If we look back, we can notice that interest rates have fluctuated over the past decade. For example, rates were much higher in the 1980s and early 1990s, often reaching 10–11%. The main reason was the economic uncertainty after the fall of the Berlin Wall.

Rates began declining from 1990 until around 2000, then rose again due to stock market instability and the dot-com bubble burst. From 2001 to 2005, rates dropped to an average of about 4% before climbing again in the 2008–2009.

From 2001 to 2005, rates dropped to an average of about 4% before climbing again in the 2008–2009.

Over the past decade, mortgage rates generally decreased as the European Central Bank (ECB) lowered its key interest rate and various stimulus measures pushed down capital market rates.

For example, during the COVID-19 pandemic, interest rates reached historically low levels.

Mortgage interest rates remained low until 2021 before peeking again due to the war in Ukraine, supply chain disruption, and the recovery after COVID-19.

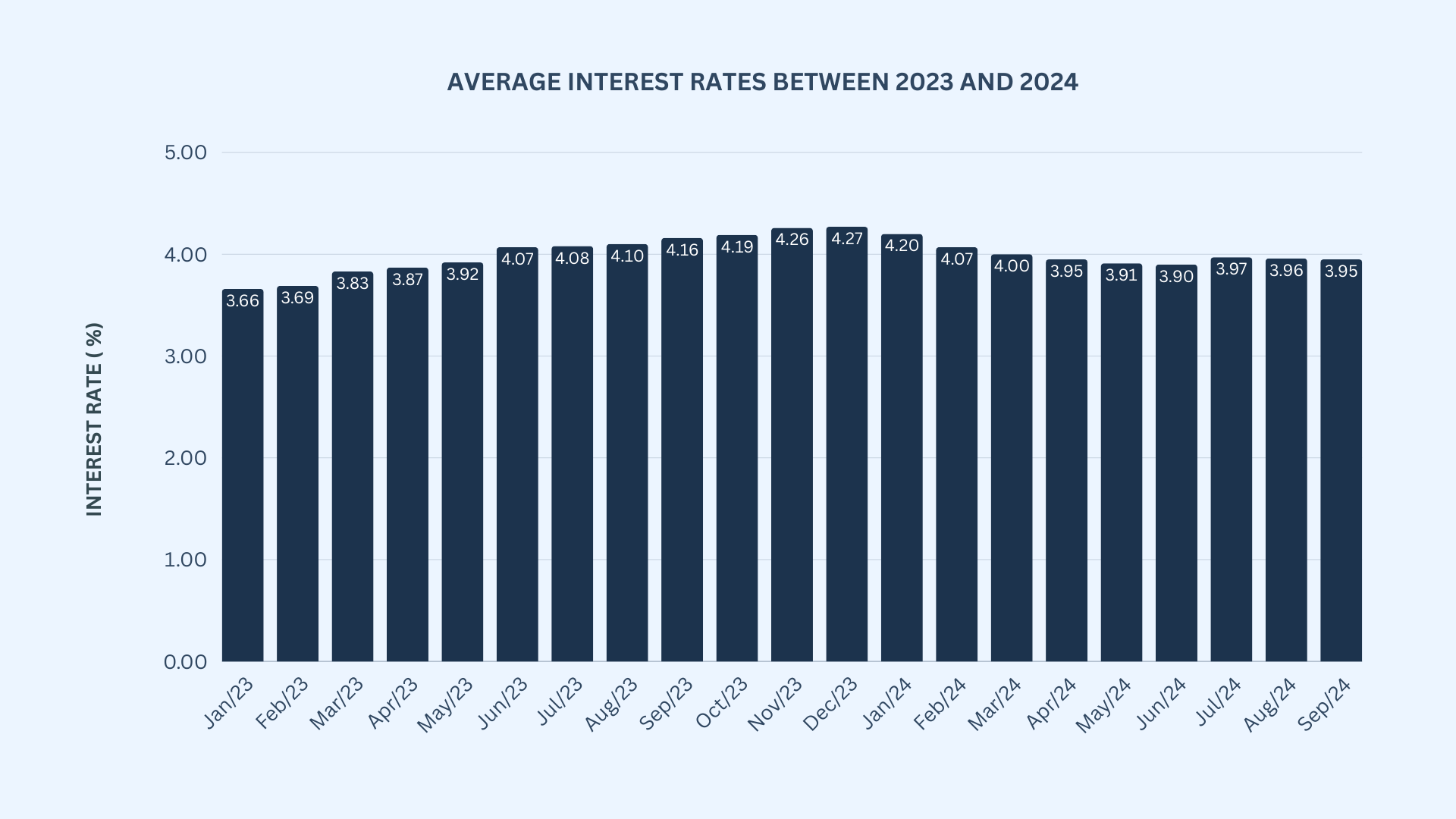

Looking back at 2023, mortgage rates stayed high throughout the year. The average rate for a 10-year fixed mortgage went up from 4.16% in January to 4.55% in November, then dropped. Other fixed-rate terms followed a similar pattern.

2024 began with a 10-year fixed mortgage rate of approximately 3.78%. Meanwhile, the 20-year fixed-rate decreased from 4.24% in January to 4.08% in August.

The 30-year fixed rate dropped from 4.37% in 2024 to 4.19%. Meanwhile, the 5-year rate fell from 3.80% to 3.75% but did not reach the February low of 3.67%.

Multiple factors often affect Dutch mortgage interest rates, including the ECB policy, which is usually influenced by EU inflation and economic conditions.

In 2024, the ECB was crucial in shaping interest rates across EU countries. The bank reduced interest rates three times in a row, with the current rate at 3.25%.

Projections indicate rates may drop to 2.5% next year if eurozone inflation slows, potentially reaching about 2% by mid-2025. This trend could support more stable or lower mortgage rates within EU member states.

Just before the US election and Trump's victory, the Federal Reserve (the central bank of the United States) reduced interest rates by 0.25%, bringing them to a range of 4.50%–4.75%.

This is positive news for European companies doing business with the US. Lower US interest rates could reduce borrowing costs for firms operating in or relying on US financing. At the same time, a weaker dollar might benefit exporters but raise costs for those purchasing goods in dollars.

However, we already know that Trump is planning to increase tariffs. There is talk of a general tariff increase of 10% to 20%, and for Chinese imports, even 60%. The tariffs aim to undermine the competitive position of foreign countries and strengthen domestic industries.

If tariffs increase the cost of imported goods, inflation will be higher. If inflation rises sharply due to these tariffs, the Federal Reserve may need to consider raising interest rates to counteract inflationary pressures despite the recent rate cuts.

What does this mean for U.S.-EU relations? This dynamic could pressure the ECB to adjust interest rates to remain competitive. At the same time, Trump's proposed tariffs may drive inflation and complicate trade, posing challenges for European exporters to the US.

According to ABN AMRO, the ECB is expected to adopt a wait-and-see approach. Tariffs are expected to be announced in Q2 2025 and implemented from Q3 2025 onward.

Major banks in the Netherlands expect interest rates to decrease next year, mainly due to the European Central Bank's (ECB) interest rate cut. What are the economists at Dutch banks expecting in 2025:

-

The ECB's current deposit rate is 3.25%, following a cut on October 23. ABN AMRO expects further reductions, with the deposit rate forecasted to drop to 3% by the end of this year and 1.5% by the end of next year. As a result, short-term fixed-rate mortgage rates are also expected to decrease.

-

ABN AMRO expects the ECB to cut the rate in June 2025. They will likely cut rates more than the market expects, continuing at each meeting until the deposit rate reaches 1% by early 2026.

-

According to ING, the ECB, which recently lowered its policy rate to 3.5%, is expected to make further cuts due to easing inflation in the Eurozone. As a result, capital market interest rates have fallen, prompting mortgage providers to reduce rates. ING predicts that capital market rates will stabilize this year, increasing the likelihood of stable long-term mortgage rates.

-

Scenario 1: Mortgage interest rates remain the same as they are now

If the EU inflation stays above the ECB's target of 2%, the central bank will likely keep interest rates stable throughout 2025, keeping borrowing costs high in the Netherlands. This could lead to a continued slowdown in consumer spending, business investment, and the housing market.In this case, interest rates may either slightly increase or remain at their current level.

-

Scenario 2: Mortgage interest rate decreases

If EU inflation drops to the ECB's target of 2%, it will be driven by lower energy prices, better supply chains, and steady wage growth. As a result, the European economy will grow at a moderate pace. In response, the ECB will gradually lower interest rates to encourage economic growth and prevent deflation.

-

Scenario 3: Mortgage interest rates increase

If inflation within the EU spikes again, the ECB may prioritize controlling inflation over supporting economic growth. To prevent inflation from spiralling out of control, the ECB could increase interest rates further, making borrowing even more expensive.As a result, interest rates in the Netherlands would rise, potentially surpassing current levels.

Here at Mister Mortgage, we expect interest rates to decline gradually in 2025, driven primarily by the European Central Bank's (ECB) ongoing rate cuts and the potential for easing inflation in the eurozone. However, it's important to remember that several factors, including political, economic, and geopolitical events, can influence/switch these predictions.

For more information or to discuss insights about interest rates, please schedule a free introductory call with one of our mortgage advisors. We are here to answer your questions.

Schedule a complimentary introductory call with our mortgage specialists. We specialize in mortgages for expats and are dedicated to navigating you through the home-buying process.

-

Access to a trusted network.

-

Highly competitive rates and flexible terms.

-

Guidance through the entire mortgage process.

-

English translations of bank documents are shared.

- 100% Independent Advice