Dutch cities have introduced a new law to prevent investors from taking away homes for first-time home buyers. You must meet the requirements if you want to invest in a property.

How does the purchase protection law affect your wishes to become a landlord/-lady in the Netherlands?

This purchase protection law only applies if you want to buy a property for investment purposes. However, some homebuyers can rent out a property only under certain conditions and with a permit.

Each municipality is free to determine its own policies. For instance, local governments may forbid new investment homes in certain parts of the city and under a certain value.

Please note: the following rules do not apply if you currently own a residential property and wish to refinance your mortgage to keep the property and rent it out.

What's the purchase protection law?

A purchase protection law forbids renting out a property under certain conditions. The primary goal is to address the shortage of modestly priced, owner-occupied homes that are both affordable and available on the housing market.

Have you bought a home in 2023 to which the purchase protection applies?

In that case, renting out your is prohibited. As a property investor, you are not allowed to rent your property within the first four years.

How does it work?

Once you've made a purchase, you need to specify whether you are a new resident of the property or an investor. The purchase protection starts to work at this point. This will be verified by checking if you are registered to live on the property. You cannot be registered at more than one address.

Renting without municipality permission

Each municipality can set a WOZ value threshold below which recently purchased properties can only be used as the owner's primary residence and cannot be repurposed for any other use.

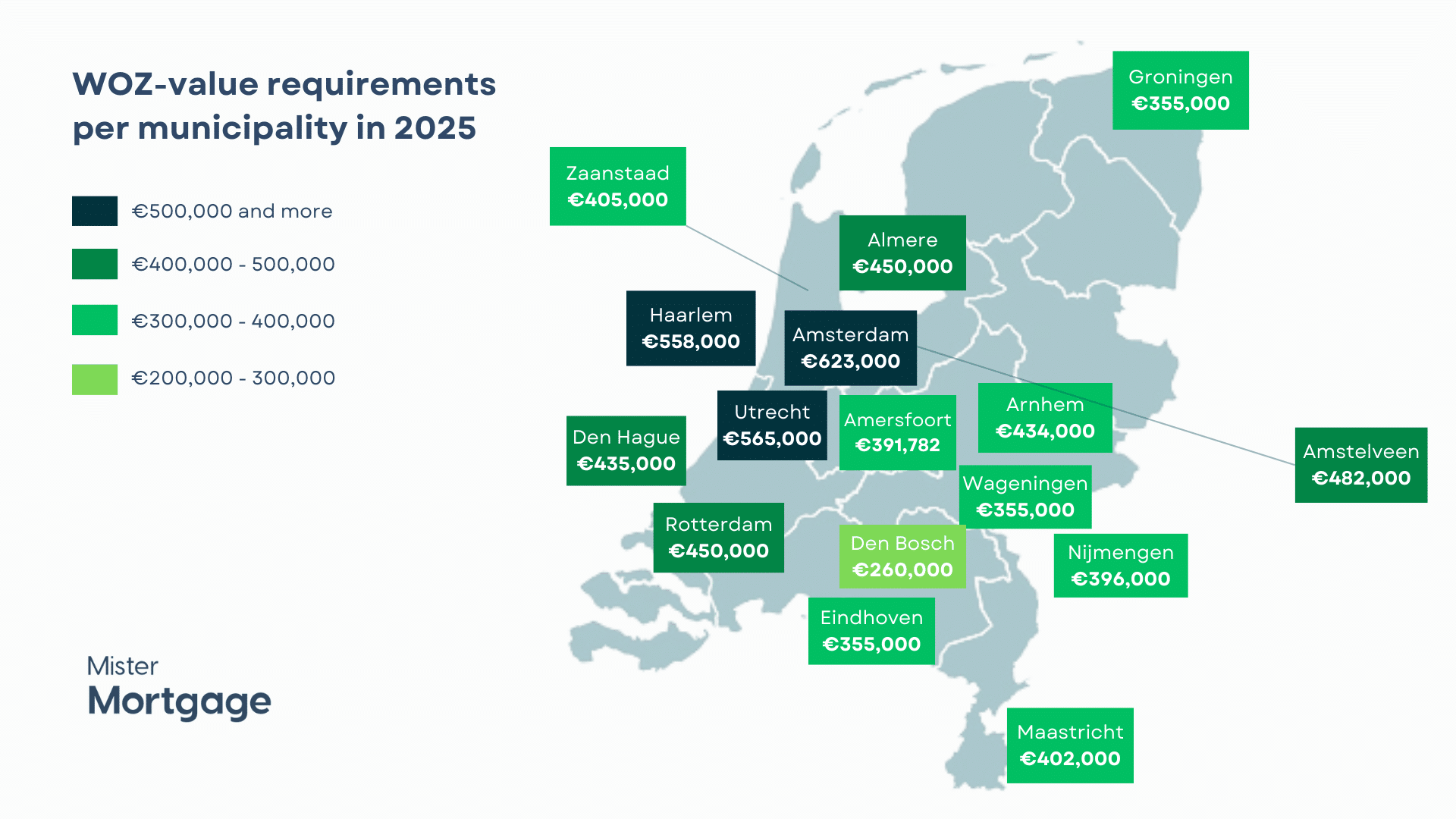

Please note that each municipality has its own requirements for investment properties. The infographic below is based on 2025 data, sourced from the relevant municipality websites.

-

Amsterdam: €623,000

-

Almere: €450,000

-

Haarlem: €558,000

-

Amersfoort: €391,782

-

Arnhem: €434,000

-

Wageningen: €355,000

-

Rotterdam: €450,000

-

Utrecht: €565,000

-

Den Bosch: €260,000

-

Eindhoven: €355,000

-

Nijmegen: €396,000

-

Maastricht: €402,000

-

Groningen: €355,000

-

Amstelveen: €482,000

-

Zaandstad: €405,000

Schedule a complimentary introductory call with our mortgage specialists. We specialize in mortgages for expats and are dedicated to navigating you through the home-buying process.

-

Access to a trusted network.

-

Highly competitive rates and flexible terms.

-

Guidance through the entire mortgage process.

-

English translations of bank documents are shared.

- 100% Independent Advice