A few key factors always influence the rise and fall of interest rates. That’s why we’re here to explain them and show you that mortgages aren’t rocket science. Let us guide you in making an informed decision!

It is important to understand that inflation adds up to increasing interest rates, and there is nothing scary there. Increasing interest rates reflect a growing economy and can be seen as a sign of stability and progress. Lenders adjust their rates to maintain a healthy balance, ensuring their profits while offering competitive options to borrowers.

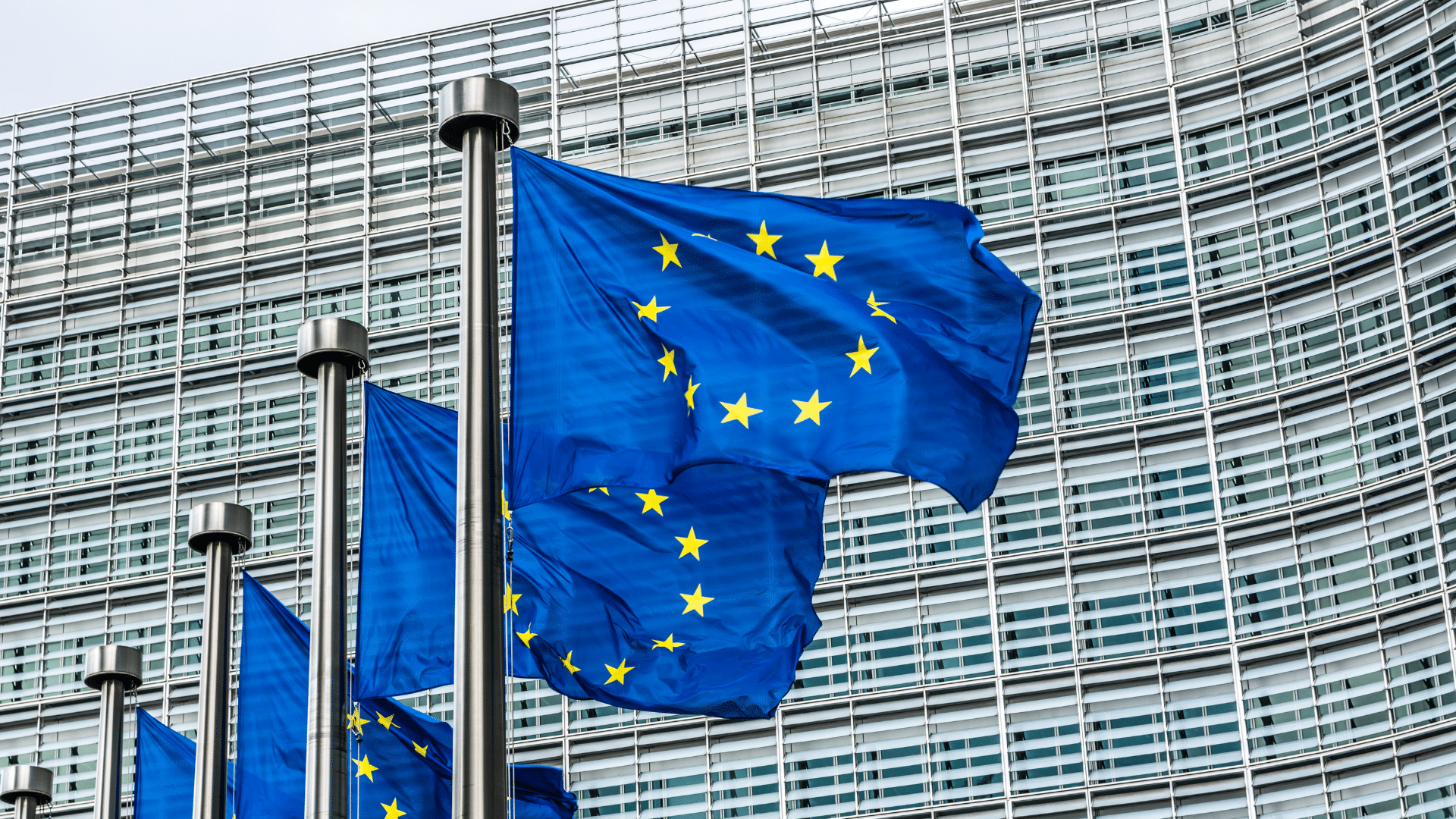

The European Central Bank (ECB) wields an extraordinary influence over mortgage interest rates. The ECB's ability to adjust interest rates, both in the short and extended term, holds the key to shaping mortgage rates at the national level. At the moment, there are no plans to increase interest rates at the EU level.

In times of economic growth, interest rates generally trend upward. A rise in mortgage interest rates signals renewed buyer confidence, accompanied by increasing income and a strong labour market, which can foster inflation over the long term. Moreover, higher mortgage rates suggest that investors are more at ease shifting their funds away from the haven of bonds and toward more risky investments like stocks.

Lower interest rates do not always mean the best borrowing conditions. Different variables can impact your mortgage amount, not only the interest rate. Focusing only on your mortgage rate shifts your attention away from the loan's actual cost, which can be costly.

International events, including political instability or significant economic crises in other countries, can considerably impact interest rates. When a nation experiences political turmoil, it can lead to uncertainty in global financial markets, causing investors to seek safer assets and influencing interest rates in other regions.

Similarly, a major economic crisis in a foreign country can disrupt international trade, financial stability, and investor confidence, leading central banks to adjust interest rates in response.

Schedule a complimentary introductory call with our mortgage specialists. We specialize in mortgages for expats and are dedicated to navigating you through the home-buying process.

-

Access to a trusted network.

-

Highly competitive rates and flexible terms.

-

Guidance through the entire mortgage process.

-

English translations of bank documents are shared.

- 100% Independent Advice