Dutch mortgage rules change every year. Starting in 2024, new regulations regarding taxes and mortgage protection policies are undergoing revisions. What should you expect in 2024? This blog brings you up-to-date insight into changes in mortgage rules.

National Mortgage Guarantee (NHG)

Notably, the National Mortgage Guarantee (NHG) limit is set to rise to €435,000 in 2024, marking a €30,000 increase from the present limit of €405,000. The NHG limit with energy-saving facilities will be €461,100. This increase allows more individuals to secure their mortgage within this NHG coverage, providing more financial security.

Property transfer tax (2%) changes

-

In 2024, the property transfer tax for first-time home buyers will rise from €440,000 to €510,000. First-time home buyers between 18 and 35 years old can enjoy a 2% transfer tax exemption on their initial property purchase price of up to and including €510,000.

-

For real estate investors, this exemption does not apply. They face a current transfer tax rate of 10.4% on their properties.

Increasing student loan interest rates

Starting January 1, 2024, the interest rate for Dutch student loans will increase to 2.56%, marking a significant rise from the current rate of 0.46%—increasing fivefold. This increase could reduce the amount buyers with student loans are eligible to borrow because lenders prioritize these higher monthly debt obligations in assessing borrowing capacity.

But new mortgage rules bring new lights. In the past, mortgage lenders focused on estimating monthly expenses using the total amount of the student loan. However, starting in 2024, the focus will shift. Instead of relying on approximating the original student debt, lenders will prioritize the actual monthly debt payments as the primary factor in determining borrowing capacity.

LtV maximum mortgage value to loan in 2024

In 2024, the maximum amount you can borrow for a mortgage stays the same as in 2023. You can still borrow up to 100% of the property's market value.

Extra mortgage to improve sustainability

The Dutch government aims to introduce new rules that enable homeowners to borrow additional funds if they want to improve the energy efficiency of their homes. If the house has an energy label of E, F, or G, you can borrow an extra €20,000 to renovate.

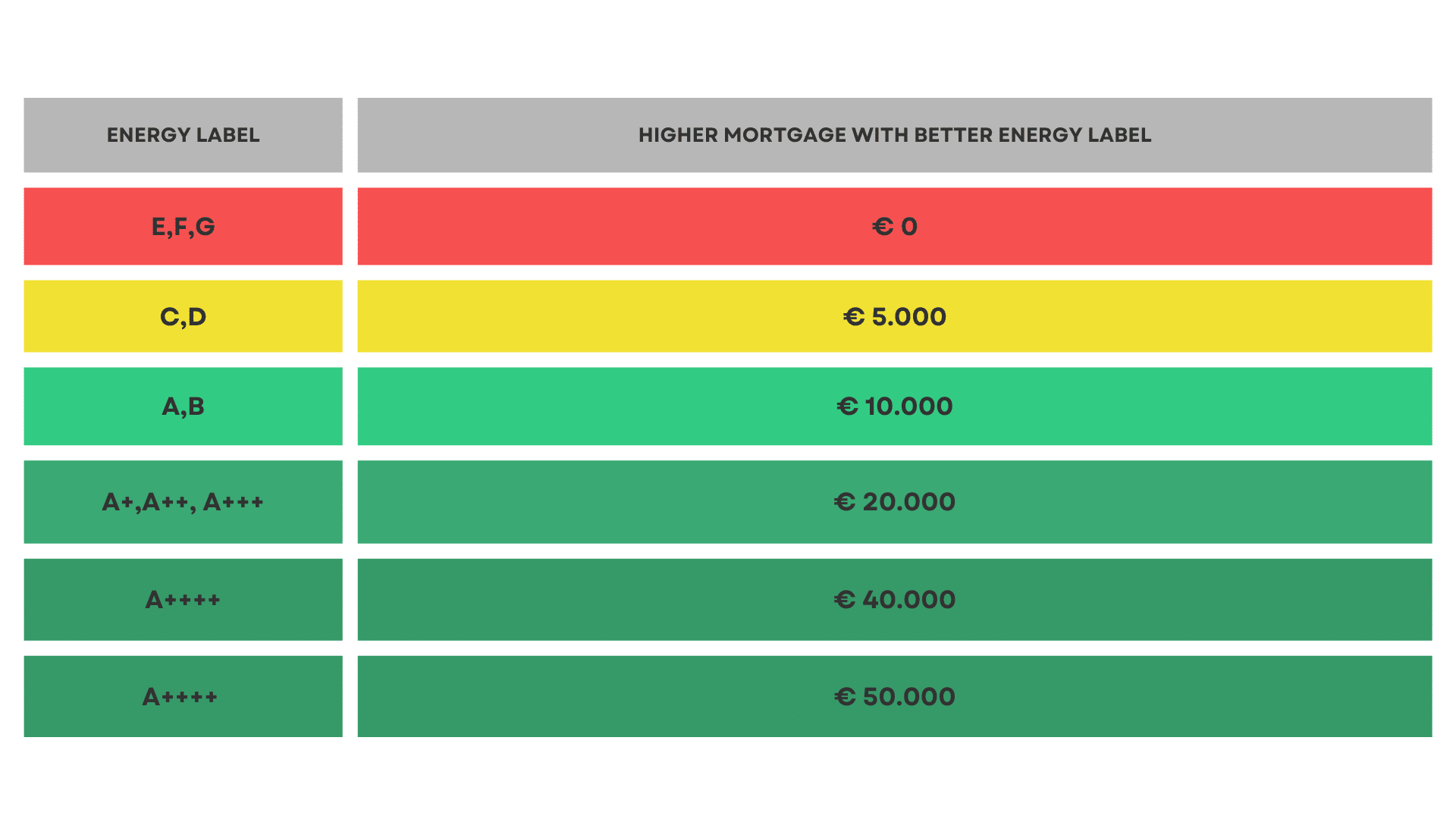

More mortgage for a sustainable home

The government's changes will allow homeowners with higher energy labels (A as the best and F as the lowest) to borrow more. If your energy label is A+ or higher, you could borrow an extra €20,000 to €50,000. Meanwhile, existing homeowners with lower energy ratings can access additional funds by making their homes more sustainable.

Starting in 2024, singles earning a yearly minimum of €28,000 will be eligible to borrow an additional €16,000 in their mortgage. This measure aims to expand housing options and increase the availability of new homes for this demographic, as stated by De Jonge. According to Nibud, this change makes single people more financially beneficial when purchasing property next year.

Tax-free donations for internationals

One of the frequently asked questions from expats in the Netherlands is: How much money can I get as a gift from my parents living overseas? A gift from abroad might not be taxable under Dutch laws. If the gift is given by a non-resident or a resident (who is not a Dutch citizen) who left the Netherlands over a year ago, there is no gift tax applicable. Additionally, if the donor has never lived in the Netherlands, no gift tax is due.

Rent increasing in the private sector

Starting on January 1, 2024, if you are renting a home privately, the landlord can increase your rent, and it will be indexed at 5.5%. This comprises 4.5% to account for inflation plus an additional 1%. The moment your rent increases depends on when your lease contract begins.

The maximum increase is up to 5.5% from January 1, 2024, to May 1, 2024. However, after May 1, 2024, these rules may change because that's when the law about this might expire.

Minister Hugo de Jonge is developing a plan to assist people in renting homes after May 1. Extending the rules will safeguard individuals in private rentals from significant rent hikes after May 1, 2024.

Schedule a free call with our mortgage specialists