Mortgage rules are changing every year. The Dutch Banking Association, Nibud (National Institute for Family Finance Information), and the Dutch government introduced amended mortgage rules that start in January 2021. What does it mean for homebuyers in the Netherlands? Find out more below in the list of changing mortgage rules for 2021.

The good news is that the NHG limit increases to € 325,000 from € 310,000 as of January 2021. The National Mortgage Guarantee is a unique scheme in the Netherlands which protects the homebuyer and the mortgage lender. If you cannot pay back your mortgage in the event of unemployment, incapacity for work, divorce, or losing your partner, the lender and NHG assess your financial position and find a solution for you.

Property transfer tax (2%) changes

First-time homebuyers aged between 18-35-year-old that purchase their first property are exempt from paying the property transfer tax of 2%.

Buy-to-let investors pay a higher property transfer tax from January 2021. Currently, the transfer tax for buy to let properties is 2%. Investors will pay 8% on property transfer tax when buying a property in the Netherlands from January 2021.

Interest rate deduction in 2021

The tax relief is only applicable for annuity and linear mortgages. You can get tax relief on the interest that you pay for your mortgage. The Dutch government reduces the tax deduction from 46% to 43% in 2021. The rate of 43% decreases to 40% in 2022 and 37% in 2023.

LtV maximum mortgage value to loan in 2021

The maximum mortgage based on the value of the property remains the same as in 2020. You can borrow 100% equal to the market value of the home.

Maximum mortgage (Loan-to-Income) increases for two-income households in 2021

The least earning partner’s income contributes to 90% of the maximum mortgage (Loan-to-Income or LtI). The least making partner of two-income households contributed 80% in 2020. What does it mean? Two-income homes can get a higher mortgage in 2021. However, it may be wise to borrow less than the maximum is allowed, so that more money remains available, for example, to invest, buy furniture or a holiday.

No taxes on income from savings or small investments in 2021

Capital tax reduces in 2021. If you have saved more than € 50,000, you will not pay capital tax. Besides, you will pay fewer taxes if you have saved up to € 220,000. These amounts change to € 100,000 and € 440,000 for registered couples. Paying capital tax in the Netherlands is only applicable after the 30% facility ends.

Housing market predictions 2021

If the capital markets remain the same or even improve, and the pandemic is under control, the mortgage rates could slightly decrease. The lending criteria are becoming more accessible, which means more people have a chance to buy a home in 2021.

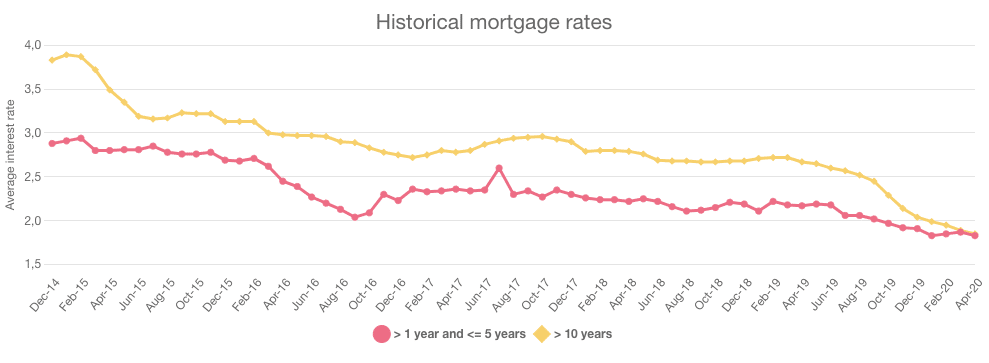

Mortgage interest rates 2021

According to our expectations, interest rates are likely to remain the same. The mortgage interest rates have decreased drastically in the last years in the Netherlands. The Dutch housing market is home to fierce competition. The low mortgage interest rates attract home buyers. More than 40 mortgage lenders in the Netherlands compete and push interest rates down for a population of only 17.28 million inhabitants.

For example, you can fix a mortgage interest rate for ten years at 1.60 per cent.

The demand for mortgages is still strong in the Netherlands. The number of mortgages taken out has increased by 23% in 2020 compared with the previous year. The main reason that caused the demand for more mortgages is the low mortgage interest rates. The enthusiasm for remortgaging is slowly declining in the last few months. Remortgaging is becoming slightly less attractive from next year because banks ask homeowners to show a valuation report.

Housing prices in the Netherlands in 2021

The expectation is that the Netherlands’ housing prices rise due to the remaining housing shortage in 2021. These times have shown that living in a home, and even a city you love is more important for your health. The expectation is that housing prices increase by 2.5 percent in 2021.

The real estate market is quite active because of the housing shortage in the Netherlands. A few years ago, the homeowners who took out their mortgages with a higher interest rate now decided to sell or take a second mortgage, increasing the market movement.

Besides, the increasing incomes push home buyers to buy and borrow more.

1. Decreasing mortgage interest rates that improve affordability is causing housing prices to increase.

2. Lower mortgage interest rates make houses more affordable; however, it increases the competition between buyers.

Buy-to-let investment in 2021

The demand for residential homes continues to grow while demand for rental properties has decreased. Banned Airbnb and reduced numbers of international students and tourists lead investors to buy fewer houses. The investors could lose a part of their rental income, leading them to sell rental properties shortly. Another hot topic is that the property transfer tax increases to 8% in 2021, which will slow down rental property investments.

Schedule a complimentary introductory call with our mortgage specialists. We specialize in mortgages for expats and are dedicated to navigating you through the home-buying process.

-

Get clarity on your financial possibilities.

-

Access to a trusted network.

-

Highly competitive rates and flexible terms.

-

English translations of bank documents are shared.

- 100% Independent Advice