rates are low, people push to get the maximum mortgage to win a bid on a house. The rising property prices have not deterred buyers from overbidding —more than half of the properties in the Netherlands were sold for more than the asking price.

How to win a bid in the current market?

The housing market remains tight in the Randstad area, as more people want to buy than houses are listed for sale. If you want to win a bid, it is highly recommended that you work with a real estate agent. Real estate agents have extensive knowledge of the Dutch real estate market, including housing prices, building conditions, and area. Cooperating with a real estate agent gives you more chances to win a bid.

Reasons to work with a real estate agent:

1. Attends viewing with you and helps you to inspect the property.

2. Guide and support through the buying process.

3. Negotiate the final price, terms, and conditions.

4. Help you to place a competitive bid based on the current market value.

5. A real estate agent gives you insights and advice about building foundations, VVe, and neighborhoods.

6. Arrange paperwork: written offer, closing deed, and conditions.

7. Help arrange a technical inspection.

How does the process of bidding work?

All potential buyers can submit their best bid on a property; after the deadline, the seller selects a winner. The purchase price is a necessary part of winning a bid; however, other factors can influence sellers’ choice to select a bid winner. For example, your flexibility or financial situation to get a mortgage can also play a crucial role in winning a bid.

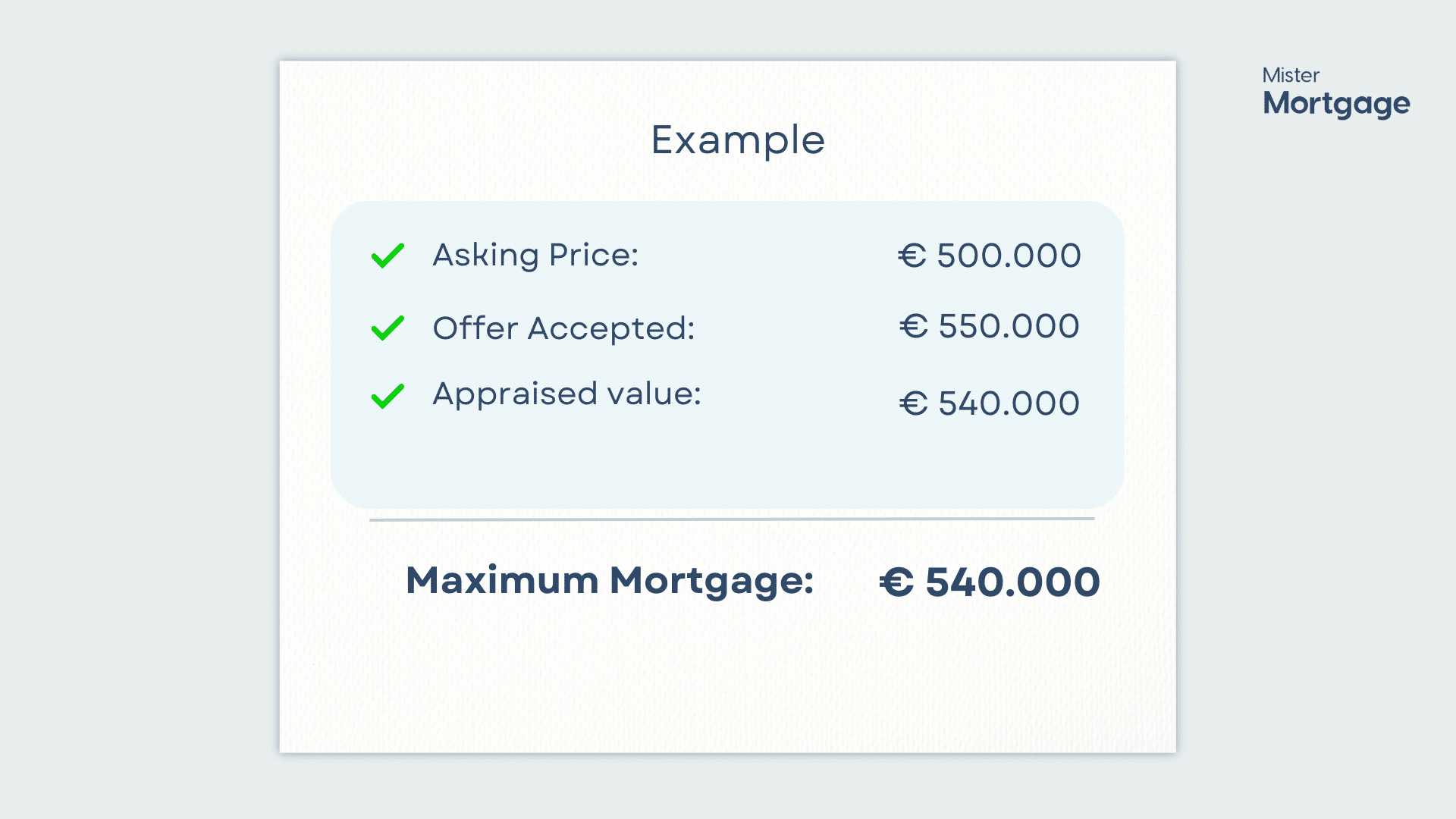

If your bid is too low, it may not be accepted; if it is too high, the seller may question your financial situation. Please note your maximum mortgage is based on loan-to-value in the Netherlands.

For example:

As a buyer, you can protect yourself by signing a financial clause with a seller. A financial clause gives you a right to withdraw from the agreement. For example, if a mortgage lender rejects your application, you have no consequences for leaving the deal.

If you sign a purchase agreement without a financial clause, the seller is better protected than you. If your finances are not in place by the handover date and the transaction fails, you must pay 10% of the property price.

Technical inspection

Another necessary dissolving clause is the technical inspection clause. This one allows you to cancel the transaction if the technical inspection results fall short of your expectations. Both of these clauses provide you with additional security.

Time to start mortgage application

Getting and closing a mortgage takes time. You must find a mortgage lender, choose a type, obtain a mortgage offer, and have your property appraised. If the bank declines your mortgage application, you must start all over again. In this case, it’s highly recommended to work with a mortgage broker. Mortgage advisers work with a variety of mortgage lenders, whereas banks only represent themselves.

Transfer date

It is necessary to indicate the transfer date in the offer. Some sellers are more already have a specific date when a property can be available; some sellers are more flexible in moving out as soon as possible. Together with a real estate agent, you can negotiate the moving date and other terms and conditions.

Schedule a complimentary introductory call with our mortgage specialists. We specialize in mortgages for expats and are dedicated to navigating you through the home-buying process.

-

Get clarity on your financial possibilities.

-

Access to a trusted network.

-

Highly competitive rates and flexible terms.

-

English translations of bank documents are shared.

- 100% Independent Advice