The commitment to pay a mortgage for the next 25- 30 years is lengthy, and deciding to pay off your mortgage as quickly as possible makes sense.

Extra mortgage repayments can be a good solution for whoever wants to lower their monthly payments. Before spending all your savings or selling your property, understanding what makes the most financial sense is essential.

Here in this article, we overview reasons to keep your mortgage:

-

Mortgage value and inflation

-

Keep your interest rate if moving homes or refinancing

-

Refinance current mortgage into investment mortgage

-

Save up

Mortgage value and inflation

Imagine you took your mortgage some years ago with a lower interest rate. The interest rate has significantly increased in the last months, making your current mortgage more affordable. As a rule, the purchasing power of money declines over time due to inflation. Because of this, it is recommended to keep the loan as it is because inflation causes the mortgage's value to decrease yearly.

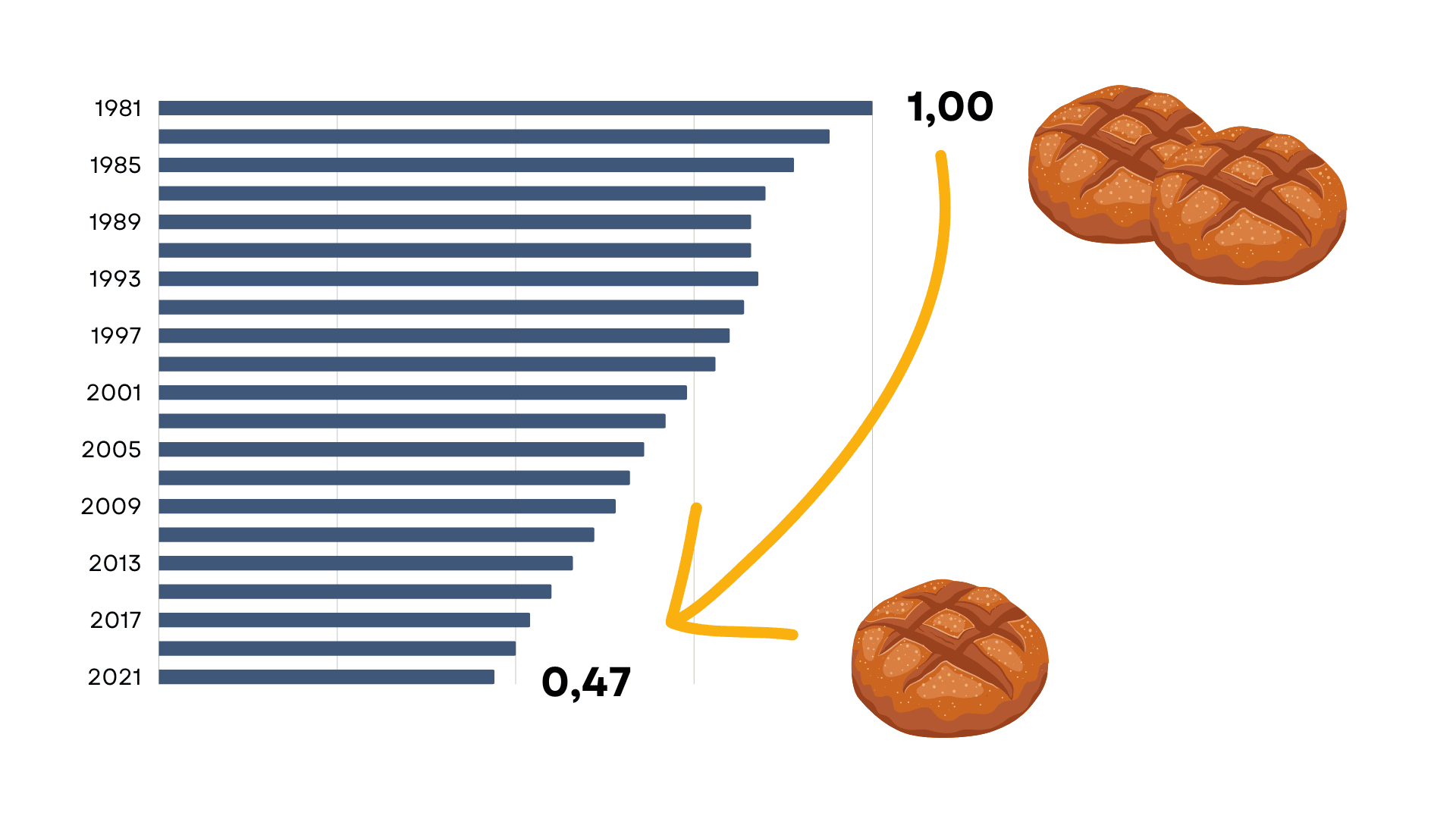

How much money is worth now versus 1981? The currency's value decreases over time while the value of the service and products increases. For example, in 1981, you could buy two pieces of bread for 1 euro, while now you can afford only one part of the bread.

Keep your interest rate if moving homes or refinancing

If you plan to move houses, the first logical idea that comes to mind is to sell your current home and repay your mortgage in full.

In this situation, you repay the mortgage and could lose your low-interest rate, which means that the new mortgage rate becomes more expensive since the interest rates have increased in the last year.

Moving your mortgage to a new property will cost you less than when paying off your mortgage and applying for a new mortgage. You can transfer/carry your mortgage terms, payment, and interest rates together with you.

However, it is always a good idea to check with our mortgage specialists to see if you qualify to move your current mortgage.

Refinance current mortgage to investment mortgage

Another reason you should keep your cheap interest rate when buying a second property is that you can refinance your mortgage to keep to let.

Dutch banks, such as Florius, add a premium to your current mortgage rate. For example, if your current rate is 2.20%, and you want to rent out your home, they add +1.00%, so your interest rate becomes 3.20% when renting your property out. In this case, you save and don't need to pay the current market rates for buy-to-let from 5% to 5.5%.

Save up

For many years, the interest rate for saving accounts was negative in the Netherlands; however, the situation changed when the ECB increased the rates by 0.5 percent in July 2022.

To respond to the increase, the Dutch banks moved from a negative rate on saving accounts. Instead of giving up your interest rate, you can open a saving account to keep interest rate deductions.

When does it start working for you?

If you're currently paying 2% on your mortgage, you probably get a tax benefit of around 30% of the interest you paid. This means you're effectively paying 1.4% (2% minus 30% tax benefit) per year on your mortgage.

You're already earning money when you find a savings account (or a brokerage account) that gives you at least a guaranteed return of 1.5% per year. Plan a free call with our mortgage specialists to check which scenario best benefits your situation.

Schedule a complimentary introductory call with our mortgage specialists. We specialize in mortgages for expats and are dedicated to navigating you through the home-buying process.

-

Get clarity on your financial possibilities.

-

Access to a trusted network.

-

Highly competitive rates and flexible terms.

-

English translations of bank documents are shared.

- 100% Independent Advice