Did you buy a home in 2024? Then, you are eligible to receive tax money back in 2025. In the Netherlands, homeowners can take advantage of unique tax deductions when filing their tax returns from March 1 to April 30. Please note: the article is updated for 2025.

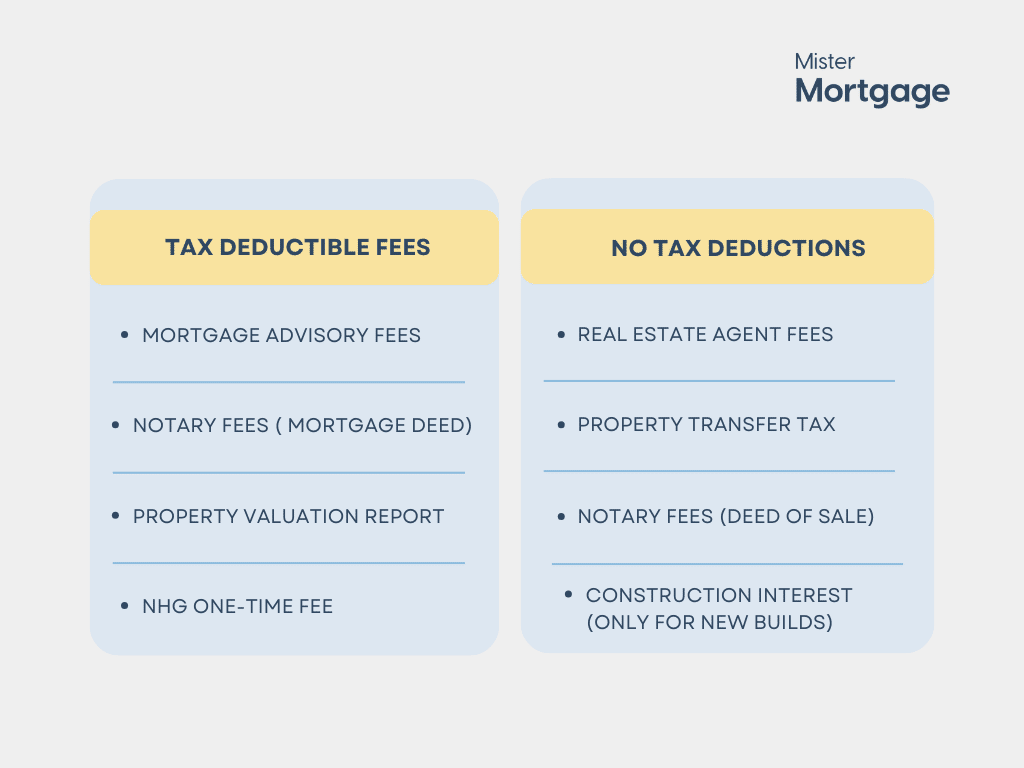

Which fees are tax deductible when buying a home?

When purchasing a house in the Netherlands, you incur closing fees eligible for a tax deduction. For instance:

-

Mortgage advisory fees: the costs associated with mortgage advice, including brokerage.

-

Mortgage contract: the expenses related to the mortgage contract, such as notary fees.

-

Valuation: the cost of obtaining a valuation report for the property can be tax-deductible.

-

NHG-costs: the one-off costs to include NHG (Nationale Mortgage Guarantee) to your mortgage.

What percentage of tax-deductible fees you can get back in the Netherlands?

You can get up to 37,48% (2025) back on closing fees.

These fees include the costs of the mortgage appraisal, advisory and closing fees paid to the lender or a mortgage advisor, the notary fees for preparing the mortgage deed, the one-time fee for a National Mortgage Guarantee (NHG), any costs to extend the mortgage offer, and interest paid on construction loans or ground rent. Any penalty fees incurred when refinancing an existing mortgage can also be deducted.

Regarding how much you can get back, the deductible mortgage-related costs are subtracted from your taxable income. The amount you receive back depends on your income tax rate. For example, for every €1,000 in deductible mortgage costs, you can expect to receive around €374,80 back from the tax authorities, depending on your specific tax situation and the applicable rate.

Which fees are not tax deductible?

It is important to note that not all costs associated with buying a house are tax-deductible. Here are some fees that are generally not eligible for tax deductions:

-

Real estate agent fees

-

Property transfer tax

-

Notary costs and cadastral duties for the deed of sale

-

Construction interest (only for new builds)

Mortgage interest deduction in the Netherlands

Homeowners' mortgage interest each year can be deducted from their taxable income. This deduction is known as the "hypotheekrenteaftrek" or mortgage interest deduction. The way this deduction is received depends on the individual's preference.

Annual mortgage interest deductions in the Netherlands

-

The full amount of mortgage interest paid over the course of the year can be deducted when filing the annual tax return.

-

After the tax return is processed, the homeowner will receive a lump sum refund from the tax authorities based on their applicable tax bracket (up to 37,48% in 2025).

Monthly mortgage interest deductions in the Netherlands

-

Homeowners can apply for a "voorlopige aanslag" or provisional tax assessment with the tax authorities. This allows the mortgage interest deduction to be spread out and applied to the homeowner's monthly tax withholding.

-

Rather than waiting for the annual tax return, the deduction is factored into the monthly income tax payments, resulting in a lower monthly tax burden.

The individual homeowner can choose between an annual or monthly deduction. Many prefer the monthly option, as it provides more immediate tax savings throughout the year rather than a larger lump sum refund. However, the final deductible amount will be the same regardless of whether the homeowner chooses the annual or monthly approach.

Schedule a complimentary introductory call with our mortgage specialists. We specialize in mortgages for expats and are dedicated to navigating you through the home-buying process.

-

Access to a trusted network.

-

Highly competitive rates and flexible terms.

-

Guidance through the entire mortgage process.

-

English translations of bank documents are shared.

- 100% Independent Advice