The Dutch government announced transfer tax amendments starting on 1 January 2023. How will the transfer tax changes affect first-time home buyers and investors in 2024?

First-time home buyer

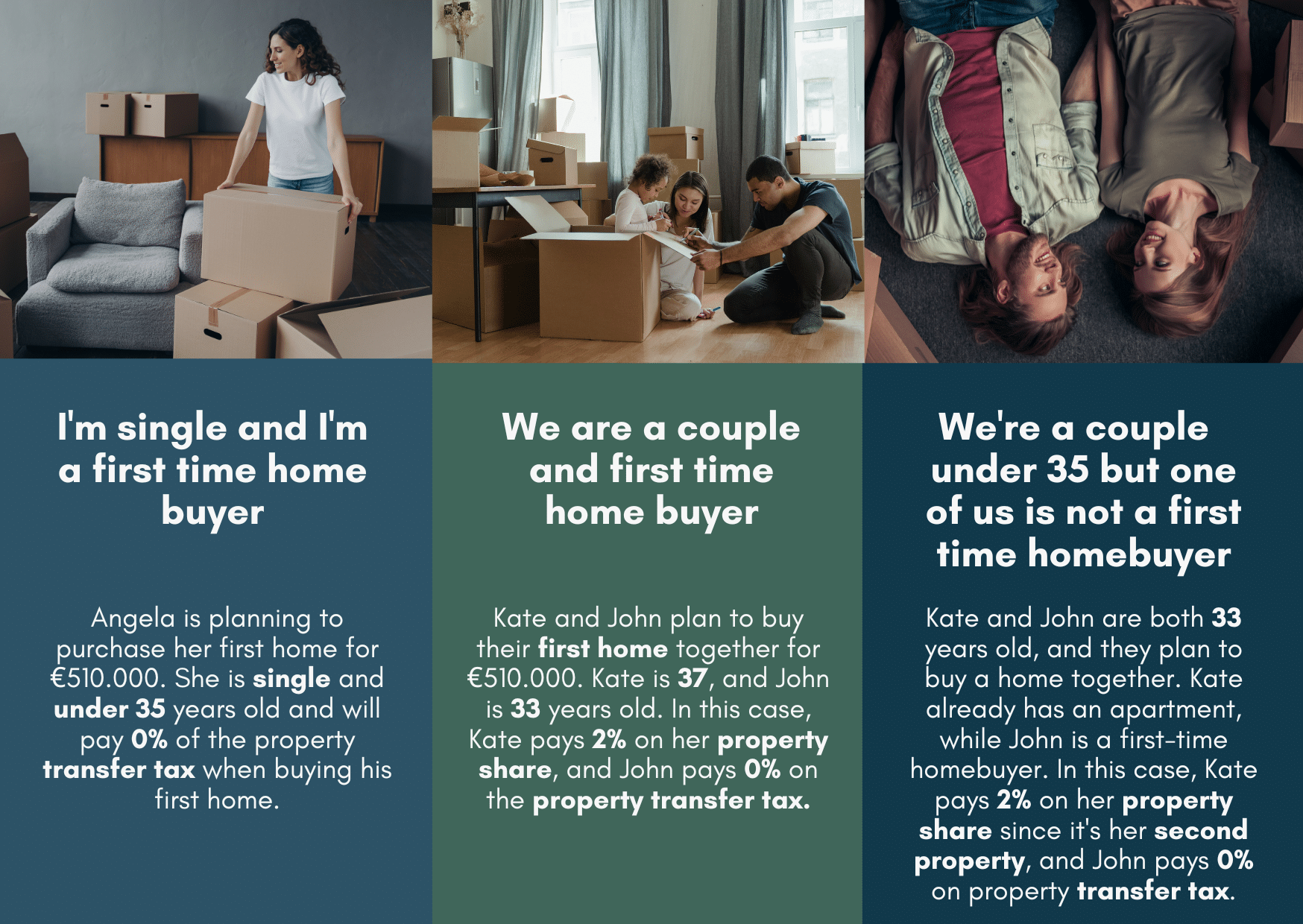

First-time home buyers between 18 and 35 years old are exempt from paying a transfer tax of 2%. If you plan to buy a home valued at less than €510.000, you do not need to pay the transfer tax of 2%.

To qualify for the tax exemption, the first-time home buyer must:

-

Age requirements: the buyer is of age (18) and under 35 years of age.

-

The buyer is not allowed to rent and must be a primal occupational resident of the property.

-

The buyer is entitled to use the transfer tax exemption once in a lifetime.

-

The value of a home cannot exceed €510.000.

Buy to let investors

The property transfer tax for buy-to-let investors is 10.4%. The Dutch government announced an increase in the transfer tax for buy-to-let houses in 2023 to fight an existing problem- a shortage in the housing sector. In 2024, the transfer tax for buying to let investors remains the same.

-

You must contribute 30 % of the property price from savings or equity from an existing property.

-

You need to be registered and live and work in the Netherlands.

-

Pay a transfer tax of 10.4%.

-

Satisfy the criteria of the Purchase Protection Act. Dutch cities prevent investors from taking away homes from first-time home buyers. Find out about the requirements per municipality here.

Schedule a complimentary introductory call with our mortgage specialists. We specialize in mortgages for expats and are dedicated to navigating you through the home-buying process.

-

Get clarity on your financial possibilities.

-

Access to a trusted network.

-

Highly competitive rates and flexible terms.

-

English translations of bank documents are shared.

- 100% Independent Advice