What is a linear mortgage payment in the Netherlands? A linear mortgage is a type of mortgage where a fixed amount is repaid each month, leading to the complete repayment of the mortgage by the end of the term.

In the Netherlands, this involves making fixed monthly payments determined by dividing the loan amount by the number of payments. Over time, both the principal and interest payments decrease until the mortgage is fully settled at the end of the term.

What are the different types of mortgage payments?

There are different types of mortgages in the Netherlands, with two main mortgage options:

-

Linear mortgage: consistent monthly payments reduce both principal and interest gradually. As the principal decreases, so does the interest over time.

-

Annuity mortgage: for an annuity mortgage, you also pay the same amount each month, but this fixed payment covers both interest and a portion of the principal. In the early years, a larger part of your monthly payment goes towards interest while the principal repayment gradually increases.

-

Interest-only: the key feature of this type of mortgage is that you do not make regular payments, and your mortgage debt stays the same—it does not increase or decrease. You are required to repay the loan in full at the end of the term.

How does a linear mortgage payment work?

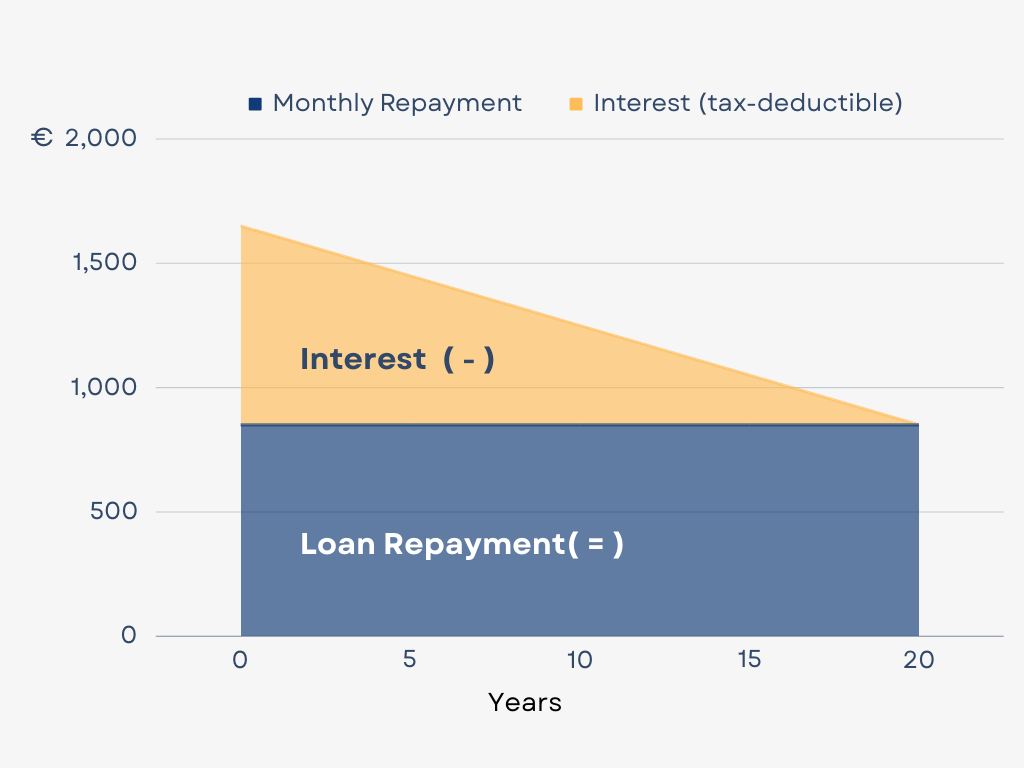

Choosing a linear mortgage involves making consistent, equal payments towards reducing the principal amount, resulting in a monthly payment that decreases over time as the interest decreases. A linear mortgage typically requires lower interest payments throughout the contract compared to an annuity mortgage. This repayment model is particularly advantageous if you anticipate a future decrease in income or aim to repay your mortgage more quickly.

What are the advantages of a linear mortgage?

-

You make fixed monthly repayments, and the mortgage principal repaid remains consistent each month.

-

With each repayment, both the debt and the interest decrease.

-

Your monthly costs fluctuate over time, starting higher and gradually reducing throughout the mortgage term.

-

Your interest payments are higher initially, automatically resulting in higher interest deductions.

Therefore, a linear mortgage is financially advantageous for those looking to minimize the total mortgage cost and pay off their mortgage more quickly, saving money in the long run.

What are the disadvantages of linear mortgage payments?

-

The initial monthly payments are higher at the beginning.

-

The tax benefit diminishes as time progresses.

Does a linear mortgage suit my needs?

A linear mortgage is well-suited for individuals with higher current incomes, particularly those anticipating a decrease in future income, such as early retirees. It ensures mortgage completion by the term's end, offering financial security. Monthly repayments remain constant, covering both loan repayment and decreasing interest. On the other hand, if you prioritize paying less money in the initial years and value consistent monthly payments for enhanced financial predictability, an annuity mortgage proves to be more practical despite its higher total cost compared to a linear mortgage.

Why do people like to choose more annuity than linear?

Many homebuyers, especially first-time buyers, opt for an annuity rather than a linear mortgage. There are a few reasons:

-

Firstly, in the beginning, the payment of an annuity mortgage is much lower than the linear mortgage, which makes the affordability more appealing.

-

Second, an annuity requires fixed monthly repayment -- you pay the same amount of money every month, making it predictable to manage cash flow and budget for future financial plans that prioritize financial stability or those with fluctuating income.

Linear vs annuity mortgage payments

Opting for a linear mortgage means immediate repayment and higher initial monthly costs. On the other hand, an annuity mortgage offers lower initial monthly expenses, although net monthly fees gradually increase due to reduced mortgage interest deductions. Despite this, the assurance lies in consistent gross monthly expenses.

However, with a linear mortgage, you can expect a steady repayment amount, leading to a reduction in net monthly expenses. If you want to learn more about choosing between these mortgages, schedule a free call with one of our mortgage advisors, and we will guide you through the mortgage types in the Netherlands.

Schedule a complimentary introductory call with our mortgage specialists. We specialize in mortgages for expats and are dedicated to navigating you through the home-buying process.

-

Access to a trusted network.

-

Highly competitive rates and flexible terms.

-

Guidance through the entire mortgage process.

-

English translations of bank documents are shared.

- 100% Independent Advice