Have you ever considered taking over a seller's property and mortgage terms? Yes, this is possible. Taking over the seller's mortgage rate and terms can be beneficial as interest rates rise. For example, if the seller took out a mortgage a few years ago and the situation has changed, the buyer can directly benefit from a lower interest rate.

There is a win-win situation for both sides; buyers can get better interest rates, and sellers can attract more potential buyers and raise their asking price. This situation only occurs sometimes; however, it is possible. Various Dutch mortgage lenders offer to pass on mortgage interest schemes. Most importantly, the seller must be willing to waive the mortgage terms and meet the mortgage lender's requirements.

How does it work?

When a seller passes the interest rate to the buyer, the buyer takes over the remaining duration of the fixed-rate period. The buyer must go through the mortgage application procedure, and the lender must approve the mortgage. The current interest in the market will apply to the additional amount if the buyer needs a higher mortgage.

Seller benefits

-

More attractive house offer. Taking over a mortgage with a lower interest rate; current interest rates are over 4,5 % (10 years fixed, 100% LtV).

-

Higher asking price. In return for giving your interest rate away, the seller can have more leverage to negotiate the purchasing price.

Buyers benefits

-

Lower interest rates. Save on monthly interest rates over a fixed period.

-

Lower monthly payment. Moving the interest to a future home (within the interest fixed period).

For example

Most Dutch lenders now allow borrowers to move their mortgage interest to their new home. Some lenders offer that the seller can leave the interest rate for the buyer. The latter can be attractive during negotiating the selling price when you leave the Netherlands.

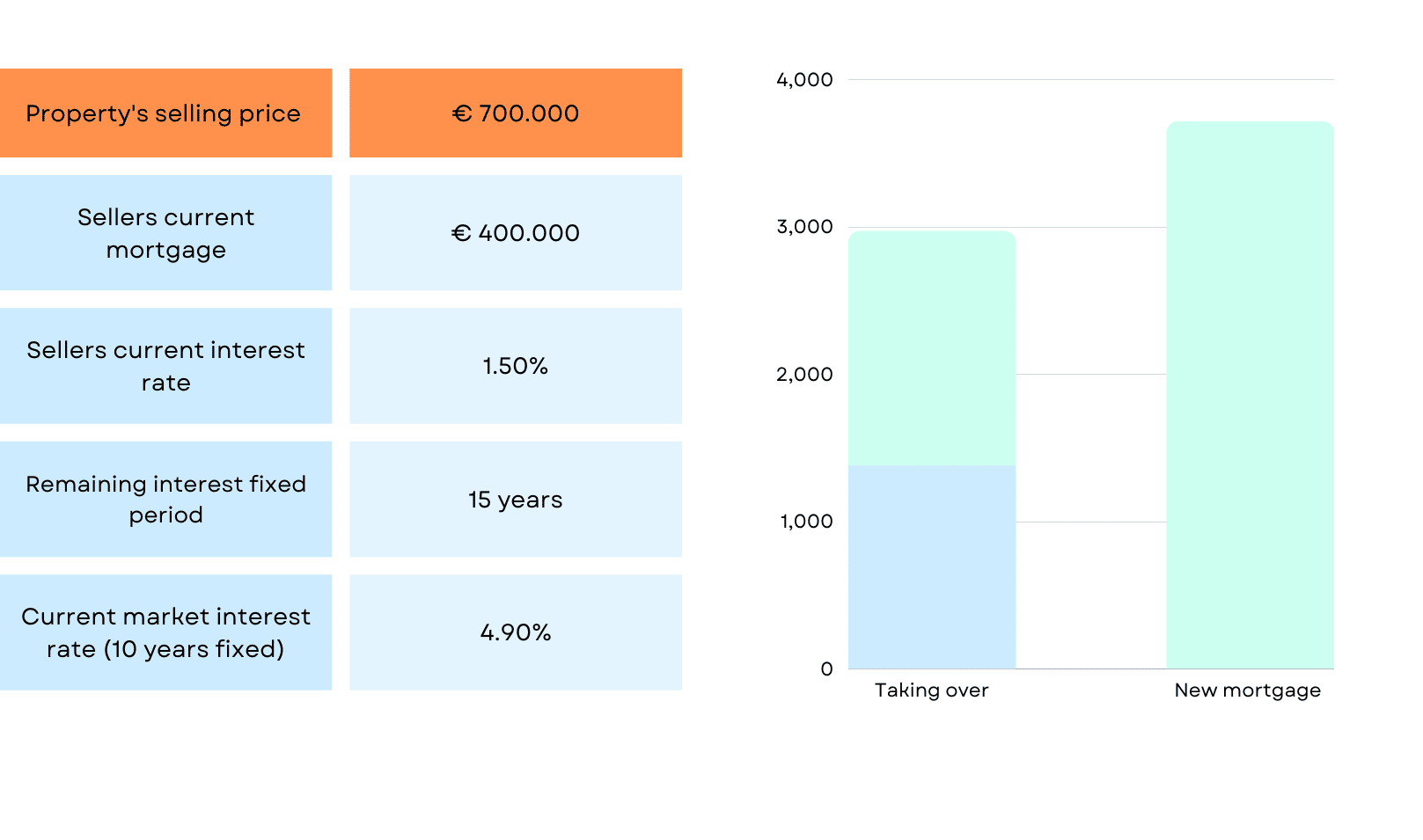

Let's use an example where you buy a home with a price of € 700,000 and, if possible, take over the seller's mortgage of € 400,000 with a 1.5% mortgage rate. When we look at today's rates, the difference is significant.

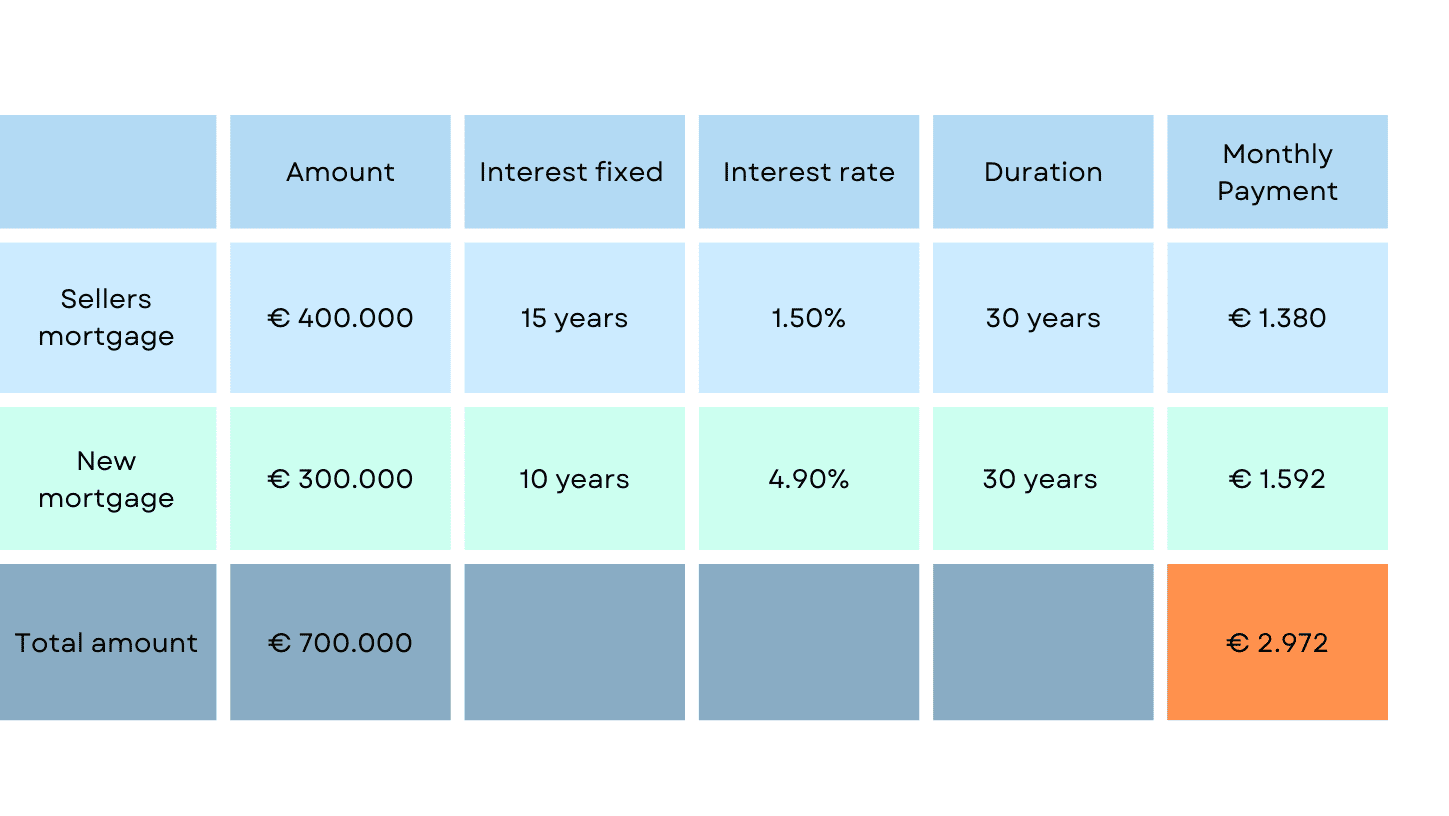

So, what does your mortgage look like if you take over the seller's mortgage? Since you want to borrow €700,000 (100% loan-to-value), you can only borrow €400,000 with the previous owner's terms and conditions. The remaining €300,000 will have today's interest rates dividing your mortgage into two parts.

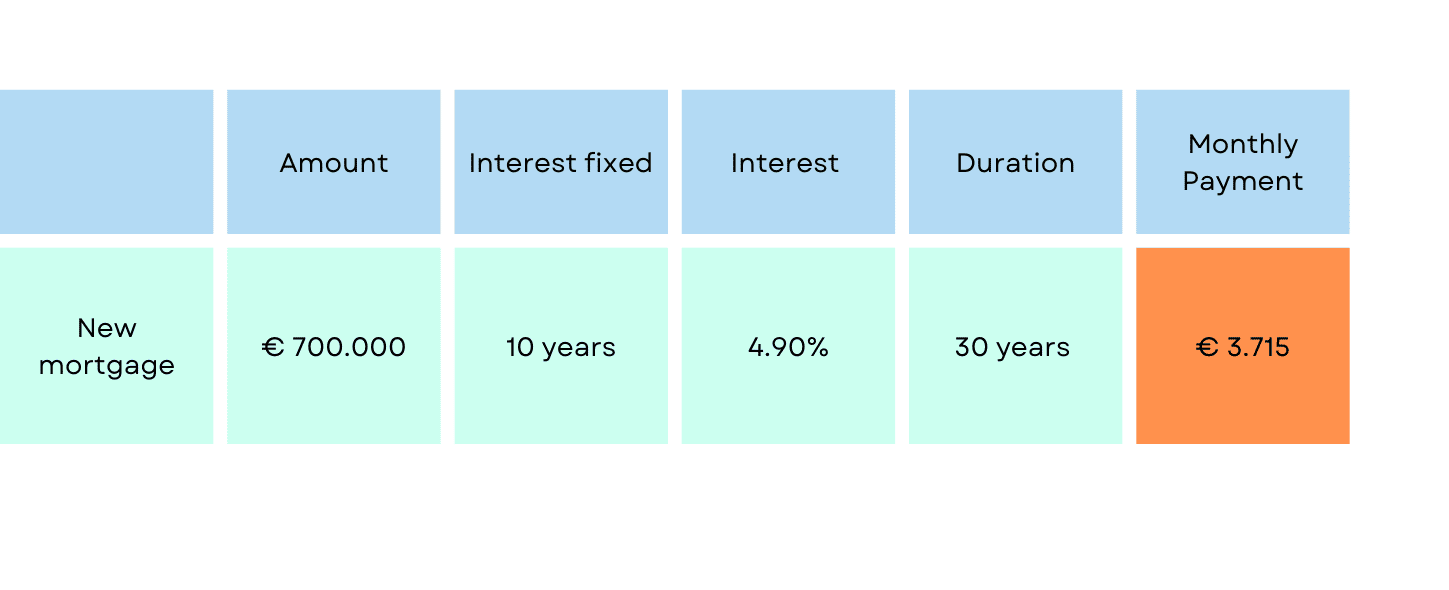

Applying for a new mortgage without taking over the seller's mortgage terms and conditions

Below you can find the mortgage payments without any tax benefits.

We always look for the best possible solution in your situation and adjust the mortgage to match your wishes and long-term goals.

Schedule a complimentary introductory call with our mortgage specialists. We specialize in mortgages for expats and are dedicated to navigating you through the home-buying process.

-

Get clarity on your financial possibilities.

-

Access to a trusted network.

-

Highly competitive rates and flexible terms.

-

English translations of bank documents are shared.

- 100% Independent Advice