When moving with a partner, an increasing number of private homeowners want to keep their former homes. A keep-to-let situation occurs when two people acquire a new property, and one does not sell the prior home. The goal is to keep an old home as an investment.

The new trend in the Netherlands

The keep-to-let trend is becoming more and more popular among private homebuyers in the Netherlands.

According to Kadaster (public land register), homeowners owned roughly 62.000 homes for keep-to-let, and 75.000 residences were purchased as an investment in the last ten years. However, the gap between these two property types is narrowing as keep-to-let grows and buy-to-let shrinks. In 2021, the change in the transfer tax from 2% to 8% reduced the number of buy-to-let transactions. In 2023, the transfer tax to buy to let increases to 10.4%.

Reasons to keep the property

The most significant benefit of keeping your property is that the rental income is not taxed because the property moves from box 1 (taxable income: employment and owner-occupied home) to box 3 (capital tax: savings and investments). Also, keeping the property doesn't involve substantial additional costs. Furthermore, the rental property moves from box 1 (work and income) to box 3 (assets).

Keep to let conditions

-

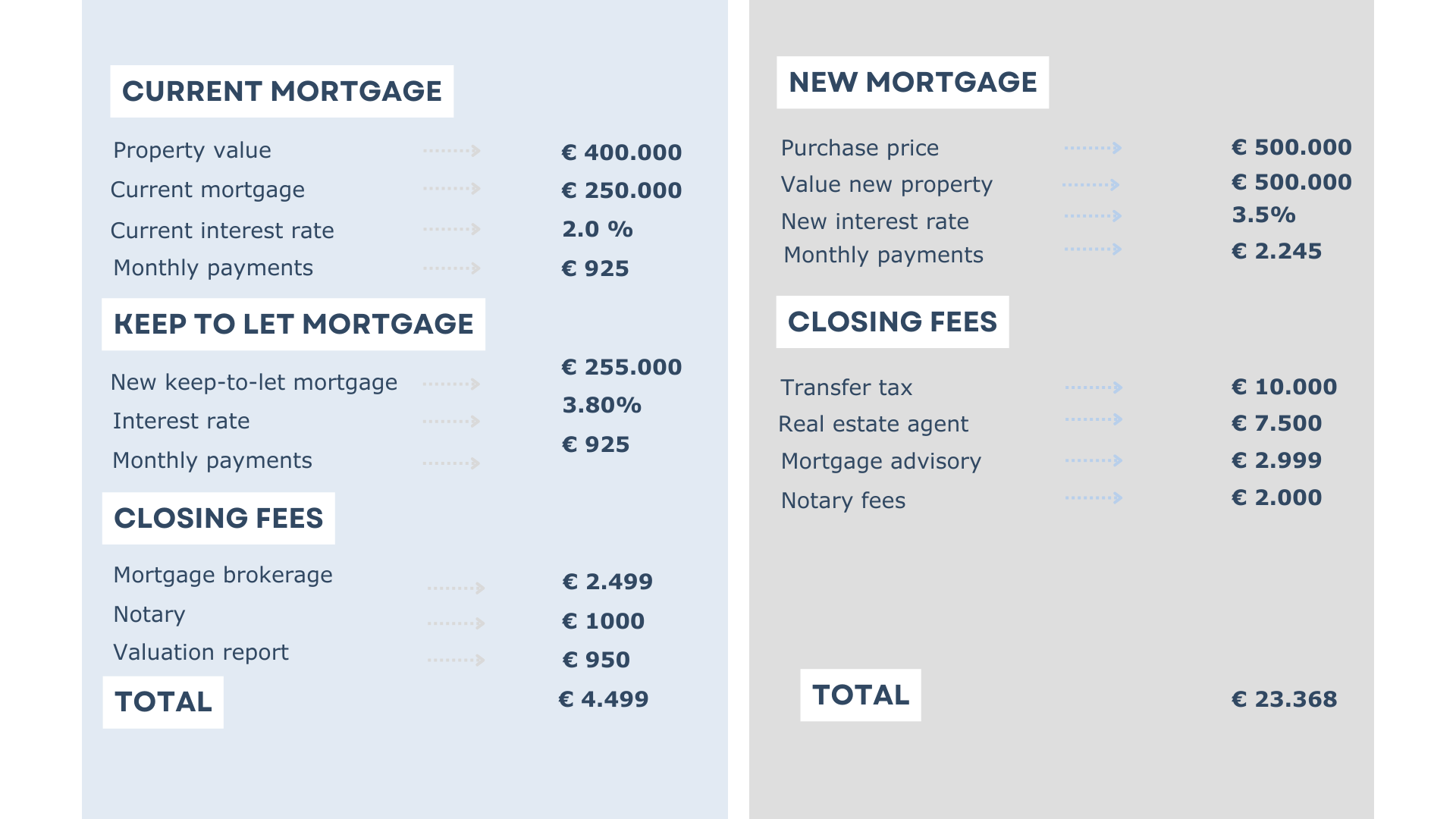

The financing conditions, such as interest rates and repayment, change because it is no longer an owner-occupied home, so the bank's exposure increases.

-

Interest paid is not tax-deductible.

-

When you rent out a property, you must think about the tenancy agreement, what rights and obligations the tenants have, how to determine the amount of the rent, etc. A certified real estate agent can assist you in estimating the expected rent and finding a tenant.

-

The return on your investment depends on numerous factors, including the rent, financing, and maintenance costs.

Keep to let interest rates

Mortgage rates for keep-to-let properties are higher than those for owner-occupied properties, and the difference, as a rule of thumb, is roughly 1%. Because you can never borrow 100 per cent of the property's worth, a ten-year fixed interest rate is currently around 2.5 per cent. You can also reduce the monthly payments to the lender by changing the duration back to 30 years.

Mortgage penalty

When you transfer a residential mortgage to a keep-to-let mortgage, you pay an early repayment penalty to your existing mortgage lender. Your new lender repays the existing mortgage with your new keep-to-let mortgage. The prepayment penalty depends on a few factors:

-

The fixed term of your rate at your current lender.

-

The mortgage rate.

-

The difference between your interest rate and the current interest rates.

-

Mortgage lender terms.

Please note: not all mortgage lenders offer keep / buy-to-let mortgage products.

Schedule a complimentary introductory call with our mortgage specialists. We specialize in mortgages for expats and are dedicated to navigating you through the home-buying process.

-

Get clarity on your financial possibilities.

-

Access to a trusted network.

-

Highly competitive rates and flexible terms.

-

English translations of bank documents are shared.

- 100% Independent Advice