What is an annuity mortgage in the Netherlands? An annuity mortgage is also known as a repayment mortgage.

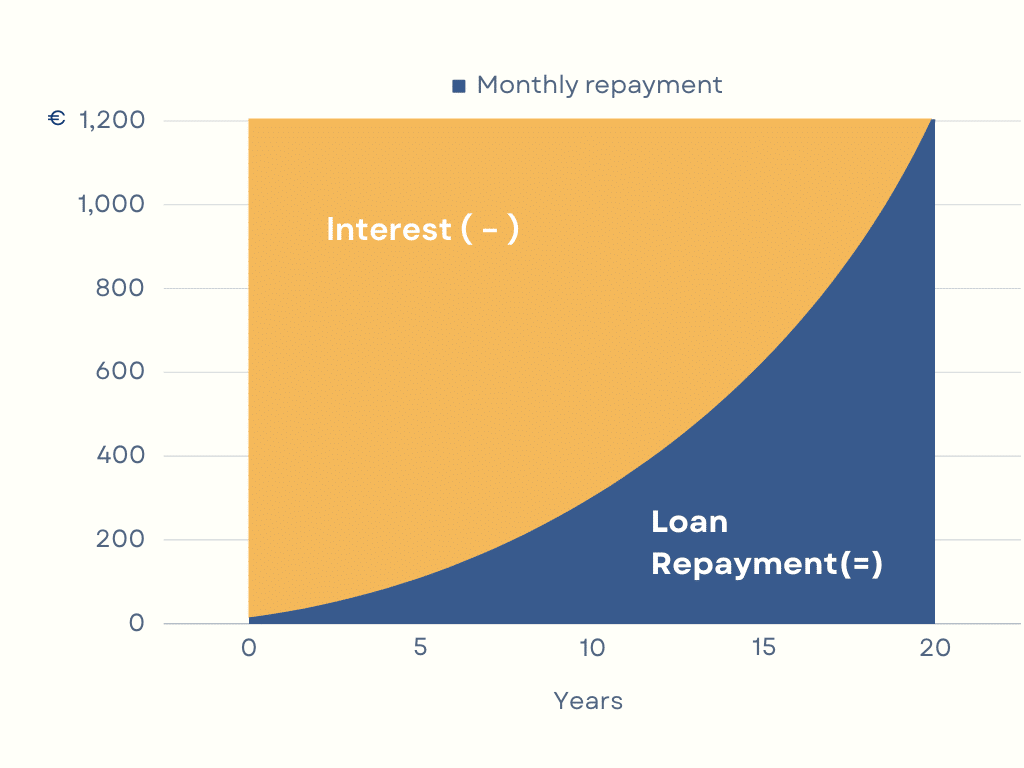

This mortgage type entails fixed monthly payments covering both interest and principal, ensuring complete repayment by the end of the loan term, typically spanning 20 to 30 years. As the interest decreases and mortgage interest deductions decline monthly, the tax benefit diminishes, leading to higher net monthly costs.

What are the advantages of an annuity mortgage?

The highlights of annuity mortgages are:

-

Consistent monthly payments throughout the loan term.

-

The total amount being paid off gradually increases.

-

The interest progressively decreases.

-

Financially advantageous initial years, especially when compared to a linear mortgage.

In the early phase, you contribute more to interest than to loan repayment. Yet, the interest rate is tax-deductible, resulting in a higher deductible mortgage interest than a linear mortgage. As time progresses, you gradually repay more of the loan, with a diminishing portion allocated to interest.

What are the disadvantages?

-

An annuity mortgage can have a higher net cost than a linear mortgage due to how interest is calculated.

-

In the early years of an annuity mortgage, although you pay the same amount each month, a larger portion of that payment goes towards interest. This division of your payments means the principal amount (the actual loan) reduces more slowly at the beginning.

-

In addition, you're paying interest on a larger remaining principal for a longer time with an annuity mortgage compared to a linear mortgage, where you pay off the principal steadily and with less and less interest over the mortgage period. This structure often leads to a higher overall cost with an annuity mortgage than a linear one. This structure often leads to a higher overall cost with an annuity mortgage than a linear one.

-

Over time, your tax benefit diminishes, leading to a gradual increase in net monthly expenses.

Why annuity mortgage payments are much more popular?

Annuity mortgages are favoured by many homebuyers, particularly first-time buyers, over linear mortgages. This can be due to 2 main reasons:

-

First, at the beginning of the mortgage payments, the costs for an annuity mortgage are significantly lower than those for a linear mortgage, which makes it more affordable at the start.

-

Secondly, an annuity mortgage entails consistent monthly repayments—ensuring a fixed amount is paid every month—allowing for predictable cash flow management. This stability is advantageous for individuals seeking financial security or those managing variable incomes when planning future financial endeavours.

Should I choose an annuity mortgage?

An annuity mortgage is recommended for those expecting their income to grow. It initially involves consistent monthly payments with a substantial interest portion, offering significant tax advantages. As the mortgage progresses, the repayment amount increases while interest decreases, leading to a diminishing tax benefit and an eventual rise in net monthly expenses.

Annuity vs linear mortgage

An annuity mortgage offers the initial advantage of lower monthly expenses, but the diminishing tax benefit increases net monthly costs over time. In contrast, a linear mortgage involves a steady repayment amount, gradually reducing net monthly expenses. However, the drawback is that with a linear mortgage, repayment starts immediately, causing higher monthly payments.

Schedule a complimentary introductory call with our mortgage specialists. We specialize in mortgages for expats and are dedicated to navigating you through the home-buying process.

-

Access to a trusted network.

-

Highly competitive rates and flexible terms.

-

Guidance through the entire mortgage process.

-

English translations of bank documents are shared.

- 100% Independent Advice