Mortgage rules are changing every year. How do new mortgage rules impact your situation in 2023? This blog article discusses mortgage regulations changes and gives about the future housing market in the Netherlands.

National Mortgage Guarantee

The NHG mortgage limit will increase in 2023. The NHG limit will rise to € 405,000, while the NHG premium will stay at 0.6%. In 2022, the NHG mortgage limit was € 355,000. The current increase is necessary due to increasing housing prices.

Transfer tax changes

Transfer tax rules are changing for first-time buyers and buyers to let investors. The property tax advantage for first-time home buyers has increased from € 400.000 to € 440.000. First-time homebuyers aged 18 to 35 who buy their first property worth up to € 440.000 can benefit from an exemption of the 2% transfer tax in 2023.

Buy to let investors will pay a higher transfer fee. Following the increase in 2021, the Dutch government announced a further increase in the transfer tax for investors as of January 1, 2023. The transfer tax for property investors will increase from 8 % to 10.4 % in 2023.

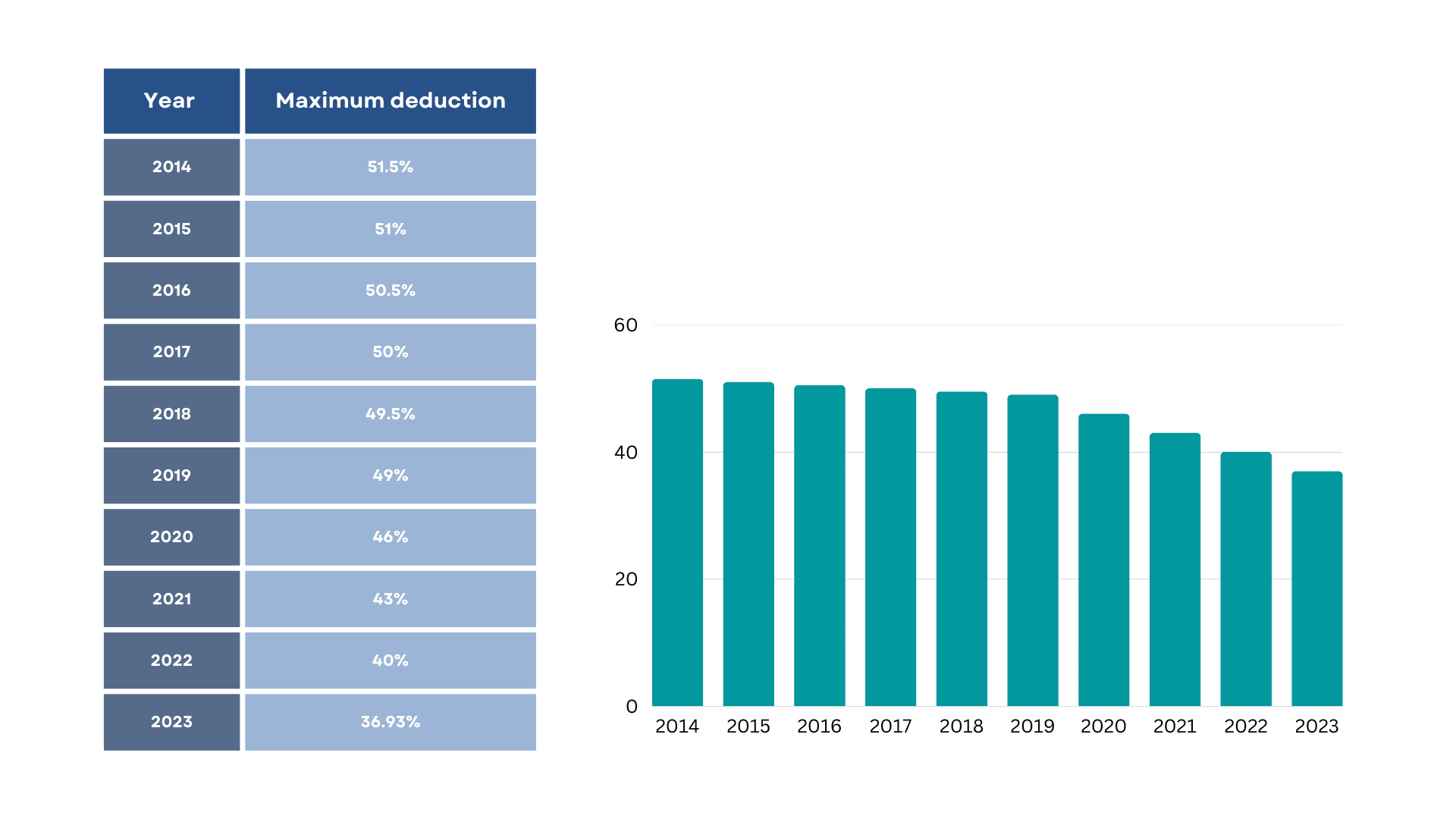

Annuity and linear mortgage interest rates for 30 years are tax deductible in the Netherlands. In 2022, mortgage interest deductions decreased to 40%. The further decrease will follow to 36.93% in 2023.

LtV maximum mortgage value to loan

The maximum mortgage based on the property's value remains the same as in 2022. You can borrow 100%, equal to the home's market value.

Mortgage lenders starting as of January 1, 2023, will be able to include the second income in calculating the maximum mortgage for two incomes couples. Both payments will count for 100% (in 2022, the dual income was 90%). Two-earners can then get the same mortgage as single-earners with the same gross income.

Isolation subsidy in 2023

The ISDE, the national subsidiary for insulation, covers about 30 % of the costs if you want to implement two different insulation measurements: insulation measure in conjunction with a heat pump, solar boiler, link to a heat network, or two insulation measures). From 2023 you can also get a subsidy for one of the insulating measurements. You can apply for measures you implemented after April 2, 2022, and this rebate typically covers 15% of the expenditures. The application must be submitted within a year of the measure's implementation and payment.

Gift tax

There are no changes to the gift tax if you receive it from abroad. There is no restriction on the amount of donation your parents can make to you if they have never lived in the Netherlands. If you receive a gift tax from a Dutch person, you need to pay taxes.

Future insights into the housing market

-

Student loans

In addition, the government plans to review how student debt impacts borrowing capacity. According to the coalition agreement, the current state of student debt will be decisive for first-time buyers when applying for a mortgage. This should give former students who have made additional repayments more room to borrow. -

Higher mortgages for energy-efficient homes

From 2024, consumers can apply for a higher mortgage when buying a property with low energy usage or implementing energy-saving measures. The idea behind this is that consumers pay lower energy bills; however, Nibud advice implementing and reviewing a few issues related to the energy label application. For this consumer, the average monthly energy bills will be minimal. Nibud suggests carefully considering a few issues relating to applying the energy label throughout the elaboration

What to expect in 2023?

One of the biggest banks, ABN Amro, expects housing prices to fall by 2.5% in 2023. Since the day Russia invaded Ukraine, food, and energy prices have skyrocketed, resulting in fewer transactions. Before, fewer transactions happened, mainly due to the housing shortage. Rabobank indicated that housing prices this year were 13.7 % higher than in 2021; however, it is predicted that property prices will fall by 3.1% in 2023. By the end of 2024, the prices should be 7.4% lower.

Homebuyers who buy a property now pay 3.0% to 3.5% more interest than at the start of the year. This means borrowing power has declined, and monthly payments have increased. On the other hand, the number of overbidding has slowed down in the last months.

Schedule a complimentary introductory call with our mortgage specialists. We specialize in mortgages for expats and are dedicated to navigating you through the home-buying process.

-

Get clarity on your financial possibilities.

-

Access to a trusted network.

-

Highly competitive rates and flexible terms.

-

English translations of bank documents are shared.

- 100% Independent Advice