During our consultations and webinars, we often encounter common questions about refinancing. In this blog article, we aim to answer the top popular questions to help you to understand this topic better.

What is a mortgage refinance or home loan refinance?

Refinancing happens when you adjust your ongoing mortgage to a new one, which could result in changes in interest rates, payment plans, conditions, or other loan terms. Refinancing is also considered when you change a mortgage lender. When you purchase a home to live in, you typically opt for a residential mortgage. You sign a mortgage deed at the notary's office to finalize the mortgage deed with the lender. This contract outlines the rules and conditions of your loan.

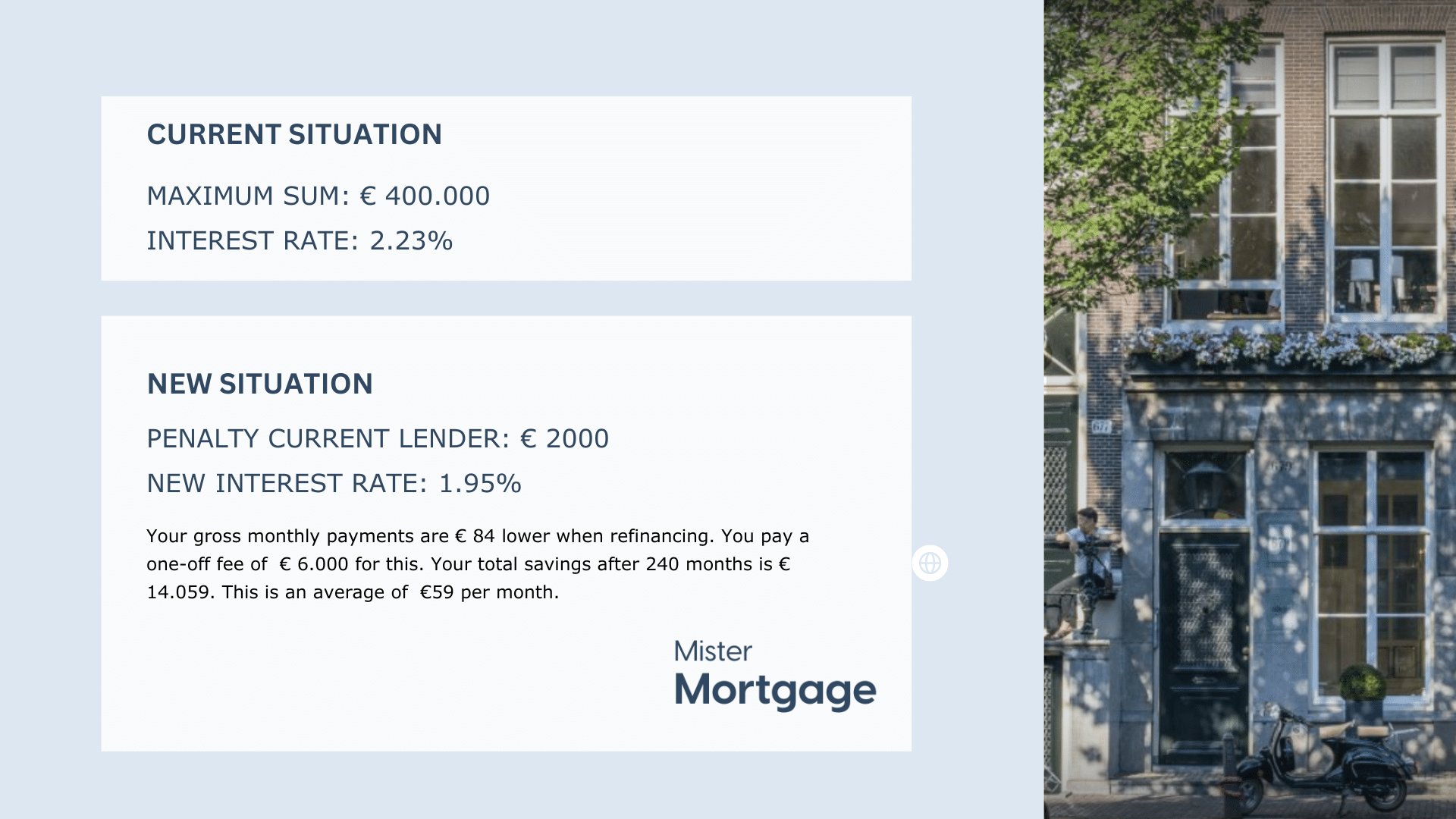

Suppose you decide to refinance and change any conditions, for example, mortgage type from residential to keep to let, or mortgage lender for a lower interest rate. In that case, it means breaking the initial deal. For this reason, depending on the lender and market situation, you may sometimes pay a penalty for leaving a deal. Refinancing your mortgage involves applying for a new loan, meeting its requirements, and signing a new mortgage deed at the notary.

Is it a good choice to refinance your current mortgage?

Refinancing is considered a good choice for some owners, and in some cases- it all depends on your financial situation. It offers the chance to adjust mortgage terms, potentially resulting in reduced monthly payments, revised loan conditions, debt consolidation, or accessing home equity for expenses like bills or renovations.

Some indicators can help you decide whether to refinance or not:

-

If interest rates are lower than your existing mortgage interest rate, it can be a good time to refinance.

-

Refinancing is often more favourable if you have built significant equity in your home.

-

Consider your financial goals, whether they involve reducing monthly payments, shortening the loan term, or tapping into home equity.

-

Be aware of any prepayment penalties on your existing mortgage, as they can affect the cost-effectiveness of refinancing. ( if applicable)

What are the reasons to refinance?

Refinancing means replacing your current mortgage term with a new one. Here are the top reasons why people are refinancing their homes:

-

Lower monthly mortgage costs

You want to ensure a reduced interest rate to save on loan expenses.

-

Secure better terms and conditions.

Negotiate improved loan conditions like lower fees or extended repayment periods. -

Adjust interest rates or types

Modify your mortgage by changing the interest rate structure, potentially reducing monthly payments. -

Convert a residential mortgage to a buy-to-let mortgage

Transform your home loan into an investment mortgage, such as buy-to-let, enabling you to rent the property for income. -

Cash-out equity

You borrow more than the owed amount of your property mortgage, so you receive an additional sum of cash based on the accumulated equity in the property. This cash can be used for home improvements, debt consolidation, education expenses, or other financial needs.

What are the downsides of refinancing?

While refinancing entails replacing your current mortgage term with a new one, it's important to note that there are also potential downsides.

-

Refinancing your existing mortgage can be expensive. Refinancing typically involves closing costs, including appraisal, application, and other charges. These costs can add up and may offset the potential savings from a lower interest rate.

-

If you refinance to reduce monthly payments, you might extend the term of your loan. While this lowers immediate financial strain, it could result in paying more interest over the loan's life. Besides, extending the mortgage term means you are no longer entitled to tax benefits because the repayment term is longer than 30 years.

-

Some existing mortgages may have prepayment penalties for early loan repayment. Be sure to check your current mortgage terms for any penalties before refinancing.

-

If you want to refinance, you need to meet again the eligibility criteria. If your financial situation has changed since obtaining your original mortgage, you may face challenges to qualify for refinancing.

Can you refinance in the Netherlands?

You can refinance your mortgage in the Netherlands whether you want to reduce your monthly payments and conditions or switch from residential to keep-to-let ( investment). Schedule a free introduction call with our mortgage advisors for refinancing options.

Can you refinance a fixed mortgage period?

Yes, you can refinance a fixed-rate mortgage during its term.

But it is worth noting that when you entered into the fixed term of a mortgage, you agreed to maintain the specified interest rate for a set duration, typically ranging from a few years to a decade or more. If you refinance your mortgage, you must compensate your mortgage lender for leaving the agreement before the fixed-rate term concludes. So yes, refinance to a lower interest comes with its price. To know if it suits you, check out all you need about refinance.

Can I refinance to another mortgage lender?

If you refinance with another lender, your existing mortgage will be paid off with funds from the new loan provided by a new lender. You start with a new mortgage, potentially benefiting from different terms, interest rates, or repayment structures that better suit your financial situation.

Schedule a complimentary introductory call with our mortgage specialists. We specialize in mortgages for expats and are dedicated to navigating you through the home-moving process.

-

Access to a trusted network.

-

Highly competitive rates and flexible terms.

-

Guidance through the entire mortgage process.

-

English translations of bank documents are shared.

- 100% Independent Advice