In reaction to the energy crisis, the Dutch government plans to adopt more sustainable practices among homeowners. Currently, the government is developing a proposal that could significantly elevate the importance of energy labels in determining the maximum mortgage available to individuals.

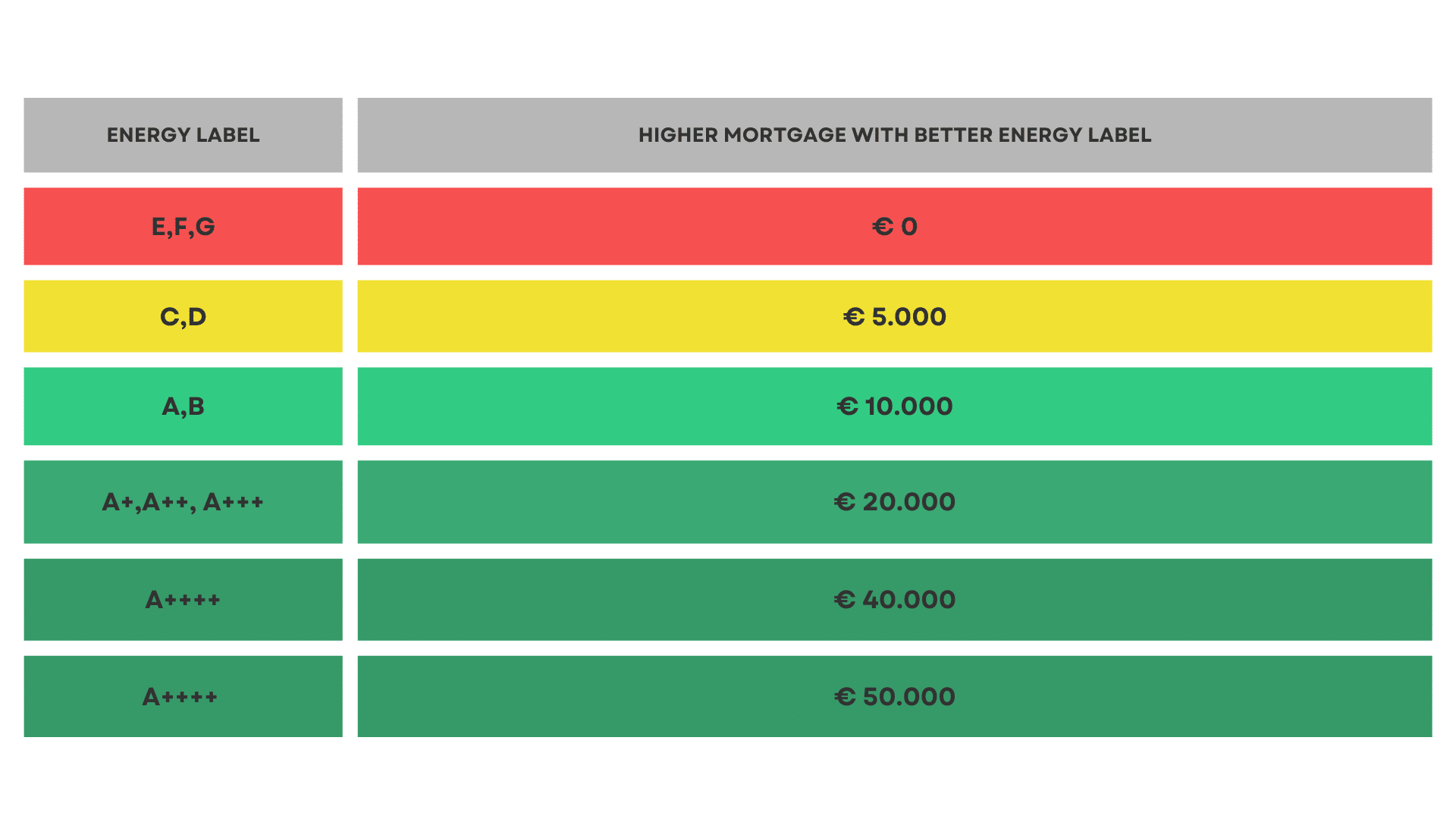

When the government implements the changes starting January 1, 2024, homeowners with a higher energy label (A being the highest and F being the lowest) can borrow more. In contrast, existing homeowners with more inadequate energy labels can borrow extra to make sustainable changes.

This article, by Mister Mortgage and Iam Expat, summarises the potential changes for those who own a home or plan to buy a new property soon.

Borrowing extra to make sustainable changes

As previously mentioned, the Dutch government encourages homeowners to make their homes more sustainable. For this reason, the Dutch government are striving to implement new regulations that allow you to borrow extra money if you already own a home and want to upgrade your energy label.

Higher mortgages for a better energy label

Besides, homebuyers will be able to secure a higher mortgage if they purchase an energy-efficient home. This modification also seeks to incentivise home sellers to increase their investments in enhancing home-efficiency while motivating buyers to prioritise sustainable choices.

Consider a newly built property

Opting for a newly constructed property is another way to secure a mortgage and achieve the most sustainable result. The most significant advantage of purchasing a newly built property is a high-energy label, ranging from A to A+++++ and up. These types of homes are crafted with the latest energy-efficient technologies and design principles, ensuring reduced energy consumption, lower monthly bills and a smaller environmental footprint.

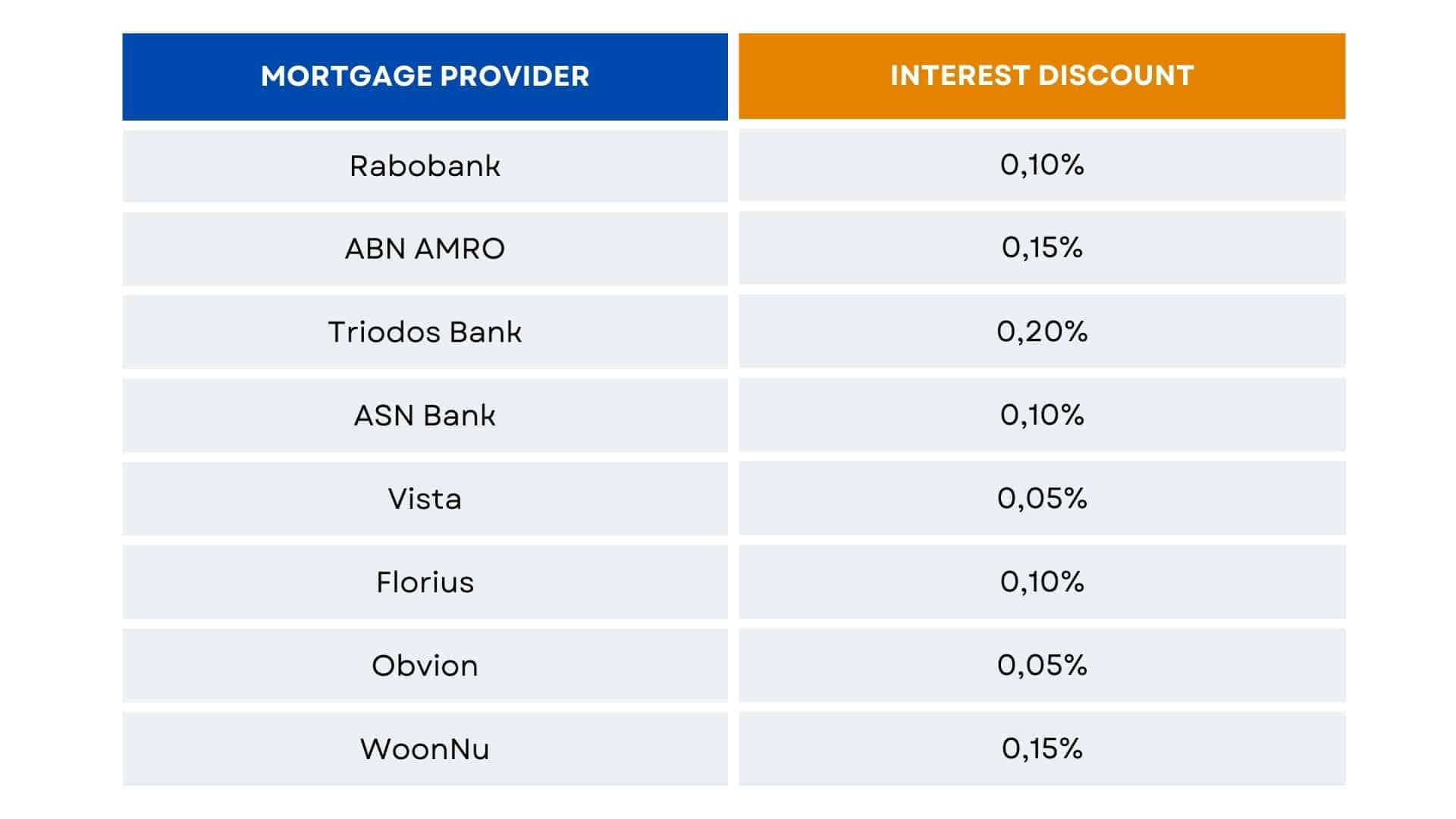

Furthermore, many Dutch mortgage providers also want to encourage sustainable homeownership. Mortgage lenders will provide reduced interest rates for energy-efficient homes to achieve this. Typically, homeowners can anticipate up to a 0.15% reduction in their mortgage interest rates. For example, the following mortgage lenders offer special rates for energy-efficient homes

By taking out a mortgage with a provider offering a discount, you can save more money on your mortgage in the long run.

If you are not convinced by a reduced mortgage interest rate, there are several other reasons to invest in a more sustainable home:

-

Contribute to environmental preservation by curbing greenhouse gas emissions.

-

Increase the value of your property.

-

Decrease your monthly bill expenses.

-

Research shows that energy-efficient homes increase more in value.

-

Speed up the process of selling your property.

Sustainability starts at home

There are many benefits to owning an energy-efficient home in the Netherlands. In the long run, a high-energy label can lower overall costs and help the environment.

Schedule a complimentary introductory call with our mortgage specialists. We specialize in mortgages for expats and are dedicated to navigating you through the home-buying process.

-

Access to a trusted network.

-

Highly competitive rates and flexible terms.

-

Guidance through the entire mortgage process.

-

English translations of bank documents are shared.

- 100% Independent Advice