In 2025, homebuyers aged 18 to 35 purchasing their first property valued at up to €525,000 can benefit from an exemption from the 2% transfer tax.

It is already known that the transfer tax limit will increase to €555,000 as of January 1, 2026.

You need fewer savings to close your mortgage, and you can keep more savings in your pocket. The property transfer tax (overdrachtsbelasting) is 2% of the purchase price. If you buy a residential property in the Netherlands, you must pay 2% of the property price on tax.

For example, if you buy a home worth € 525.000 in 2025, you must pay the transfer fee of € 10.400. First-time home buyers under 35 years old who buy a property for less than € 525.000 in 2025 will save € 10.400. If you can benefit from this exemption, you need fewer savings to close your mortgage.

Tranfer tax for buy-to-let investors

The property transfer tax for buy-to-let investors has been adjusted to 10.4%. The shortage of housing is a prevalent issue in some Dutch cities. To address this, the Dutch government is reducing costs for first-time buyers while increasing taxes for investors, seeking to establish a fairer landscape for first-time homebuyers in the Netherlands.

The Dutch government thinks that people who are buying their first home and those who invest in homes often want to buy houses that cost about the same. For this reason, the Dutch government increased the transfer tax and introduced a purchase protection act.

| Type of buyer | Residential | Other real estate |

|---|---|---|

| First-time buyers (age between 18-35 years) | 0% | 10.4% |

| Moving homes (when you buy your second property) | 2% | 10.4% |

For example, if you plan to buy a commercial property, a holiday home, or a buy-to-let property, you pay a transfer tax of 10.4%. If you decide to move houses, you pay a transfer tax of 2 % for the second residential property.

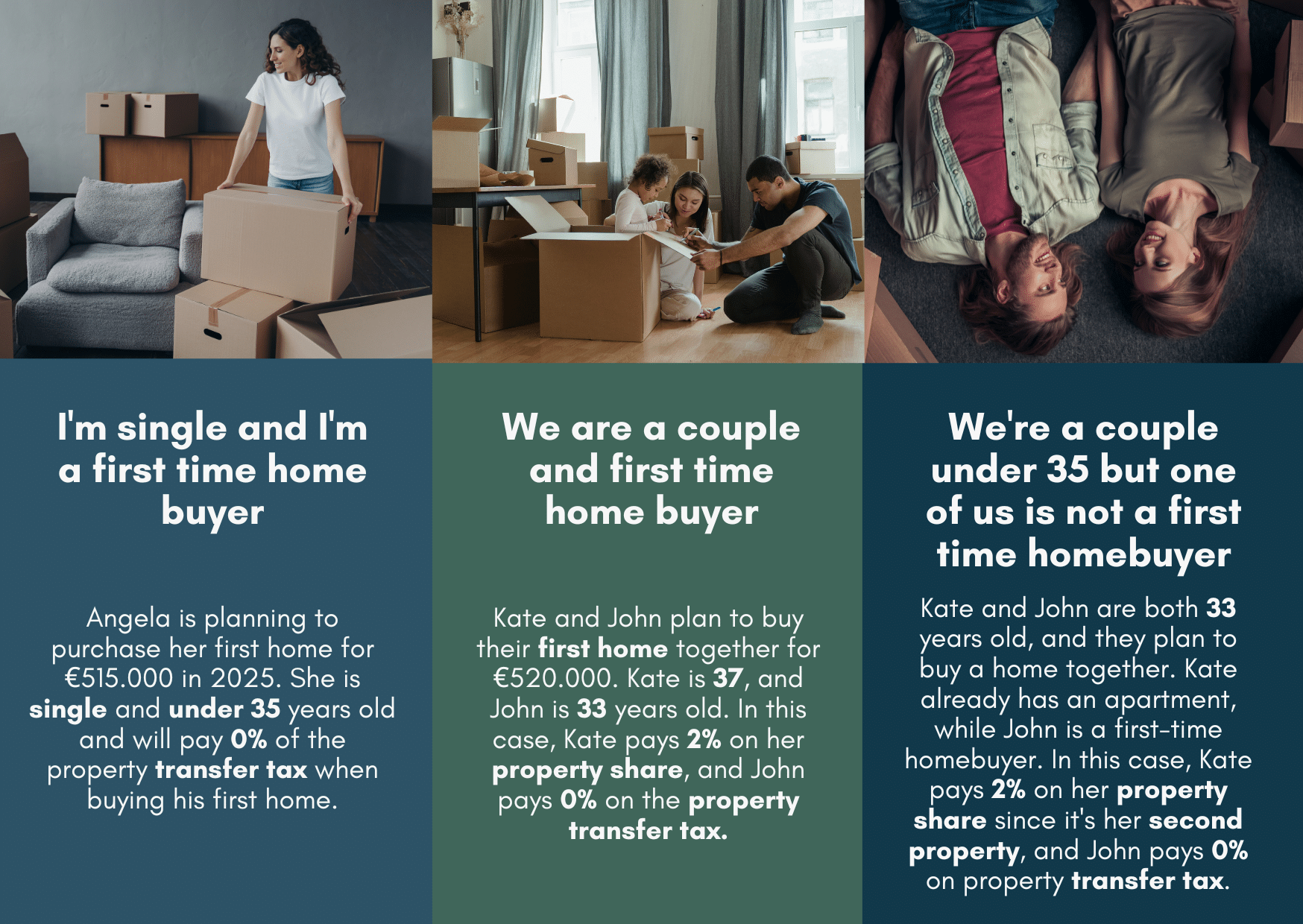

Different scenarios in 2025:

Schedule a free call with our mortgage specialists to guide you through your remortgage journey. We specialize in first-time buyer mortgages and finding the best solutions for you.

-

Get clarity on your financial possibilities.

-

Access to a trusted network.

-

Highly competitive rates and flexible terms.

-

English translations of bank documents are shared.

- 100% Independent Advice