When buying a home, it's important to choose the right mortgage. Three different types of mortgages are popular in the Netherlands, and it's important to understand how they affect your payments to match your financial goals.

This blog article discusses annuity, linear, and interest-only mortgages, each with its own way of structuring repayments over time.

Annuity mortgage

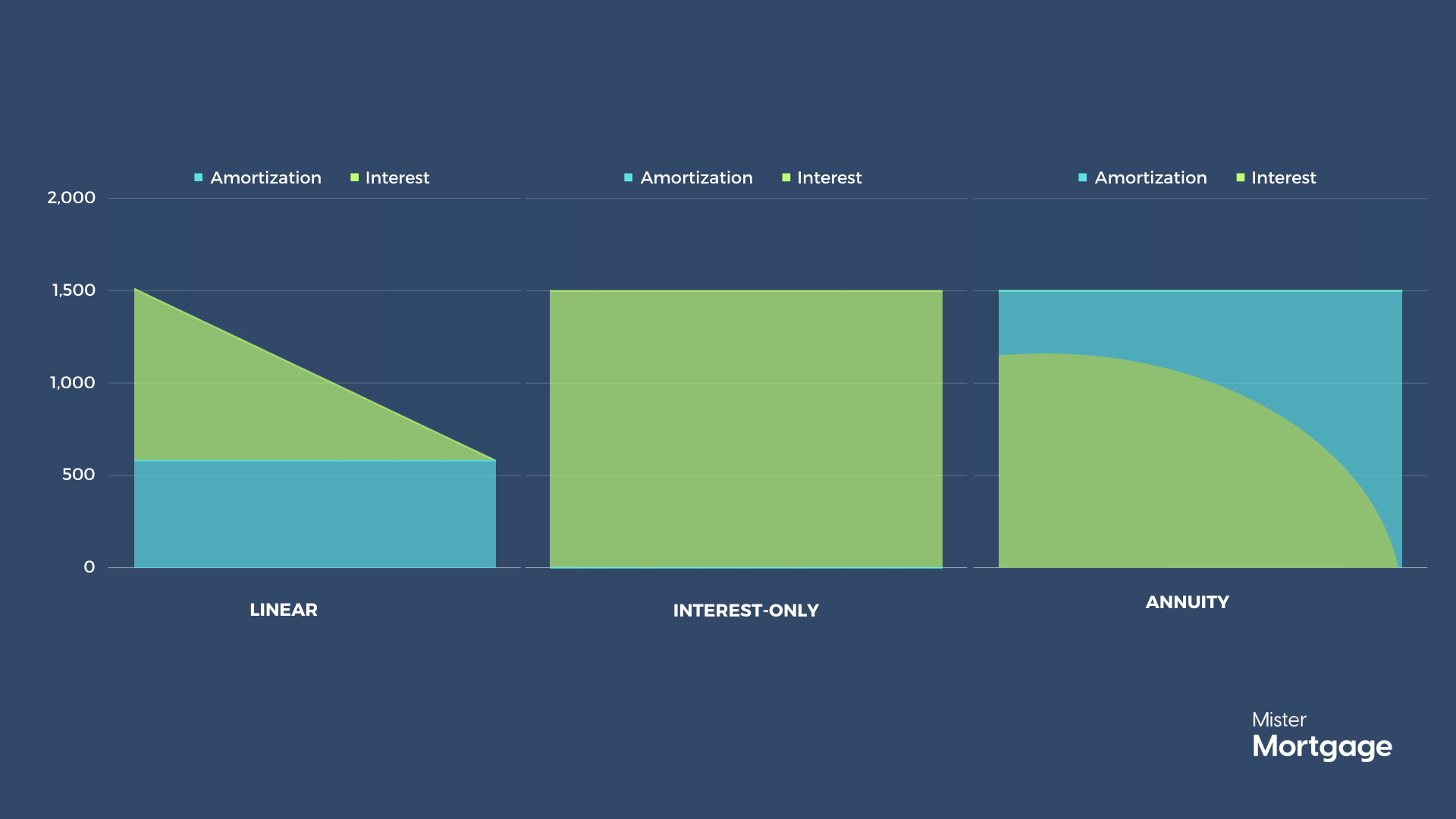

With an annuity mortgage, you primarily pay the interest at the beginning of the mortgage period, which is tax-deductible, meaning your payments are usually lower. Later in the mortgage, the period when most of the interest is paid, you’ll mainly pay back the loan – meaning while your gross payment (before taxes) is level, your net payment (after taxes) increases. As a result, this type of mortgage is recommended for those who expect their income to increase in the future.

-

Level monthly payments.

-

Level Interest payments decline over time.

-

Zero debt at the end of the duration.

Linear mortgage

With this type, you pay off the mortgage in equal installments, with the monthly payment decreasing over time as the interest diminishes. In a contract, you pay less interest with a linear than with an annuity mortgage. If you expect your income to decrease in the future, or you’re interested in paying off the mortgage as quickly as possible, you may prefer a linear mortgage.

-

Repayments stay at the same amount.

-

Interest payments decline over time.

-

Zero debt at the end of the duration.

Interest-only mortgage

In an interest-only mortgage, you only repay the interest on the mortgage, leaving the full debt to be repaid at the end of the term. Monthly payments are fixed as the total value of the mortgage stays constant throughout. Interest-only mortgages are a good option if you expect that your assets will be sufficient to cover the total mortgage in the future. The maximum interest-only mortgage available is 50% of the property’s value.

-

Level monthly payments.

-

You only pay interest during the duration.

-

Repay your debt at the end of the duration.

Should I choose a fixed or floating interest rate?

-

Fixed-rate mortgage

The interest rate on a fixed-rate mortgage does not change until the term of the fixed-rate period expires. This means your monthly mortgage payment will remain the same, aside from some fluctuation due to taxes or homeowners’ association fees. If you’re settling into your career, have a growing family, and are ready to set down some roots, a 20- or 30-year fixed-rate mortgage might be your best bet, as you’re protected against increasing interest rates in the future. -

Floating interest rates

Floating interest rates reset at specific intervals and are typically lower than a fixed rate. As a result, your monthly payment could increase or decrease depending on the capital market or other circumstances, such as if a mortgage lender wants to attract new clients or close their doors for a while. Floating interest rates are best if you expect rates to decrease in the future.

Schedule a complimentary introductory call with our mortgage specialists. We specialize in mortgages for expats and are dedicated to navigating you through the home-buying process.

-

Get clarity on your financial possibilities.

-

Access to a trusted network.

-

Highly competitive rates and flexible terms.

-

English translations of bank documents are shared.

- 100% Independent Advice