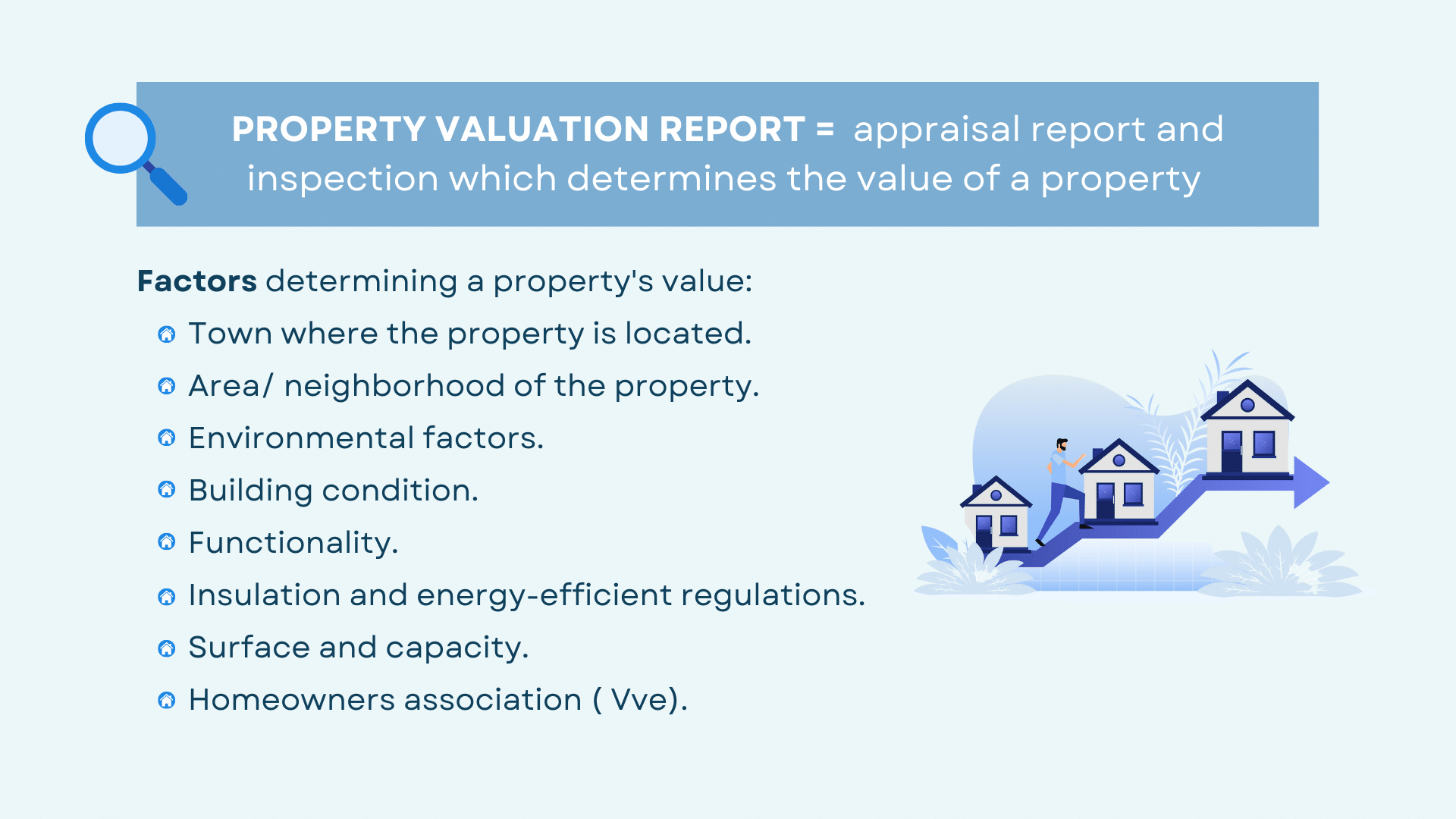

A property valuation report (appraisal report) determines the value of a property. If you want to get a loan, you need to know how much the house is worth. The bank uses the valuation report to ensure the property is worth enough money to cover the mortgage.

An appraiser must consider the following factors when determining the value of your property:

-

Town where the property is located.

-

Area/ neighborhood of the property.

-

Environmental factors.

-

Building condition.

-

Functionality.

-

Insulation and energy-efficient regulations.

-

Surface and capacity.

-

Homeowners association ( Vve).

An appraisal report indicates any relevant information about a property. For example, information about house owner association ( VVe) or ground lease (erfpacht). Besides, a real estate appraiser is often required to be within a certain distance of the residential property being appraised. It is important that your appraiser has a license and know the local market.

A valuation report must be approved by The Dutch Building Value Institute (NWWI).The NWWI checks and validates a valuation so NHG and all mortgage lenders accept it. From the 1st July 2021 National Mortgage Guarantee ( NHG ) introduces a new and less expensive way of appraising a home: desktop valuation.

The appraiser analyzes, analyses, evaluates, and accepts a computer-generated model value. This is done using a statistical model and data on the housing market. The desktop valuation report can be used for both: buying a house and transferring your mortgage. In both circumstances, the mortgage cannot exceed 90% of the property’s market value. The desktop valuation report cannot be used in cases of renovation or implementation of energy label changes.

Things to keep in mind when you ask for valuation report

-

Choose an appraiser who is familiar with the local area. With knowledge of the local market and developments, he/she can accurately assess the value of your home.

-

Act fast, do not wait too long. If the appraisal report reaches your mortgage lender quickly, they can evaluate your mortgage application promptly, and you can receive financing sooner. Typically, a valuation report is prepared within a few working days and remains valid for six months.

-

Check the requirements with your lender. It is recommended to verify with your mortgage lender whether the valuation report needs to fulfil specific criteria. Some lenders may only approve validated appraisal reports.

-

Valuation report fees. Several real estate agencies charge a fixed fee for the valuation report. It's essential to verify whether all additional expenses are covered, such as the validation by the NWWI.

Schedule a complimentary introductory call with our mortgage specialists. We specialize in mortgages for expats and are dedicated to navigating you through the home-buying process.

-

Access to a trusted network.

-

Highly competitive rates and flexible terms.

-

Guidance through the entire mortgage process.

-

English translations of bank documents are shared.

- 100% Independent Advice