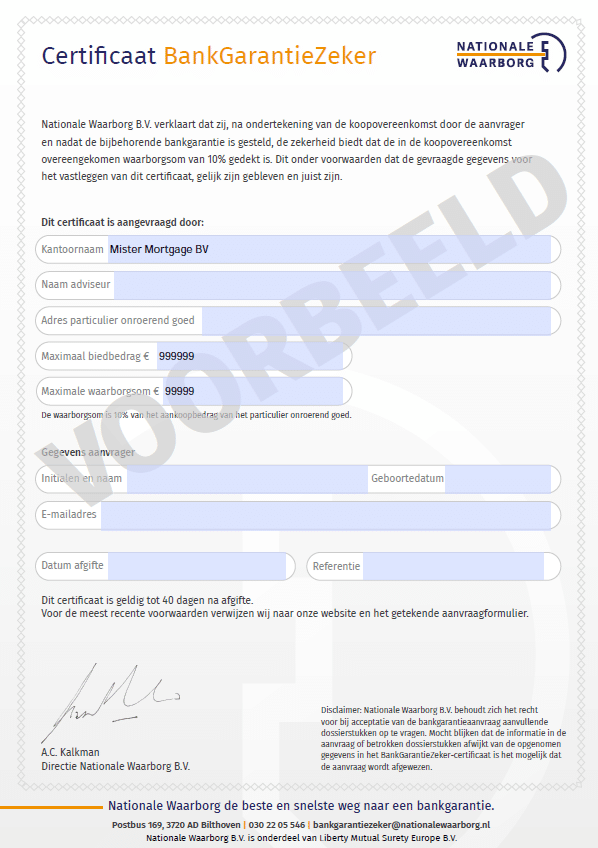

BankgarantieZeker: bid with total confidence

The BankgarantieZeker certificate issued by Nationale Waarborg allows you to submit a binding offer without a financing condition and still be protected against the statutory 10% penalty, with coverage up to €99,999 on properties priced up to €999,999.

Key benefits

-

Competitive leverage – outbid local buyers by waiving the financing contingency.

-

Up to €99,999 coverage – equivalent to the standard 10% deposit.

-

Decision in one business day – fully digital underwriting.

-

40‑day validity – plenty of time to negotiate and sign.

-

Pay only at completion – flat €500 (+ €95 admin); zero cost if the deal aborts.

Eligibility snapshot

-

Dutch tax resident

-

Salaried income

-

Residential property in NL

-

Clean BKR credit file

How we arrange it

-

Plausibility scan & expat‑specific advice

-

Digital process

-

Certificate issued within 24 hours

-

Bank guarantee filed after contract & cooling‑off

Pricing

Charged only once the guarantee is lodged: €500 service fee + €95 admin. Regular guarantee/insurance premium (€25) applies separately.

Why Mister Mortgage

-

Expat‑focused mortgage brokerage

-

AFM‑licensed

-

End‑to‑end guidance through notary completion

-

4.7★ Google reviews average