Are you considering renovating your home but are apprehensive about the costs? Making your home an ideal space is important for your enjoyment and your home's resell value. In this blog, we will outline your renovation costs and the potential return you can make on your investment.

Renovations may cost money upfront, but they're a smart investment in your home's long-term value and your enjoyment of the space.

In this blog, we will outline your renovation costs and the potential return you can make on your investment. Renovations may cost money upfront, but they're a smart investment in your home's long-term value and your enjoyment of the space.

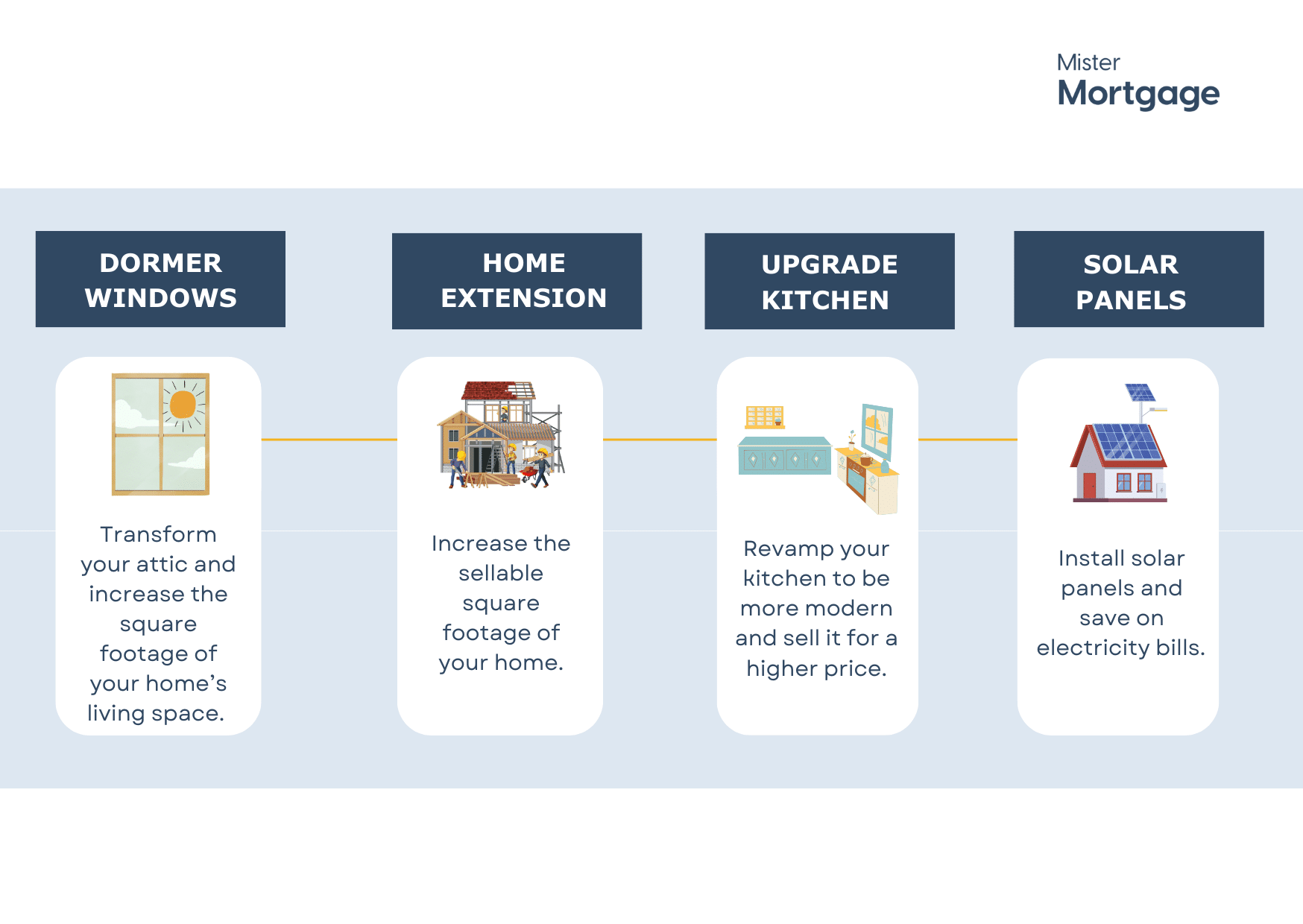

Which home renovations can improve your return on investment?

-

Expanding home space: enhancing your living area.

Extending your home is popular in the Netherlands for adding space and value. However, the value you get depends on size, design, and location. Researching the impact of design is important, especially for extra bedrooms and bathrooms. Consult with local experts for accurate evaluations. For example, a two-by-four-meter extension costs about €21,000, excluding certain expenses. Increasing to three by five meters adds around €2,800 more.

-

You are thinking about making your home more eco-friendly with solar panels. Suppose you go for a system with eight panels, costing €9,000. With this setup, you can generate about 4000 kWh of electricity annually. This means you will save roughly €1,200 yearly for the system's life. Typically, it takes around six years to get back the money you initially spent, but this could change depending on different things.

-

Upgrade your attic: add dormer windows.

Expanding your home's living space with an attic dormer conversion adds practicality and value. Installing dormer windows on your roof boosts headroom and floor space in the attic, making the area more useful. The extra light from dormer windows can turn the attic into another bedroom, increasing the property's value when you sell it. On average, a wooden dormer window measuring 3 linear meters with two pivot windows costs about €5,200, while a plastic alternative of similar size and features costs around €4,900, slightly less.

-

Upgrade your kitchen, bathroom and floors.

When people attend a viewing, the set up of the bathroom, kitchen, and floors is often a telltale sign of both the recency and tier of the home. When potential owners or tenants of a property see that these features are new, they are more likely to be willing to pay more for the space. These qualities of a home are often difficult for people to change once they move in, so people are willing to pay more to have them already set up.

Let's say you want to update your kitchen. The starting price for an entry-level kitchen is approximately €2,500. If you want something of higher quality, a premium kitchen from a luxury brand with additional features could set you back anywhere between €15,000 and €50,000.

How do you finance your home renovations in the Netherlands?

-

Apply for a new mortgage lender: you can opt to pay off your current mortgage and obtain a higher new mortgage. This requires going through the mortgage application process again, including paying closing fees and revisiting a notary. If you have a fixed mortgage interest rate for a specific period, you may need to pay a penalty to your existing lender.

-

Stay with the same lender: when signing the mortgage deed, you can register a higher mortgage sum, often higher than you initially need. This allows you to increase your mortgage without incurring additional fees or visiting a notary. Your lender typically reassesses your income and the home's value for this.

-

Apply for a second mortgage: if the above options aren't suitable, consider taking a second mortgage. This involves leveraging the equity you've built in your home to obtain a second loan on top of your existing mortgage. However, this still requires visiting a notary and paying closing fees.

-

Personal savings:iIf you've accumulated savings, you can use them to renovate your home without involving additional loans or mortgages.

-

Personal loan: personal loans generally have higher interest rates than mortgages, but they don't involve extras like closing fees. However, personal loans typically come with higher costs and shorter repayment periods, whereas mortgage payments are spread over a longer period, often 30 years, resulting in lower monthly payments.

So, what's stopping you from renovating your home?Renovations and mortgage arrangements are highly individualized and tailored to your specific circumstances. Schedule a consultation with one of our knowledgeable financial advisors today for personalized guidance.

Schedule a complimentary introductory call with our mortgage specialists. We specialize in mortgages for expats and are dedicated to navigating you through the home-buying process.

-

Access to a trusted network.

-

Highly competitive rates and flexible terms.

-

Guidance through the entire mortgage process.

-

English translations of bank documents are shared.

- 100% Independent Advice