When researching a new property market, many home buyers use online mortgage calculators as a starting point. Can you actually rely on them?

Online mortgage calculators can be a good orientational tool to know how much you want to spend on a home early in the process. However, as with any other online tool, you need to put the result into perspective and not blindly trust it.

Mortgage calculators: reality check

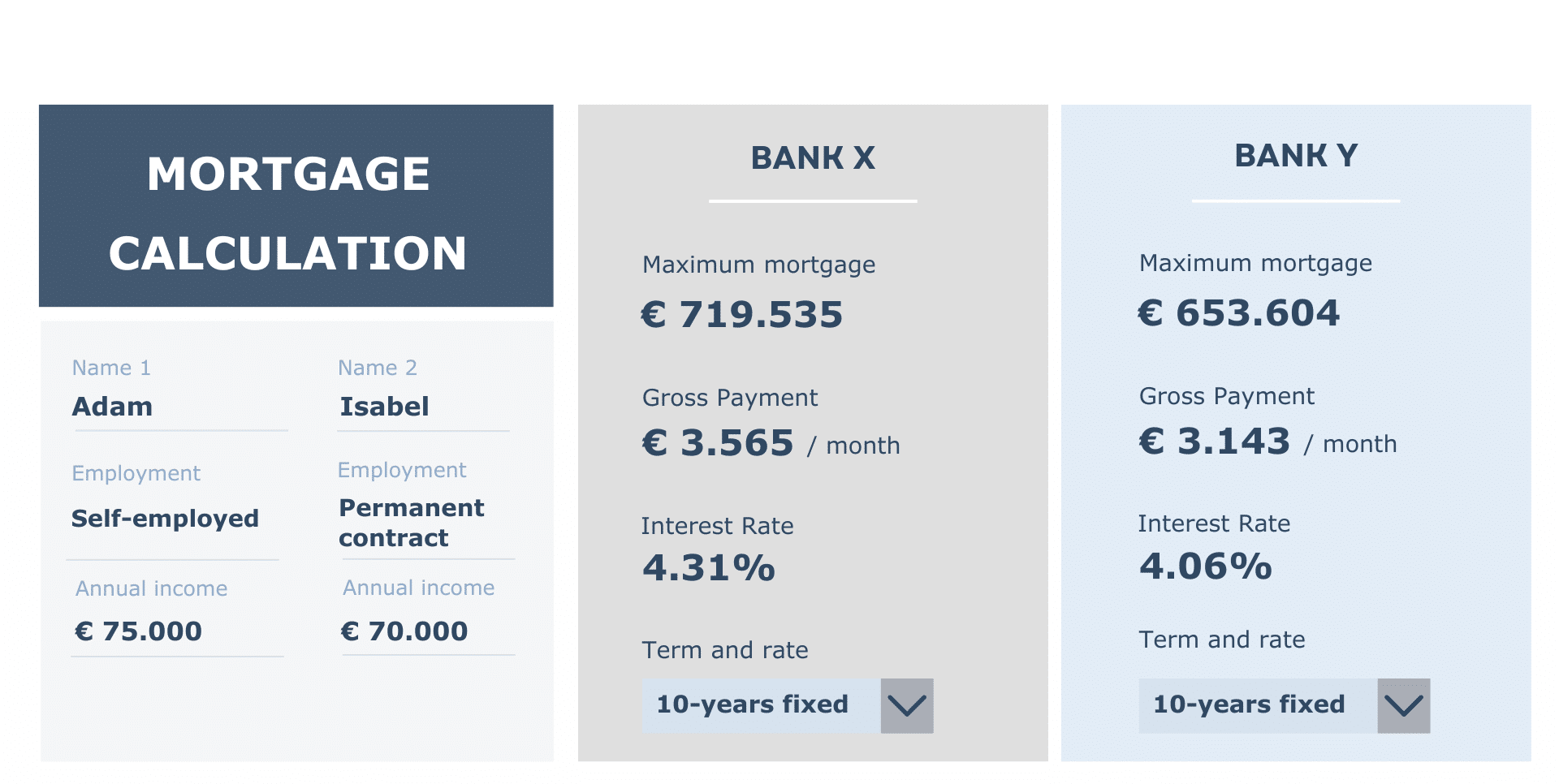

Some online calculators take only your (and your partner's) salary to calculate your maximum mortgage; others can include your age, debts, or type of employment contract. Here, you can find an example of different mortgage outcomes.

Mortgage calculation example

What factors play a role when calculating your maximum mortgage?

-

Annual income

-

Holiday pay

-

Bonuses

-

Commission

-

Mortgage interest rates

-

Credits/personal loans

-

Loan type ( annuity, linear, or interest rate)

-

A potential ground lease on the property you are buying.

How can you increase the accuracy of your monthly payments and maximum mortgage amount?

It is best to contact our financial specialists. We offer a personalized mortgage report based on your situation. With a full mortgage report, you will get a better understanding of your financial situation and the monthly payments. Your mortgage will be based on specific inputs about your situation and preferences.

Your personalized mortgage report includes:

-

Monthly mortgage payments for x amount of years.

-

Maximum mortgage.

-

Tax-deductible fees.

-

Closing fees to secure a mortgage.

When you have found a property you are interested in, we will adjust the calculations to the current interest rates, the specifics of the property, and your preferences and needs.

The calculations will also be revised if something changes in your situation or income. For instance, when you meet someone and want to buy together or when you get a raise in salary or change jobs.

Schedule a complimentary introductory call with our mortgage specialists. We specialize in mortgages for expats and are dedicated to navigating you through the home-buying process.

-

Get clarity on your financial possibilities.

-

Access to a trusted network.

-

Highly competitive rates and flexible terms.

-

English translations of bank documents are shared.

- 100% Independent Advice